$1 Billion XRP Buying Pressure Ahead? Ripple Labs Plans New DAT Initiative

Ripple Labs is spearheading an effort to raise at least $1 billion to accumulate XRP via a new digital-asset treasury, or DAT, according to Bloomberg, signaling that the latest bout of market turmoil has not dislodged heavyweight players from advancing aggressive balance-sheet strategies tied to crypto assets.

$1 Billion XRP Buying Pressure Ahead?

People familiar with the matter told Bloomberg the vehicle would be capitalized through a special purpose acquisition company (SPAC), with Ripple also planning to contribute some of its own XRP. “Representatives for Ripple did not respond to requests for comment. Exact terms of the transaction remain under discussion and could change,” Bloomberg reported, underscoring that while the plan is live, its contours are not yet finalized.

The timing places Ripple’s move squarely against a fragile market backdrop. A week after a heavy selloff triggered record liquidations, sentiment remains brittle. Against that context, the contemplated DAT is notable on several fronts.

First, the scale: “Ripple Labs Inc. is leading an effort to raise at least $1 billion to accumulate XRP,” Bloomberg reported, adding that if completed, “it would be the biggest one to focus on XRP.”

Second, the structure: a SPAC-funded DAT reflects the 2025 wave of publicly listed token accumulators that have proliferated through reverse takeovers or SPAC listings. Bloomberg observed that “throughout 2025, digital-asset boosters set up an array of publicly listed token accumulators,” noting that “today, there are more than 300 entities holding Bitcoin alone, according to BitcoinTreasuries.net.”

The Market Backdrop

While Bitcoin-focused treasuries dominate that landscape, Bloomberg emphasized that “XRP hasn’t drawn the same level of interest from DAT investors as Bitcoin.” This initiative would attempt to change that balance. By design, a DAT channels committed capital into a defined acquisition mandate—here, XRP—creating programmatic buy-side flow that can be measured against circulating supply dynamics and secondary-market liquidity.

The framing of $1 billion in potential purchasing capacity invites obvious questions about incremental demand. Yet the wire also cautions that investor appetite for token accumulators has cooled: “Investors have also gotten more skeptical about DATs, with shares of major crypto accumulators including Michael Saylor’s Strategy Inc. and Japan’s Metaplanet Inc. posting steep declines in recent months.” That skepticism is precisely the environment in which Ripple is attempting to stand up a new vehicle.

While XRP-specific accumulation vehicles have been relatively scarce compared to Bitcoin, there are a few already established: In May, sustainable-energy firm VivoPower International announced a $121 million fundraising. Notably, the report comes the same day that Ripple agreed to buy treasury management software provider GTreasury for $1 billion, according to a Thursday announcement.

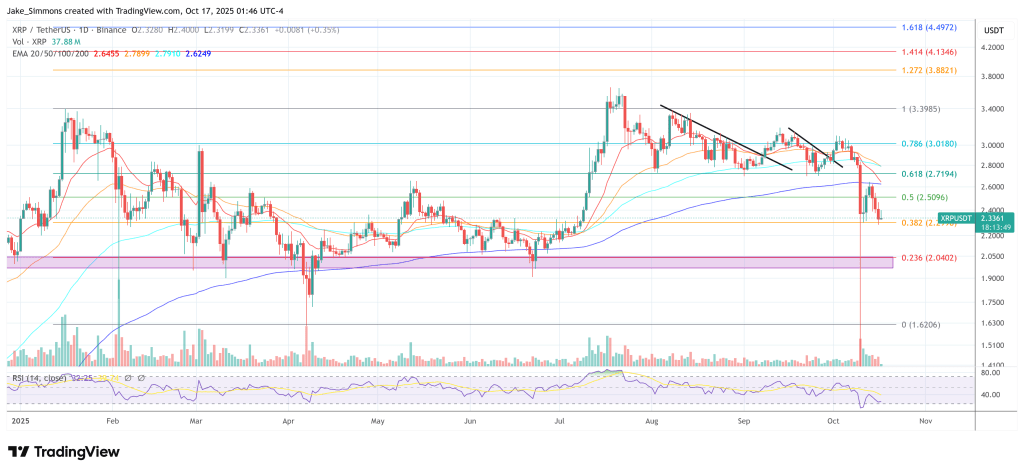

At press time, XRP traded at $2.33.

You May Also Like

XRP Ignites As Spot Volume Skyrockets

Fraudulent Token Scheme Smashed as Judge Delivers Crushing $3.34M Blow