You Can Now Buy Gold With XRP — SwissBullion Joins the Crypto Payment Wave

- SwissBullion.eu now accepts XRP and Ethereum payments for gold, silver, platinum, and palladium purchases.

- The firm aims to offer faster, borderless settlements and expand access for international clients.

SwissBullion.eu, a leading European precious metals dealer, has expanded its accepted payment methods to include Ripple’s XRP and Ethereum (ETH). The firm, which already supports Bitcoin and major stablecoins, stated that the addition of these two assets is part of a growing client demand for faster, borderless payment options.

The company’s spokesman noted, “by integrating Ripple and Ethereum into our payment ecosystem, we are bridging digital innovation with tangible wealth preservation.”

Ethereum provides high liquidity and global transactions without any issues, according to the company. SwissBullion stated that ETH has a well-established role in decentralized finance and smart contracts, making it an ideal candidate for efficient high-volume purchases. The platform now offers customers the option to pay for gold, silver, platinum, and palladium directly with ETH.

Ripple’s XRP, which is also designed to facilitate low-cost cross-border transfers, is an excellent fit with SwissBullion’s vision to make bullion more accessible globally. The company said that integrating XRP would provide “frictionless and near-instant settlement,” which would benefit customers in over 90 countries.

A company spokesperson stated that the update “bridges digital innovation with tangible wealth preservation,” adding that cryptocurrencies provide both speed and security compared to traditional banking systems.

XRPL Transaction Volume Surges Over 80%

The company’s move aligns with a broader trend of accelerating activity on the XRP Ledger (XRPL). Over the past 30 days, on-chain data indicate that transaction volume has surged by more than 80%, primarily driven by tokenized real-world assets (RWAs) and stablecoins.

Analytics reports indicate the XRPL processed approximately $885 million in transfers during that period. RWAs and stablecoins accounted for the bulk of that growth, with tokenized T-bill vaults and securities alone surpassing $200 million in value. The ledger now supports 22 tokenized RWAs and five stablecoins, with a combined market value exceeding $650 million.

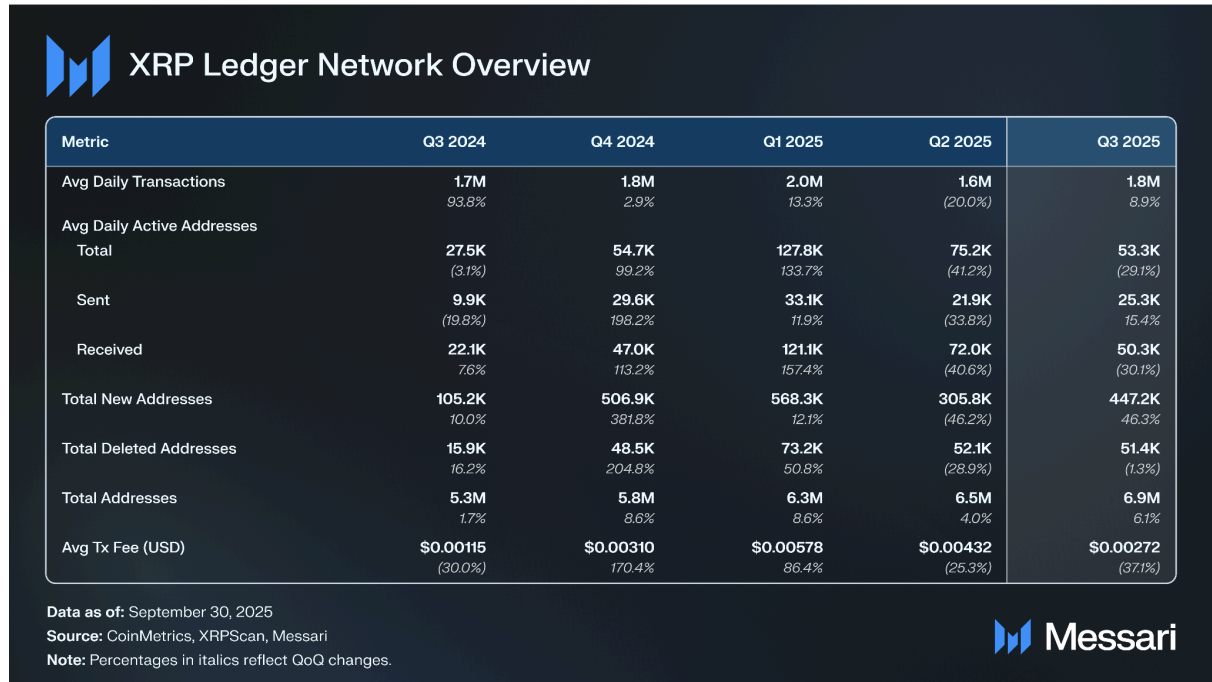

Messari reported an 8.9% quarter-over-quarter increase in average daily transactions on the XRP Ledger (XRPL), rising from 1.6 million to 1.8 million. Daily active addresses climbed 15.4% to 25,300, while new address creation surged 46.3% to 447,200.

Source: Messari

Source: Messari

Ripple’s USD-pegged stablecoin, RLUSD, concluded the third quarter with a combined market capitalization of $789 million across both the XRP Ledger and Ethereum. On the XRPL alone, RLUSD’s market cap grew 34.7% quarter-over-quarter to $88.8 million, making it the network’s largest stablecoin, according to Messari. Ripple’s Markus Infanger attributed the network’s rising adoption to its built-in decentralized exchange and near-instant settlement.

Institutional Demand Strengthens XRP Liquidity

Recent corporate initiatives have further fueled XRPL’s growth. Ripple’s $1 billion acquisition of GTreasury marked a major step into institutional treasury management. In comparison, Ripple-backed Evernorth announced plans to go public through a SPAC merger and raise over $1 billion to build a dedicated XRP treasury.

Evernorth’s capital raise includes $200 million from SBI Holdings and other investors, with proceeds aimed at purchasing XRP and expanding institutional yield products. Bloomberg and Reuters report that Evernorth’s listing could make it the largest public XRP treasury vehicle globally.

]]>You May Also Like

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?

This U.S. politician’s suspicious stock trade just returned over 200% in weeks