XRP Has Held Its Ground As Most Altcoins Fall, Market Observers Say

XRP has shown far less movement than many other tokens during a recent sell-off in the altcoin market. According to Coingecko data, the token traded around $2.50 in the first days of November before pulling back to about $2.48. Reports have disclosed that its market capitalization sits near $148 billion.

XRP Stands Its Ground

Community voice 0xKOL pointed out that XRP’s calm performance stuck out while other alternative tokens were dropping. He described the period as an “alt bear market,” and his comment sparked wider talk among traders about what gives XRP a firmer price base than its peers. Based on reports, traders and analysts began examining both who owns XRP and how those holders behave.

Other analysts explained that XRP’s steadiness comes from who holds it. They noted that, unlike many recent tokens driven by traders chasing fast gains, XRP is largely owned by seasoned investors who plan to keep their coins for the long haul.

Price Moves And Recent Drops Put Numbers In View

In terms or price action, the token has fallen about 6% over the past month and about 8% in the previous week. Its drop from the $2.50 region to roughly $2.47 shows some weakening, but market watchers note the decline is smaller than what many other altcoins experienced in the same stretch.

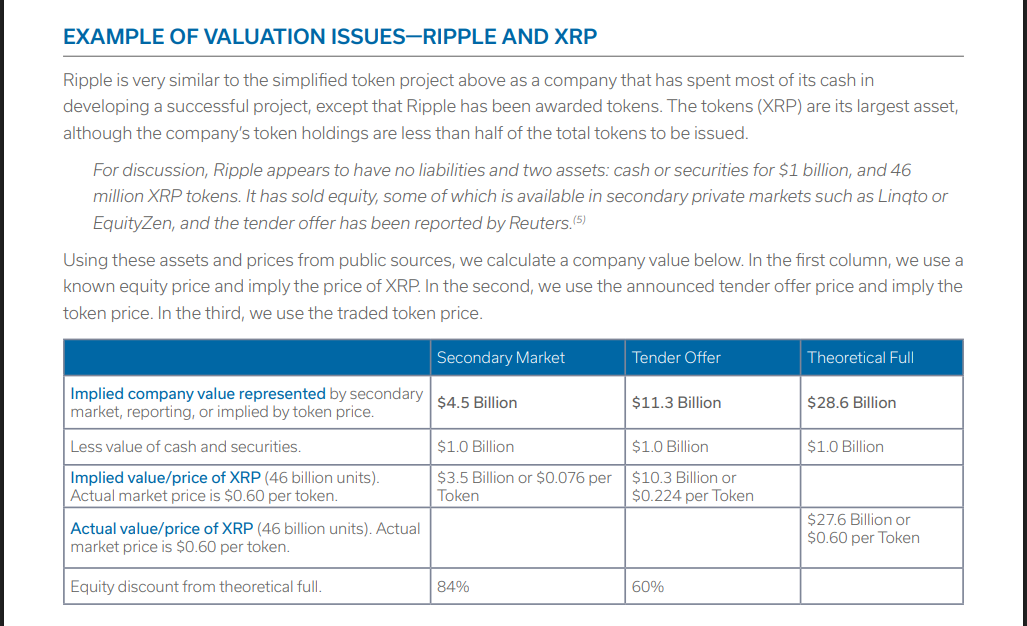

Institutional Research Links Ripple Value To XRP HoldingsMeanwhile, a February 2024 study by global investment bank Houlihan Lokey has reappeared in community conversations.

Researcher SMQKE highlighted the paper, which carried the title “Digital Assets: How Can Valuation Differ From Traditional Assets?”

The report argued that for some blockchain firms, the token itself holds much of the economic upside, and in Ripple’s case a large part of corporate value may be tied to its XRP reserves rather than to ordinary equity alone.

Market Events May Have Helped Support The Token

Market Events May Have Helped Support The Token

Those watching prices say several wider events likely gave XRP extra support. Banking sector stress, a favorable court outcome for Ripple, and broader moves such as the launch of spot Bitcoin ETFs are among the items that many traders point to.

These developments, combined with a backing of long-term holders, have been cited as reasons XRP’s swings were smaller than the rest of the altcoin pack.

For now, XRP remains one of the top four cryptocurrencies by market cap, and that status keeps it under close watch from both retail and institutional participants.

Featured image from Unsplash, chart from TradingView

You May Also Like

XMR price pumps as a rare pattern points to Monero hitting $1,000

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets