Bitcoin Price May Briefly Dip Below $100k Soon, Standard Chartered Analyst Says

The post Bitcoin Price May Briefly Dip Below $100k Soon, Standard Chartered Analyst Says appeared first on Coinpedia Fintech News

Bitcoin (BTC) price faces a midterm risk of dropping below $100,000 soon, Standard Chartered’s Geoff Kendrick says. According to the bank’s market analyst, the Bitcoin price may briefly fall below $100k amid trade war worries.

However, Geoff noted that the potential Bitcoin price drop below $100k may be short-lived. As such, Geoff noted that such a Bitcoin move would be a buying opportunity, for as long as the asset remains above the 50-week Moving Average (MA).

Standard Chartered Relates Bitcoin and Gold Moves

According to the bank’s analyst, Bitcoin price recently briefly rebounded after gold recorded its worst two consecutive days since mid-August 2025. Geoff noted that BTC price briefly rebounded as capital rotation from gold to the flagship coin escalated.

As such, if the Gold price continues with its weakness in the midterm, the Bitcoin price may experience a parabolic rally. The Bitcoin buying opportunity will continue for as long as the fear and greed index continues to hover in the fear zone of below 30.

Other Key BTC Opinions to Consider

According to Mike Novogratz, CEO of Galaxy, the Bitcoin price is likely to hold above the support level around $100k in the midterm. In an interview on Wednesday, Novogratz noted that the Bitcoin price will likely rally if President Donald Trump makes a move on the Federal Reserve amid the anticipated rate cuts.

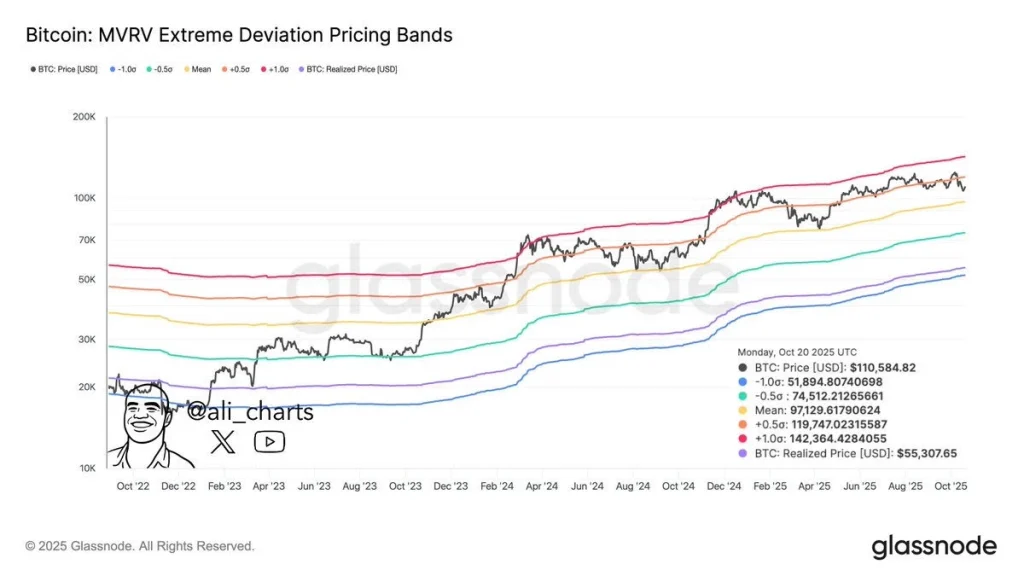

Meanwhile, the Bitcoin MVRV Extreme Deviation Pricing Bands from Glassnode show that the flagship coin has lost a crucial support level above $120k. Consequently, BTC price must consistently rally above $120k to invalidate a capitulation towards $97k or even $74.5k in the worst-case scenario.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun