Bitcoin ETF Flows Pause: Best Altcoins to Buy Now as XRP and Solana Defy Market Pressure

The crypto market is shifting as Bitcoin ETF inflows ease, pushing investors to look beyond BTC. Many now explore MAGACOIN FINANCE as a fresh alternative, an altcoin gaining attention from analysts and early adopters seeking diversification and undervalued opportunities.

Bitcoin ETF Inflows Cool Down but Demand Remains

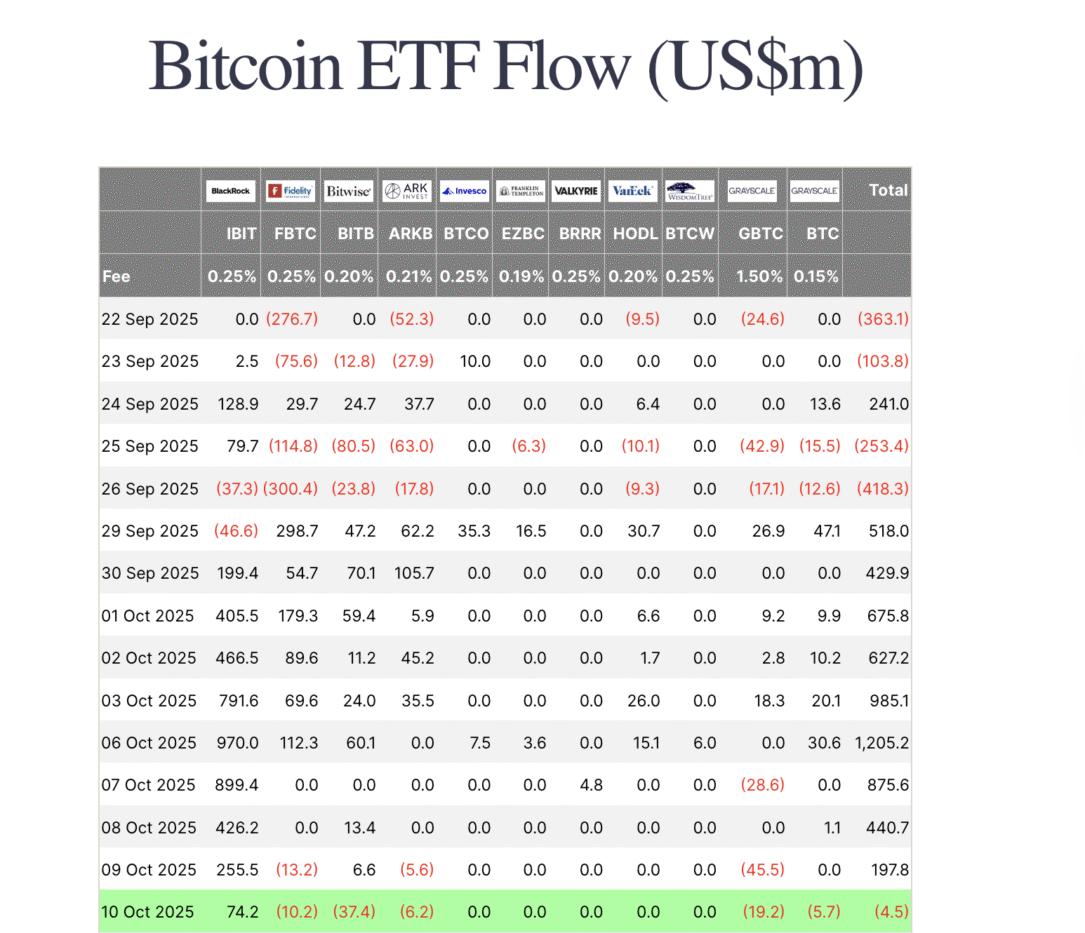

Bitcoin ETF flows have slowed this week after a strong start to October. According to Farside data, ETF inflows dropped to $197 million on Thursday, far below the over $1 billion surge recorded last week. By Friday, Bitcoin ETFs recorded $4.5 million in outflows.

