Newbie Bitcoin Whales Capitulating, But Old Hands Stay Silent

On-chain data shows New Whales on the Bitcoin network have been realizing losses recently, while Old Whales have remained at the sidelines.

Bitcoin Has Faced Loss Selling From The Newbie Whales

In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the profit/loss realization behavior of the Bitcoin whales. “Whales” broadly refer to the BTC investors that hold at least 1,000 tokens in their balance.

At the current exchange rate, the cutoff for the cohort is equivalent to $91.6 million, which is quite significant. As such, this group represents the big-money hands of the market, who can carry some degree of influence.

Whales can be divided into two subgroups based on holding time. Investors of this size who purchased their coins within the past 155 days are known as the short-term holder (STH) or New Whales. Similarly, whales with a longer holding time are called the long-term holder (LTH) or Old Whales.

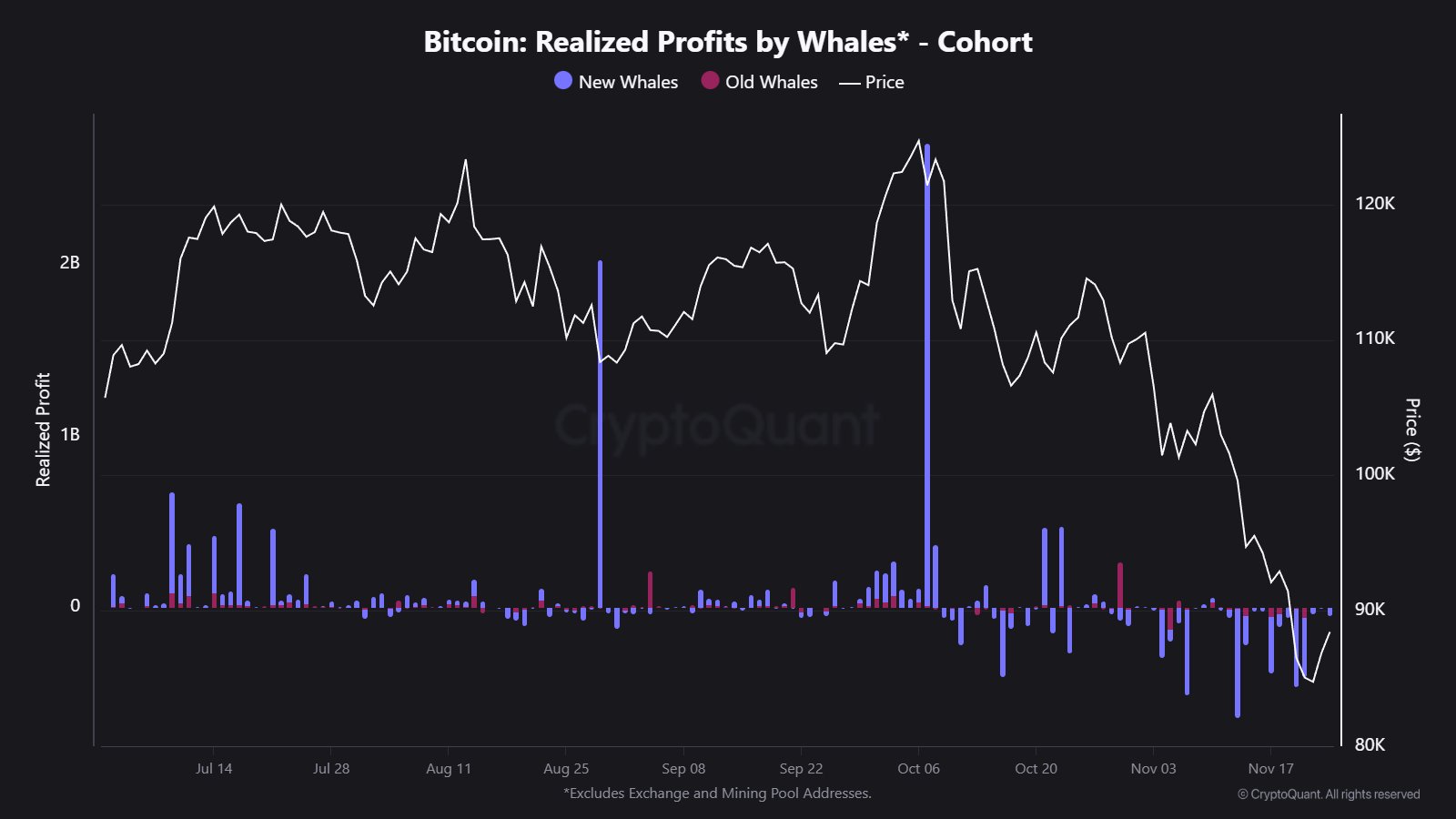

Now, here is the chart shared by Maartunn that shows the trend in the net amount of profit/loss that these Bitcoin whale groups have been realizing through their selling over the last few months:

As displayed in the above graph, the Bitcoin New Whales have shown some loss realization spikes recently. This underwater selling from the cohort has come as the cryptocurrency’s price has gone through a decline.

