Most institutional investors unaware of Bitcoin Core-Knots software debate

Institutional investors largely unaware of Bitcoin Core-Knots debate, Galaxy Digital survey finds

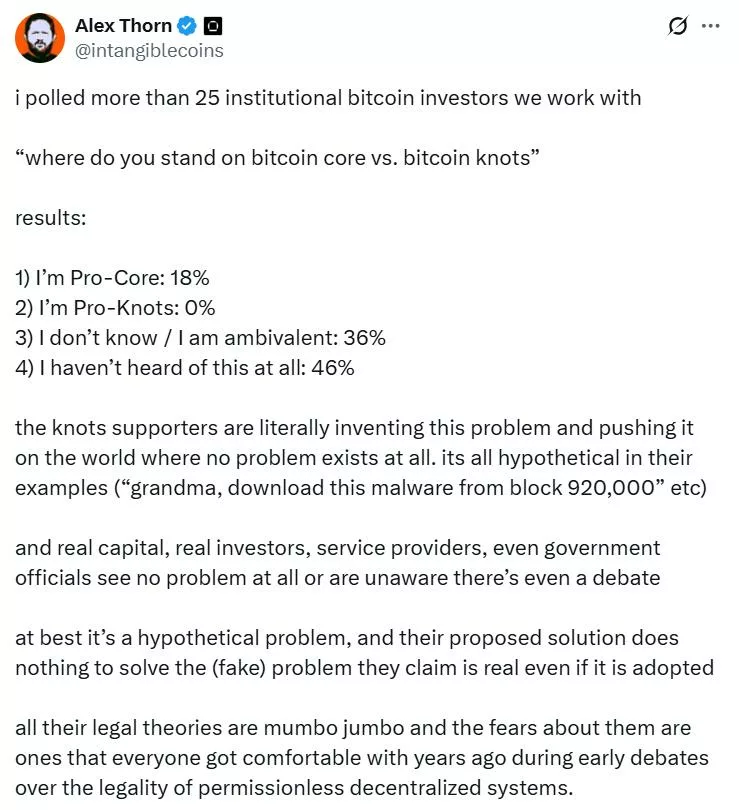

- 46% of surveyed institutional investors had no knowledge of the Bitcoin Core versus Bitcoin Knots debate

- Only 18% of respondents held strong opinions, all supporting Bitcoin Core’s approach

- Major mining operations show minimal concern about the protocol dispute, according to Galaxy Digital research

Most institutional investors in the Bitcoin (BTC) sector remain either uninformed or indifferent to the ongoing debate between Bitcoin Core and Bitcoin Knots, according to a survey conducted by Galaxy Digital.

Alex Thorn, head of research at Galaxy Digital, released findings showing that 46% of 25 institutional investors surveyed were not aware of the debate, while 36% reported having no clear opinion or remaining indifferent to the issue. Of the remaining 18%, all respondents expressed support for the Bitcoin Core position.

The debate centers on how the Bitcoin network should be utilized and whether non-financial transactions should be excluded from the blockchain. The discussion intensified following the release of the Bitcoin Core v30 update, which some users claim opened the door to operations considered spam on the blockchain.

Supporters of Bitcoin Knots argue that unwanted content should be filtered, citing concerns that malicious actors could insert illegal or immoral material into the blockchain. Bitcoin Core supporters maintain that any limitation could fragment the network, create user confusion, and contradict core principles of the protocol.

In a post published on social media platform X, Thorn stated that real capital, real investors, service providers, and government officials either see no problem or remain unaware of the debate. He characterized the issue as a hypothetical problem at best, according to the post.

Thorn also indicated that while miners were not included in the survey, his knowledge of major mining operations suggests minimal awareness or concern regarding the debate, according to his statement on X.

You May Also Like

WOW Summit Partners with Hong Kong Sevens: Five Memorable Days of Web3, Sports, and Excitement!

First Multi-Asset Crypto ETP Opens Door to Institutional Adoption