Google’s Gemini AI Predicts Shocking Prices for XRP, Pi Coin, Ethereum as Crypto Prices Crash

Google’s ChatGPT competitor, Gemini AI, is warning that XRP, Pi Network, and Ethereum could face further steep declines if current market momentum doesn’t improve.

The crypto sector has endured a string of sharp pullbacks over the past month as overleveraged positions were wiped out. Bitcoin is now hovering above $85,000, marking a seven-month low.

Still, the broader outlook isn’t entirely bleak. Blockchain technology continues to advance, and XRP, Solana, and Dogecoin remain some of crypto’s most resilient long-term players, so there are optimistic scenarios for them in a recovery cycle.

Here’s how Gemini AI projects the situation could evolve as the holiday season approaches.

XRP (XRP): Gemini AI Predicts a Slump Down to $1 Next Month

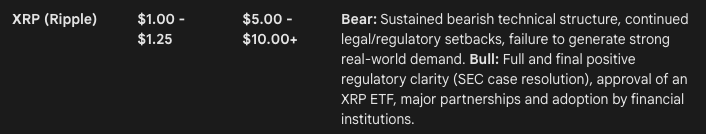

Gemini AI’s predictive models indicate that Ripple’s XRP ($XRP) could slump to around $1 by Christmas, a drop of roughly 50% from its current price near $2.

Source: Gemini AI

Source: Gemini AI

Such a decline would be a dramatic reversal for Ripple’s flagship token, which surged to a seven-year peak of $3.65 in July following Ripple’s major courtroom victory over the U.S. Securities and Exchange Commission. Over the past year, XRP has climbed 70%, outperforming both Bitcoin and Ethereum.

Technically, XRP has been trading within a tight consolidation channel for months, repeatedly forming bullish flag setups that have failed to break upward. With the Relative Strength Index (RSI) uptrending to 40, XRP is no longer oversold, and some buying momentum could lead to a weekend recovery and stabilisation.

However, Gemini AI also outlines a more bullish alternative. A strong move upward could be triggered by this week’s US SEC approval of the 9 XRP spot ETF, which can generate substantial inflows if Bitcoin and Ethereum’s history are anything to go by.

Furthermore, large-scale institutional partnerships or favorable U.S. regulatory developments could push XRP to reach $5 to $10 by 2026.

Pi Network (PI): Gemini AI Sees a Sudden Rebound and Fast Growth

Pi Network ($PI) is unique for its mobile mining system that rewards users with crypto for daily tapping.

Now priced around $0.23, PI has risen 8.5% over the past week, highlighting its resilience. However, Gemini AI forecasts a bear market scenario where Pi sinks to $0.04. The alternative trajectory in a bull market is over 100x that figure, possibly reaching $4.34.

After a prolonged downtrend following its debut, November appears to be at a turning point. Recent momentum may be tied to Pi Network’s partnership with AI startup OpenMind, which demonstrated that node operators can provide computational services for external enterprises, a groundbreaking use case for blockchain networks.

The Pi testnet has also added support for decentralized exchanges, automated market makers, liquidity tools, and a more advanced KYC system, all of which significantly expand the ecosystem’s practical utility.

Ethereum (ETH): Gemini AI Projects a Rally Toward $15,000

Ethereum ($ETH), the core infrastructure powering decentralized apps, smart contracts, and much of modern DeFi, continues to dominate Web3 development. With a market cap above $332 billion and more than $64.5 billion in total value locked in its DeFi protocols, Ethereum remains crypto’s leading programmable network.

Gemini AI anticipates that ETH could drop 37% from its current price of $2,799 to $1,763 by the end of the year if current bearishness persists.

However, Ethereum’s strong security profile, reliable settlement layer, and commanding role in stablecoins and real-world asset tokenization position it to benefit from institutional inflows should US regulators deliver their long-promised comprehensive crypto legislation.

ETH currently faces heavy resistance in the upper $4,000 range. In Gemin’s bull-case scenario, achieving a breakout above this ceiling could pave the way for a new all-time high anywhere between $5,000 and $12,300 by Christmas.

Maxi Doge (MAXI): A Rising Meme Coin Outside Gemini AI’s Purview

Even in a declining market, capital continues flowing into presales, where traders hunt for low-priced tokens with high upside potential.

Maxi Doge ($MAXI) is emerging as one of the most intriguing new contenders. The project has already raised nearly $4.2 million in its presale, combining classic Dogecoin-style humor with a modern, energy-efficient blockchain foundation.

According to its lore, Maxi Doge spent the early days of crypto watching Dogecoin succeed while he trained in his mother’s basement, aiming to become a top-tier degen. Today, MAXI emphasizes community participation through viral challenges, meme contests, and a strong social media identity.

Built on Ethereum as an ERC-20 token, MAXI benefits from the network’s scalability, low environmental impact, and large developer ecosystem, advantages that the older, proof-of-work Dogecoin lacks.

The token has a total supply of 150.24 billion, with 25% allocated to a “Maxi Fund” intended for marketing and ecosystem growth. Staking rewards currently offer up to 74% APY, though rates decrease as more users join.

The presale price begins today at $0.000269, with scheduled increases across later stages. Investors can participate using MetaMask or Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC