XRP nosedives after ETF launch as investors favor Zcash and Digitap

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

XRP is slipping despite ETF excitement, while investors shift attention to rising contenders like Zcash and Digitap.

- XRP risks losing its $2.0 support as traders “sell the news” despite new ETF listings.

- Zcash breaks into the top 15 and eyes a move toward $1,000, earning a spot among top altcoins to watch.

- Digitap gains traction as a low-cap DeFi–TradFi token with forecasts of major upside after launch.

ETF buzz should have pushed the XRP price higher, but the market has different plans. With investors “selling the news,” combined with a broader market downturn, XRP is at risk of losing the $2.0 support. Meanwhile, investors are doubling down on the Zcash coin and Digitap (TAP), currently on several “best altcoins to buy in 2025” watchlists.

ZEC, a novel privacy coin, recently entered the top 15 and has been dubbed by many as the best crypto to buy now. At the same time, TAP, standing at the intersection of traditional banking and decentralized finance, is a new favorite among investors. By blurring the line between crypto and fiat, alongside imminent mainstream adoption, it is considered the most profitable crypto to buy now at less than $0.05.

Will XRP price retest lower support levels?

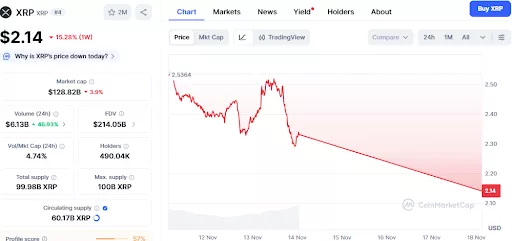

Franklin and Bitwise XRP ETFs hit the US market, with others set to debut in the coming days. Despite institutional demand and strong inflows into this exchange-traded fund, the XRP price is in a downtrend.

At the time of writing, the XRP price has slid by 15% on its 7-day chart, prompting many analysts to remove it from their list of promising altcoins to buy in November. The payment-based crypto trades around $2.1, a potential fall below the $2.0 support level cannot be ruled out.

Ali, a crypto analyst on X, shares a similar sentiment. Their XRP price prediction targets a possible retest of $1.9 before rallying to $6. While ETFs may not have had a substantial price impact on XRP yet, it is expected in the future, making Ripple one of the best altcoins to buy this cycle.

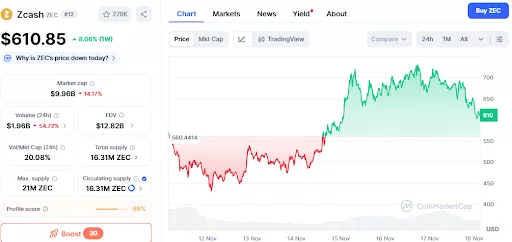

Is Zcash coin the best crypto to buy now?

The Zcash coin broke into the top 15 after an impressive Q4 market performance. It crossed $730 this week, racing fast toward a breakout above $1,000. Despite a pullback toward $600, it maintains an 8% gain on its 7-day chart.

Its next leg up is expected to push it past $1,000, fueling forecasts about ZEC being the best crypto to buy now. A retest of its 30-day high of $736 may serve as the fuel for this jump, putting Zcash coin on the list of promising altcoins not to miss in Q4.

Meanwhile, Nextiscrypto sees the Zcash coin reaching $1,600, followed by $3,500 if it maintains its current trend, a bullish wave worth riding. However, given its large market cap of $10 billion, ZEC has limited upside potential compared to new and low-cap coins like TAP, making the latter a better bet for life-changing gains.

Digitap: Could buying TAP today set traders up for life?

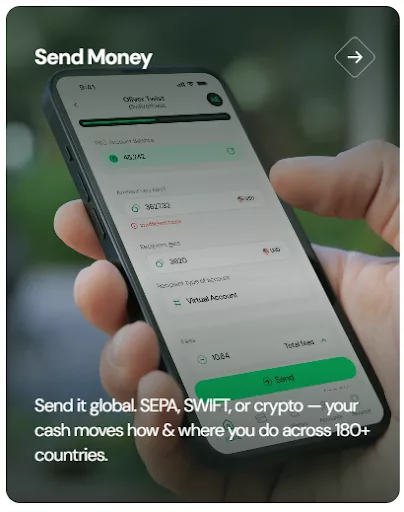

There is a difference between scalping for modest gains and positioning for life-changing returns. Digitap, an emerging DeFi-TradFi coin, tilts toward the latter as a low-cap coin with real-world spending utility. It revolutionizes digital payments by allowing users to spend crypto like cash, sparking both interest and demand.

In its early stages, a token costs just $0.0313 in the second presale round. Having surged by 150% from $0.0125, its impressive performance is expected to continue till and after its launch date. At the listing price of $0.14, new investors are positioned for a 347% gain. Meanwhile, analysts predict a 50x rally this quarter after its market debut, making it arguably the most profitable crypto to buy now.

It stands out even further by representing the best of the worlds of TradFi and DeFi, bank-grade security meets blockchain speed. Described as the “last money app you’ll ever need,” it features a single control panel for seamless deposits, transfers, payments, and withdrawals in both fiat and crypto. It blurs the line between cash and crypto even more by allowing borderless transactions with a globally accepted Visa card.

Interested investors can use the code “DIGITAP20” for 20% off first-time purchases.

Zcash and Digitap: New favorites ahead of XRP

While the XRP price faltered despite the launch of ETFs, the Zcash coin price and Digitap are soaring high. ZEC recently entered the top 15 crypto, and its next target is breaking past $1,000. Meanwhile, the projected 50x rally for TAP after its market debut makes it the most promising crypto to buy now, a compelling bet for life-changing gains in 2026.

To learn more about Digitap, visit its presale, website, socials and the $250k giveaway.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun