XRP Builds Pressure at $2.73: Will the Bulls Take Over?

- XRP faces mild pressure but continues to attract strong trading activity, showing steady market participation.

- The token is holding above key support levels as investors await signs of recovery and a possible trend reversal.

- Tight price movement hints at an upcoming breakout, with analysts watching closely for a decisive market shift.

Ripple (XRP) is currently trading at $2.73, with a 1.98% decrease in the last 24 hours. Although there has been a fall, the trading volume has grown by 7.97% to $5.91 billion, which shows improved participation in the market. The increase in volume indicates that the traders are still operating despite the lowering prices.

Source: CoinMarketCap

The price of XRP is down 11.17% over the last week. The token remains trading around key support points as investors analyze any signs of recovery. Market analysts are keenly awaiting whether the buyers will be able to correct the trend in the future sessions.

XRP Maintains Strength Amid Market Pressure

Crypto analyst CasiTrades highlighted the level that has served as a firm resistance to further downside. Brief dips below this line did not succeed, and all hourly and daily candles have closed at higher levels. According to analysts, this demonstrates consistent demand among buyers, which further supports the role this zone now plays in the XRP market structure.

XRP started to rise towards the consolidated central trendline in July as it gained support at this level. The price has a rough trading range now between $2.72 and $2.83. Tight ranges normally signify that the market is preparing to make a significant move. This is referred to by traders as a coiling hold till it breaks out.

Source: X

Also Read: Is WIF Preparing to Smash the $0.85 Resistance Zone?

RSI Signals Renewed Strength in XRP Trend

A test above XRP of $2.83 rests on the critical level of $3.00. Any established shift above that might be an indication of a Wave 3 impulse will typically spur powerful rallies. There, analysts forecast potential near-term price targets of about $4.00 and $4.50.

The Relative Strength Index (RSI) is indicating that it is recovering. The recent correction of Bitcoin appears to be nearing its end, and the outlook for altcoins is becoming increasingly favorable. This compounding puts in a more convincing case of a possible XRP breakout in case of purchases.

Rising Trading Volume, Falling Open Interest Shape XRP Trend

CoinGlass data shows that the trading volume increased by 14.16% to $6.98 billion, indicating more interest in the market. Nonetheless, Open Interest dropped 2.79% to $8.14 billion, giving the impression that some traders are unwinding leverage positions before the volatility. The OI-weighted funding rate is 0.0081%, reflecting a neutral mood in futures markets.

Source: CoinGlass

The market has entered a pivotal turning point, as XRP approaches near support and volatility compresses. Analysts see the next big trend of XRP being characterized shortly by a decisive breakout either way. Meanwhile, traders are still bound in a tight margin of the $2.72 and $3.00 range, which would determine the future path of the token in the short and long term.

Also Read: Sei (SEI) Price Analysis: Institutional Adoption Boosts Growth as Bulls Target $0.36

You May Also Like

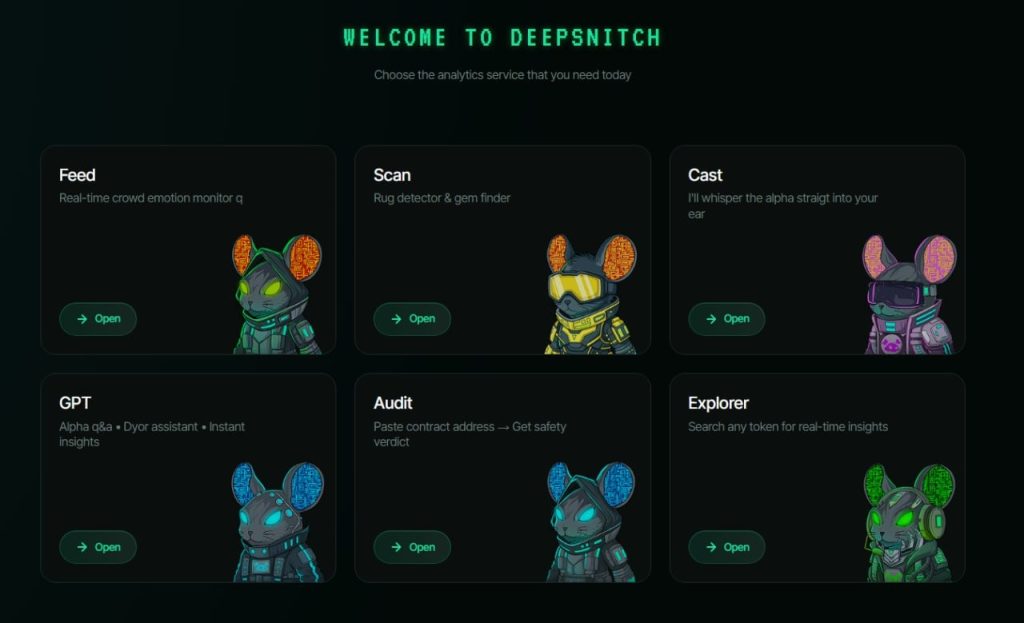

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24