Frustration with XRP’s 7.9% Crash at $2.50 is Fueling the Record-Breaking Digitap ($TAP) 114% Surge

The post Frustration with XRP’s 7.9% Crash at $2.50 is Fueling the Record-Breaking Digitap ($TAP) 114% Surge appeared first on Coinpedia Fintech News

Crypto moves fast, and investors have to update their theses or they end up holding the bag. XRP is down nearly 15% in the last 30 days, and falling below $2.50 again marks yet another lower high and failed reversal.

The chart is screaming distribution, and traders are acting accordingly. Huge outflows from XRP are hitting the Digitap ($TAP) presale, which has climbed more than 114% since launch.

While XRP promises institutional adoption that never seems to materialize, the other is a live, consumer-first money app with Visa, Apple Pay, and Google Pay already integrated. Digitap’s presale has shot past $1.2 million, and its distribution strategy is exactly the type of approach investors look for when searching for the best cryptos to buy now.

Is XRP Dead? How Stablecoins Killed XRP

XRP bulls have had a rough couple of months—and the chart hints that it is about to get worse. A big rejection at $3 in early October, another rejection near $2.70, and trading firmly below $2.50. Sequential lower highs—a bull’s worst nightmare.

The path of least resistance is lower for XRP unless a fresh catalyst appears. This is a fundamental problem. Ripple has been promising to modernize cross-border payments since 2012. Yet actual volume on its ledger remains tiny. New stablecoin-centric chains are launching and pushing to use stablecoins for settlement—easily XRP’s biggest headwind.

It has been a rude wake-up call for XRP bulls. Valued at $150 billion based on the belief that institutional adoption would be coming soon. Now, these institutions are using stablecoins for settlement. The XRP price reflects this change.

Why Money is chasing $TAP instead

Presales are a brilliant way to understand narrative strength. When a name conducts a big raise fast while the market is chopping sideways, it is a signal of where attention and future liquidity will concentrate. Digitap raising $1.2 million was one of these signals. The product is downloadable today, and this has been a core part of why this presale has been so successful.

Digitap: Introducing the Omni-Bank Concept

Digitap is the world’s first omni-bank. On the app, which anyone can download today, cash, stablecoins, and crypto live as one balance instead of three silos. Users move money in real-time without borders. This is a postcard from the future about what the future of money looks like when value travels at information speed.

A freelancer can split pay across currencies, a merchant can settle payments across borders, and a saver can park in stables. All of this from a single interface, and under the hood, Digitap’s AI routing engine ensures it always picks the best rail for transfers, and finds the best swap price when users spend crypto via their Visa cards.

Why Digitap’s Visa Card Fueled 114% Surge

Digitap has put on-chain balances onto Visa rails via the card. Rails people already use, so millions of merchants globally now accept crypto.

This consumer-first approach is a large part of why $TAP is beating XRP in terms of momentum currently. XRP wanted the world to adopt a new ledger; Digitap focuses on getting the product in people’s hands and making it as familiar as possible. It is already getting thousands of sign-ups a day.

Another big success has been tokenomics. The old generation of tokens doesn’t share any revenue with token holders. $TAP is different. Digitap dedicates 50% of platform profits to burn $TAP permanently and reward stakers. The total supply of 2 billion will steadily decline, and scarcity typically drives value.

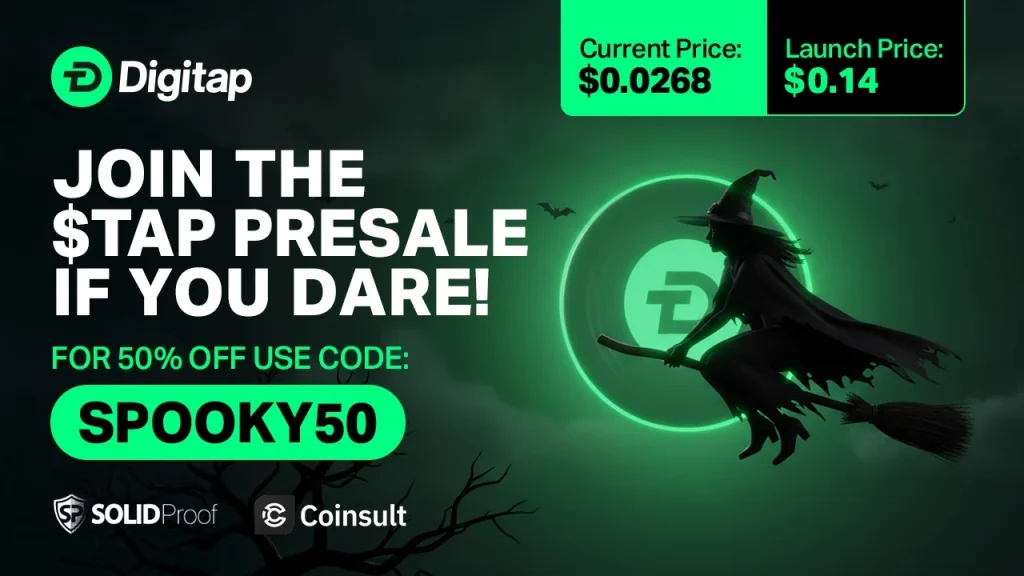

The current price of $TAP is $0.0268 today. But scheduled to step up to $0.0297 in the next stage, and will continue to increase until it lists at $0.14. It has an aggressive buyback and burn flywheel, and if adoption scales, buybacks could become enormous. Another reason $TAP continues to pop up on the lists of best cryptos to buy now.

XRP vs. $TAP: Who Wins the Cross-Border Payments Race?

Digitap positions itself as an interoperability layer joining crypto and traditional finance. Using whichever payment corridor is faster. It arrives looking like a neobank, but supercharged with crypto rails under the hood.

It is relatively obvious that stablecoins will win out over the XRP ledger, and as more stablecoin corridors appear, Digitap gains more options, whereas Ripple gains more competition.

Digitap has plenty of catalysts, live rails, and a presale cadence that rewards early positioning. In many ways, it is the perfect expression of the cross-border payment trade and the successor to Ripple’s original idea. No wonder $TAP continues to rank as one of the best cryptos to buy now.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

You May Also Like

The Channel Factories We’ve Been Waiting For

Fed Decides On Interest Rates Today—Here’s What To Watch For