American Bitcoin stock price down 6%, erasing treasury buy bump

Shares of Trump-linked American Bitcoin are still up 20% over the week as the company nears the 4000 BTC mark.

- Shares of American Bitcoin rose are down 6%

- The Trump-linked firm made a major Bitcoin acquisition

- Treasury and mining firm now owns 3,865 BTC, and has a market cap of $5.29 billion

Despite Bitcoin trading close to its historic highs, treasury companies continue to accumulate Bitcoin. Still, on Tuesday, October 28 shares of Trump-linked American Bitcoin were down 6%, after seeing a significant rally the day prior.

American Bitcoin stock price was at $5.57, falling from the weekly high of $6.29 on the day prior. This decline erased the gains from a day prior, when ABTC shares gained a boost from the latest treasury accumulation.

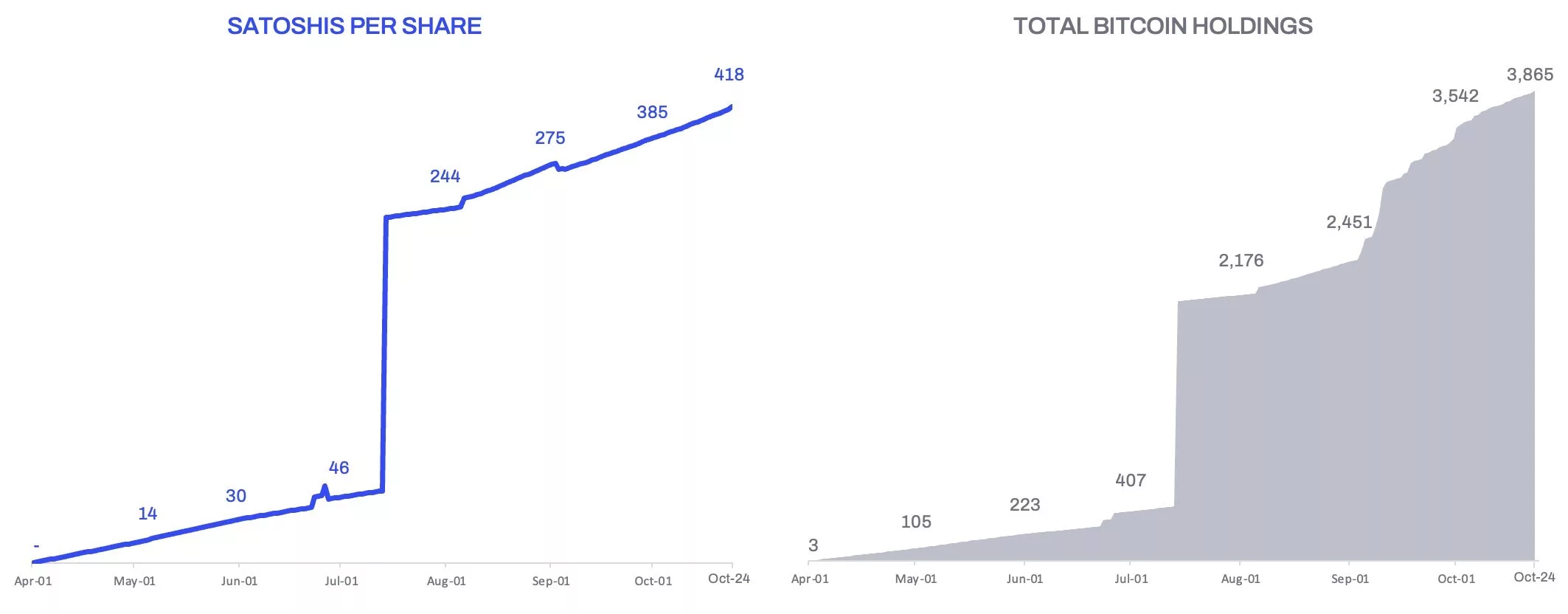

Namely, on Monday, October 27, American Bitcoin acquired 1,414 BTC, raising its total Bitcoin (BTC) holdings to 3,865 BTC. At the same time, the company also started publishing the “satoshis per share” metric, tracking the effectiveness of its acquisition strategy.

American Bitcoin faces market headwinds

Despite positive sentiment around the latest acquisition, some traders are concerned with ABTC’s valuation. While its current Bitcoin reserves are worth about $444 million, the company’s market cap is $5.10 billion. This lofty valuation gives the firm ample opportunity to acquire Bitcoin for equity, but it’s also dependent on its future performance.

American Bitcoin came out of a partnership between publicly traded BTC mining form Hut 8 and the Trump family. Notably, the firm’s co-founders are Donald Trump Jr. and Eric Trump, who is also the company’s Chief Strategy Officer.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

QNT Technical Analysis Jan 21