Spot Bitcoin ETFs Rebound with $238M Inflows Amid Market Volatility

Highlights:

- Spot Bitcoin ETFs saw $238M in inflows, reversing a six-day outflow streak.

- Fidelity’s FBTC led the recovery with $108M in inflows.

- Ethereum funds ended an eight-day outflow streak with $55M in inflows.

Spot Bitcoin ETFs on November 21 recorded a net inflow of $238M, a decisive recovery after a major volatility period. This huge turnaround came after a massive outflow on November 20, during which the market lost $903M. Spot Bitcoin ETFs experienced six days of losses in a row, with the overall outflows exceeding 2.1B.

Spot Bitcoin ETFs Turn to Positive Inflows

According to Sosovalue data, Fidelity FBTC led with a staggering inflow of $108M. This inflow comprised nearly half of the total daily inflow of spot Bitcoin ETFs. The strong performance of Fidelity represents the continued institutional focus on high-volatility, low-priced assets. Grayscale’s Bitcoin Mini Trust closely followed with an $84.93M influx.

Bitcoin ETFs’ inflows followed a brutal period of redemptions. On November 20, BlackRock’s IBIT experienced massive outflows of $355M, which was one of the worst Bitcoin ETF days of the year.

Ether ETFs Break 8-Day Outflow Streak

Meanwhile, Ether ETFs experienced a significant shift after eight straight days of redemptions. On November 21, the Ether funds had a total of $55.7M in inflows. Fidelity’s FETH was the main contributor with a huge $95.4M, thus reversing the trend of losses.

The previous week had been the toughest for Ethereum funds, with $1.28B of outflows recorded between November 11 and 20. The inflow surge on November 21 marked a break from the downward trend as institutional investors showed interest. Other Ether funds, such as Bitwise’s ETHW, also had smaller contributions, which hinted at the recovery of the broader market.

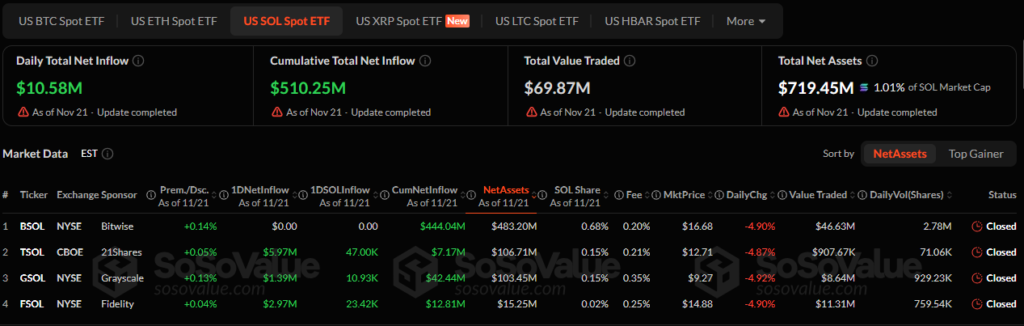

Solana Funds Extend 10-Day Inflow Streak

As for Solana ETFs, they maintained a good performance despite the recent shaky spot of Bitcoin and Ethereum ETFs. These funds, especially Bitwise BSOL, which comprised 444M of the total 510M inflows, have been on an upward trajectory over the past ten days. The trend of a steady inflow is in stark contrast with the volatility of the Bitcoin and Ethereum ETFs.

Source: Sosovalue

Source: Sosovalue

While Bitcoin and Ether funds are recovering following significant losses, Solana is still doing well, indicating the potential of the broader altcoin market.

Market Trends and Investor Sentiment

Recently, investor confidence in spot Bitcoin ETFs has shifted towards optimism. Institutional players are slowly coming back to the market with large inflows to funds such as Fidelity’s FBTC and Grayscale’s Bitcoin Mini Trust. The moves indicate a revival of confidence, especially among the major investors aiming to take advantage of the prevailing price lows.

However, Bitcoin ETFs have not escaped challenges. November has been brutal and the worst month for Bitcoin ETFs since their launch. Despite these challenges, Bitcoin ETFs have been performing well in terms of year-to-date performance, with inflows of $57 billion, which reflects a strong performance in the market despite the volatility.

The total assets of Bitcoin ETFs have been stable, with approximately $110 billion, although they have undergone some volatility throughout the month. Currently, Bitcoin ETFs manage approximately 1.05 million BTC, which is almost half of the total Bitcoin supply. Trading volume improved significantly yesterday by 25% to $4.5 billion compared to the previous session.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

X Announces Higher Creator Payouts on Platform

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release