This decline coincided with price pullbacks, as Bitcoin dropped to $102,000 level after touching new highs above $126,000.

Outflows from Grayscale, Ark Invest, and Fidelity, totaling $64 million, also show profit-taking after Bitcoin’s big run.

Analysts say Bitcoin’s ETF performance has become a reliable gauge of institutional sentiment. Even with reduced flows, exchange reserves continue trending lower, meaning holders are not rushing to sell.

With Q4 approaching, asset manager Bitwise expects ETF inflows to hit record highs again, thanks to new institutional access from firms like Morgan Stanley and Wells Fargo.

While Bitcoin ETF activity steadies, many investors are using this moment to rotate capital into altcoins, seeking better entry points before the next wave of inflows.

XRP Price Targets Spark Fresh Interest

XRP continues to stand out among the best altcoins to buy now, as analysts compare its long-term chart to Amazon’s early growth cycle. Market analyst ChartNerd recently projected a possible XRP price move to $27, noting striking similarities between Amazon’s 1999–2009 consolidation and XRP’s 2017–2025 pattern.

The theory suggests XRP has spent years building a base under $3, just like Amazon stayed below resistance before breaking out into a long-term rally. Other voices like EGRAG and Bullrunners’ Nick Anderson share similar optimism, forecasting a new expansion phase.

At the moment, XRP trades around $2.80, and analysts see it as undervalued compared to its historical trend. With the broader crypto market rotating funds from Bitcoin ETF profits, XRP could benefit as capital seeks assets with long-term upside narratives and established use cases.

For many traders, XRP’s setup is less about speculation and more about patience, a quality often rewarded in cycles like this.

Solana Gains Institutional Attention

Solana is another name rising on the list of best altcoins to buy now, thanks to institutional adoption through Digital Asset Treasuries (DATs). These entities, listed on public markets, allow firms to gain crypto exposure through traditional brokerage accounts — an approach similar to ETFs but with more flexibility.

Over the last 30 days, Solana treasury companies have accumulated over 6.3 million SOL, representing more than 1.6% of the token’s circulating supply. This trend shows that major investors are positioning for the next phase of growth, especially after the FTX estate sale, which distributed millions of SOL to institutions under multi-year lockups.

Executives like Joseph Onorati of DFDV have said that Solana is leading the “technology race” among Layer-1 networks. With high speed, low fees, and an active DeFi ecosystem, Solana continues to attract both retail and institutional participants.

As more firms seek diversification away from Bitcoin ETFs, Solana remains a top pick for exposure to blockchain innovation and on-chain activity.

MAGACOIN FINANCE: The Undervalued Altcoin Pick

Among the best altcoins to buy now, many analysts highlight MAGACOIN FINANCE, a community-driven project gaining traction for its transparent structure and growing investor base.

With over 20,000 participants already positioned, it’s viewed as a hidden gem in the current market rotation.

Why MAGACOIN FINANCE stands out:

- Strategic hedge amid Bitcoin ETF cool-down

- Analyst and whale accumulation spotted

- Listing expected soon

- Growing interest from institutional groups

Investors are treating MAGACOIN FINANCE as a diversification play — one that blends meme coin appeal with solid fundamentals and verified audits.

Audited and Verified

MAGACOIN FINANCE is audited by HashEx and CertiK to ensure safety and transparency.

How Traders Can Position Now

With Bitcoin ETF flows cooling, traders are turning to high-upside altcoins before the next capital rotation wave. MAGACOIN FINANCE, XRP, and Solana are all gaining attention for different reasons — utility, structure, or institutional backing.

Smart traders are taking early positions before ETF-driven liquidity returns later this quarter. Visit the official links to explore MAGACOIN FINANCE and secure a spot before listings begin:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

The post Bitcoin ETF Flows Pause: Best Altcoins to Buy Now as XRP and Solana Defy Market Pressure appeared first on Blockonomi.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Sonami Token Presale Launches With 53% Staking Rewards, Powering a Solana Layer-Two Network Vision