Billionaire Michael Saylor’s Strategy Keeps Buying Bitcoin — Adds 397 BTC for $45.6M

Strategy, the software-intelligence company led by billionaire executive chairman Michael Saylor, has once again expanded its Bitcoin holdings.

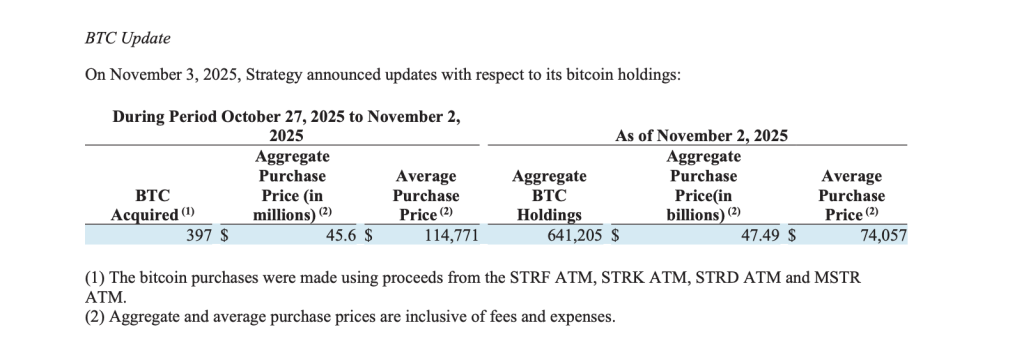

According to a company filing dated November 3, Strategy purchased 397 BTC between October 27 and November 2 for a total of $45.6 million in cash, paying an average price of $114,771 per coin.

The acquisition brings the company’s total Bitcoin stash to 641,205 BTC, accumulated at an average purchase price of $74,057 per BTC, representing a combined investment of $47.49 billion.

Strategy said the new bitcoins were acquired using proceeds from its active at-the-market (ATM) equity programs, a mechanism the company has relied on throughout 2025 to finance continuous Bitcoin accumulation.

Funding the Bitcoin Buys

The filing shows Strategy raised approximately $69.5 million in net proceeds during the one-week period across several preferred- and common-stock issuances.

These include proceeds generated through the sale of Series A perpetual preferred stock and class A common shares. The company continues to hold more than $46 billion in available capacity under its ATM programs, giving it flexibility to keep raising capital for future purchases.

The document details that $8.4 million came from the sale of STRF shares, $4.4 million from STRK shares, $2.3 million from STRD shares, and $54.4 million from MSTR common stock.

Proceeds from all these programs were directed specifically toward Bitcoin acquisitions, underscoring Saylor’s focus on converting equity capital into what he views as the world’s most reliable store of value.

Long-Term Conviction

Since adopting Bitcoin as its primary treasury reserve asset in 2020, Strategy has remained one of the most aggressive corporate buyers in the market.

Saylor’s thesis is that Bitcoin functions as a digital form of gold—an appreciating monetary network that preserves value across time better than cash or bonds. His strategy has faced skepticism during bear-market drawdowns but has delivered large unrealized gains during price rallies.

Strategy’s holdings now exceed those of any other publicly listed company and most sovereign treasuries. At current market prices, the firm’s Bitcoin reserve is valued at roughly $45 billion, cementing its position as the largest corporate holder of the cryptocurrency.

No Signs of Slowing

The company’s steady rhythm of weekly purchases demonstrates Saylor’s unwavering commitment to Bitcoin accumulation regardless of market conditions. He has frequently stated that every dollar raised will ultimately be converted into BTC. With substantial ATM capacity remaining and Bitcoin trading near record highs, Strategy shows no indication of easing its buying strategy.

If the company maintains this pace, its Bitcoin holdings could soon surpass 650,000 BTC, further solidifying its status as the most influential corporate participant in the Bitcoin ecosystem.

You May Also Like

X Announces Higher Creator Payouts on Platform

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release