Ondo Price Prediction 2026, 2027 – 2030: Can Ondo Hit $10?

The post Ondo Price Prediction 2026, 2027 – 2030: Can Ondo Hit $10? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of Ondo Price is $ 0.38599611

- Price predictions for 2025 range from $0.80 to $4.15.

- Long-term forecasts suggest ONDO could reach $9.30 by 2030.

ONDO Finance in the RWA sector is a hot topic, investors are closely eyeing its future potential. Especially as its native token ONDO continues to build credibility and momentum through high-profile developments.

Moreover, Ondo Finance is known to be a leading RWA provider on the Solana chain and it is witnessing growing institutional interest, ONDO has solidified itself as a major player in the Real World Asset (RWA) space.

With such attraction, ONDO price prediction 2025 is what analysts and retail investors are intrigued about. But how far can it go from here? Let’s dive into the detailed ONDO price forecast from 2025 to 2030.

Table of contents

- ONDO Price Analysis 2025

- ONDO Price Prediction December 2025

- ONDO Price Prediction 2026

- ONDO Price Analysis: Onchain Outlook

- ONDO Cryptocurrency Price Target 2026 – 2030

- Ondo Coin Future Forecast 2026

- Ondo Token Price Prediction 2027

- ONDO Price Prediction Next Bullrun 2028

- Ondo Price Forecast Long-term 2029

- ONDO Coin Price Growth Potential 2030

- Market Analysis

- CoinPedia’s Ondo Price Targets

- FAQs

Ondo Price Today

| Cryptocurrency | Ondo |

| Token | ONDO |

| Price | $0.3860 |

| Market Cap | $ 1,219,403,207.51 |

| 24h Volume | $ 50,861,624.8420 |

| Circulating Supply | 3,159,107,529.00 |

| Total Supply | 10,000,000,000.00 |

| All-Time High | $ 2.1413 on 16 December 2024 |

| All-Time Low | $ 0.0835 on 18 January 2024 |

ONDO Price Analysis 2025

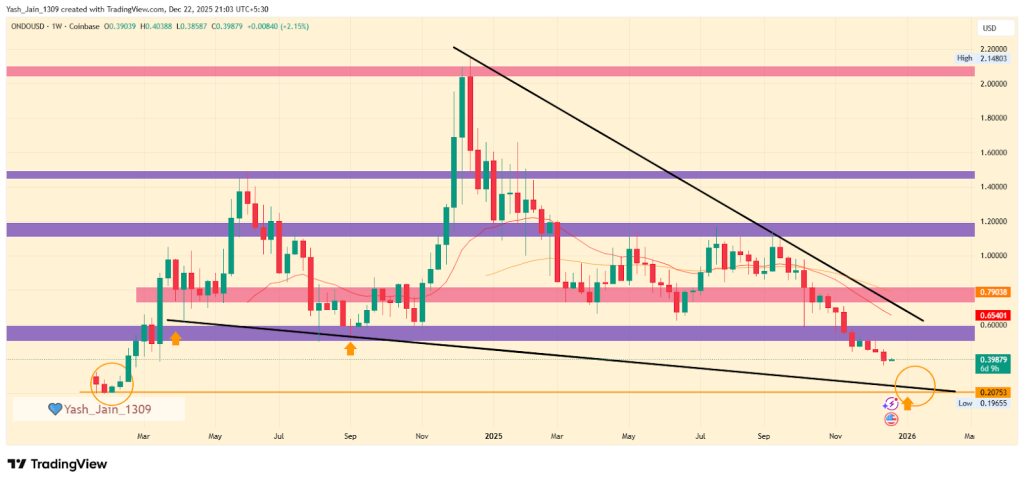

In the first quarter of 2024, the price of ONDO experienced a notable rally, capturing the attention of investors and analysts alike. However, by the fourth quarter, the price action had shifted dramatically. The most significant surge in the ONDO price occurred after Donald Trump’s election win the previous year, where it peaked at an impressive $2.148 by mid-December 2024 on Coinbase.

Subsequently, after that high the asset has been in a consistent downtrend on the weekly chart, ultimately reaching a low of $0.40 by December Q4 2025. This decline represents a staggering drop of over 80% from its peak.

The price movement has resulted in the formation of a falling wedge pattern, indicating potential bearish momentum. As we approach the final days of 2025, ONDO/USD seems to be nearing the lower border of this wedge, which suggests further downside potential.

Market analysis indicates that a decline towards $0.20 appears increasingly likely, aligning with the support levels established in Q1 2024.

ONDO Price Prediction December 2025

The ONDO/USD price action in December opened with a clear rejection from the 20-day EMA band, indicating a strong bearish dominance that suggests the price is likely to decline further without a significant market catalyst to shift sentiment back to bullish.

However, there is a promising support level around $0.40. If this level attracts demand, we can expect a potential bounce in the future. Conversely, if the price breaks below $0.40, we should anticipate even lower lows for ONDO around $0.20.

ONDO Price Prediction 2026

Upon analyzing the weekly chart of ONDO/USD, it becomes evident that a two-year-old falling wedge pattern is currently in effect. The price range has significantly narrowed, indicating strong compression in the market. Historically, such conditions often precede a substantial rally.

Looking ahead to the first quarter of 2026, one could anticipate a potential rally, strongly contingent upon the price stabilizing around the $0.20 support level. This price point not only serves as a critical support level that may attract demand for ONDO but also aligns with the lower boundary of the falling wedge pattern.

This border has previously coincided with two notable bullish instances in 2024, and a third interaction at $0.20 could further bolster the likelihood of an upward movement. Additionally, this support level intersects with the anticipated dynamics of Q1 2024, suggesting there could be significant buying interest in this region as we approach 2026.

| Year | Potential Low | Potential Average | Potential High |

| 2026 | $0.50 | $1.20 | $2.10 |

ONDO Price Analysis: Onchain Outlook

The on-chain data indicates that although the price is currently capped and has been consolidating for several months, the on-chain metrics have strengthened significantly despite the weak ONDO price action.

Since January 2024, the number of confirmed transactions sent to a project’s contracts has increased. By December 2025, the project had surpassed 1.3 million transactions, making it the second-largest project for real-world asset (RWA) issuance after BitGo.

ONDO Cryptocurrency Price Target 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 1.65 | 2.75 | 4.15 |

| 2027 | 2.20 | 3.65 | 5.25 |

| 2028 | 2.95 | 4.30 | 6.90 |

| 2029 | 4.75 | 5.60 | 8.45 |

| 2030 | 5.35 | 7.45 | 9.30 |

Ondo Coin Future Forecast 2026

The price projection of ONDO crypto for 2026 could range between $1.65 to $4.15, with an average trading price of roughly $2.75.

Ondo Token Price Prediction 2027

This altcoin could hit a potential high of $5.25 in 2027, with a potential low of $2.20, and an average price of $3.65.

ONDO Price Prediction Next Bullrun 2028

By 2028, forecasts indicate a potential low of $2.95 and a high of $6.90. This could bring the average price to $4.30.

Ondo Price Forecast Long-term 2029

During 2029, the price of the Ondo token is anticipated to reach a minimum of $4.75, with a maximum of $8.45, and an average price of $5.60.

ONDO Coin Price Growth Potential 2030

ONDO coin price may reach a high of $9.30 in 2030. With a potential low of $5.35. With this, the average price could settle at around $7.45.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $1.32 | $1.87 | $8.26 |

| priceprediction.net | $1.34 | $2.03 | $8.43 |

| DigitalCoinPrice | $2.01 | $2.29 | $5.01 |

CoinPedia’s Ondo Price Targets

CoinPedia’s price prediction for Ondo is extremely volatile. This is due to this altcoin’s highly fidgety nature. If the crypto market successfully regains momentum, this ETH-based token may surge toward a new high.

With this, the Ondo Price Prediction for this year could range between $3.05 as its high and $1.19 as its potential low.

We expect the Ondo Price to reach $3.05 in 2025.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $1.19 | $2.12 | $3.05 |

Also read, Arbitrum Price Prediction 2025, 2026 – 2030!

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

At the time of writing, the price of the Ondo token was $ 0.38599611.

ONDO price in 2026 is projected to range between $1.65 and $4.15, with an average near $2.75 if RWA adoption continues to grow.

Ondo Finance shows long-term potential due to strong on-chain growth and its leading role in the real-world asset sector, though market risk remains.

By 2030, ONDO price could reach up to $9.30, with sustained growth driven by institutional adoption and expansion of tokenized assets.

You May Also Like

Momentous Grayscale ETF: GDLC Fund’s Historic Conversion Set to Trade Tomorrow

Korea Deepens Crypto Push With Tokenized Securities Rules