The New Whales include the inexperienced hands of the market who tend to easily panic in the face of volatility. It would appear that this quality of the group has held through the latest crash as well.

The Old Whales, on the other hand, are considered to represent the resolute side of the network. From the chart, it’s visible that there has been some loss selling from these large dormant entities recently, but its scale has been small compared to the New Whale capitulation.

The fact that the presence of the Old Whales has been relatively muted through the bearish shift, as well as the rebound that has followed, could be a signal worth keeping an eye on.

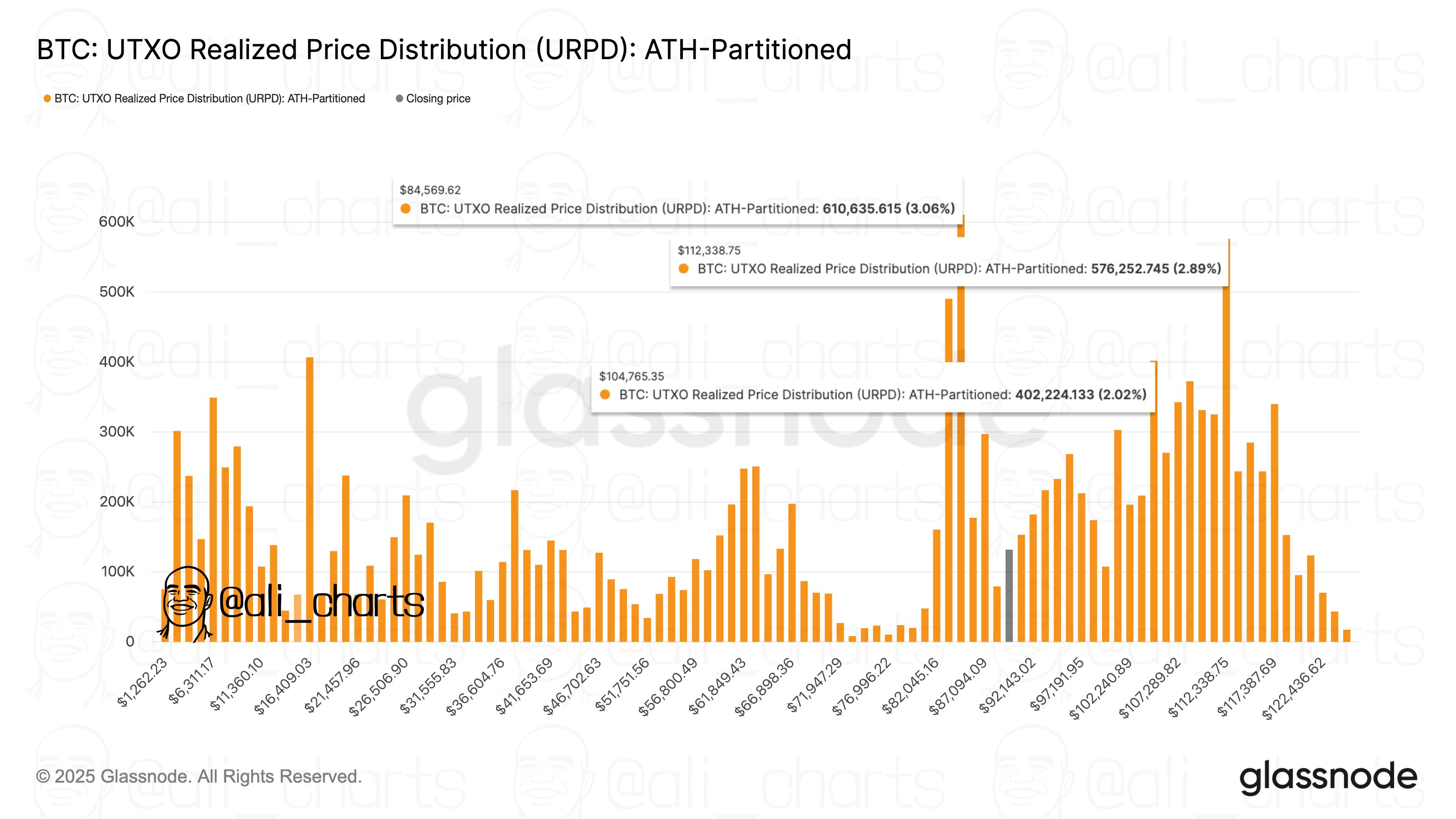

Speaking of the recovery, the Bitcoin rally has meant that its price has climbed back above a major on-chain cost basis level. As analyst Ali Martinez has shared in an X post, the Bitcoin UTXO Realized Price Distribution (URPD) suggests a strong amount of buying last occurred at $84,500.

In on-chain analysis, strong demand zones below the spot price are considered points of potential support for Bitcoin. Similarly, levels above are assumed to be sources of resistance instead. One such major level is present at $112,300.

BTC Price

Bitcoin’s recovery has furthered during the past day as its price has returned to $92,300.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

XRP Buyers Defend Most Major 200-Week Price Average: Can It Be Bottom of 2026?