Paramount Skydance (PSKY) Stock: Rises as $2B Cost-Cutting Plan Sparks Investor Optimism

TLDRs;

- Paramount Skydance (PSKY) stock rose 1.3% after unveiling a $2 billion cost-reduction strategy.

- The restructuring includes 2,000 job cuts in the U.S. and additional international layoffs.

- Over half of the cost savings will be realized in the first year, totaling 7% of the combined cost base.

- Investors view the plan as a sign of financial discipline following Skydance’s takeover of Paramount Global.

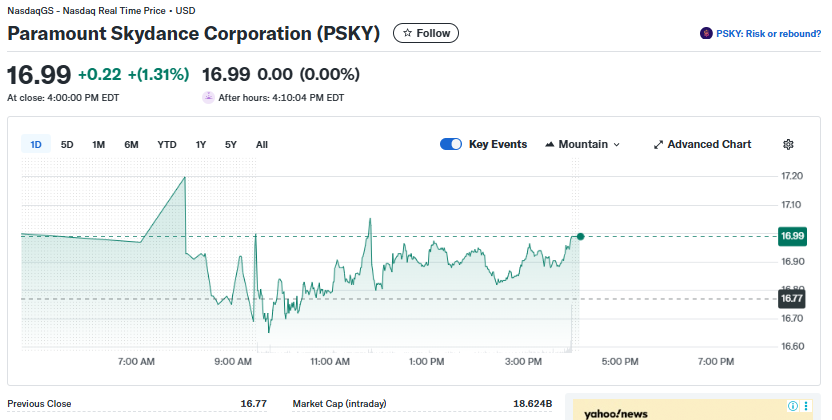

Paramount Skydance Corporation (NASDAQ: PSKY) gained 1.3% on Monday, closing at $16.99, after the newly merged entertainment powerhouse announced plans to slash $2 billion in annual costs.

The move, which includes 2,000 job cuts in the U.S. and additional reductions overseas, is being viewed by investors as a strong step toward profitability following Skydance Media’s recent takeover of Paramount Global.

Led by CEO David Ellison, the restructuring aims to streamline operations and consolidate overlapping divisions across film, television, and streaming. While the layoffs mark a sobering moment for employees, markets responded positively, signaling confidence that the company is serious about operational discipline and long-term value creation.

Paramount Skydance Corporation (PSKY)

Paramount Skydance Corporation (PSKY)

$2 Billion Savings Equals 7% of Cost Base

According to internal projections, Paramount Skydance’s cost-cutting initiative represents about 7% of its combined cost base, with over half of the savings expected in the first year. Sources familiar with the plan suggest the restructuring and integration process will carry upfront costs of around $1.6 billion, covering severance, facility downsizing, and cloud infrastructure consolidation.

The $2 billion in savings will come from several levers: merging overlapping corporate functions, trimming real estate holdings through potential sale-leaseback deals, and simplifying its cloud and technology infrastructure. The company is also rebuilding its Paramount+ platform, standardizing on fewer cloud providers, and revamping its advertising and recommendation technology.

Ellison has framed the changes as essential to creating what he calls the “New Paramount”, a leaner, tech-forward media company capable of competing with streaming titans like Netflix, Disney+, and Amazon Prime Video.

Layoffs Begin Week of October 27

Mass layoffs are scheduled to begin the week of October 27, moving ahead of the initial November timeline. The company is required to file Worker Adjustment and Retraining Notification (WARN) Act documents with the California Employment Development Department, which will detail the timing, locations, and number of affected employees.

Paramount has filed 39 WARN notices since 2008, setting a precedent for transparent layoff reporting. Analysts expect the majority of the U.S. cuts to hit Los Angeles operations, given the merger’s emphasis on real estate rationalization and back-office consolidation.

Meanwhile, competitors in the entertainment and tech sectors are expected to closely watch the WARN filings to potentially recruit displaced talent, especially in areas like streaming technology, advertising systems, and studio operations.

Investor Outlook

While the layoffs highlight the short-term human cost of the merger, investors appear focused on the financial upside. The 1.3% rise in PSKY stock reflects a cautious but growing optimism that Ellison’s leadership will stabilize the company’s finances and unlock new efficiencies.

The integration of Paramount’s legacy content library with Skydance’s production agility also presents a compelling strategic synergy. However, market watchers warn that execution risks remain high, particularly as the company balances layoffs with innovation and creative output.

For now, investors seem to be betting that leaner operations will translate into higher margins, a sentiment reflected in Monday’s modest but symbolic stock uptick.

The post Paramount Skydance (PSKY) Stock: Rises as $2B Cost-Cutting Plan Sparks Investor Optimism appeared first on CoinCentral.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Trump headscratcher has critics wondering 'what's in it for him?'