Hashdex Crypto Index ETF Boasts New Altcoin Exposure for Greater Gains

In a significant development for the cryptocurrency investment landscape, Hashdex has expanded its Crypto Index US ETF to include popular digital assets like XRP, Solana (SOL), and Stellar (XLM). This move comes after the SEC’s recent rule change allowing for a more streamlined process for listing digital assets on exchanges, potentially accelerating the adoption of more diverse crypto assets within traditional financial products.

- Hashdex’s ETF now includes XRP, SOL, and XLM, alongside Bitcoin and Ether.

- The ETF is listed on Nasdaq under the ticker NCIQ, offering investors exposure to five leading cryptocurrencies.

- The SEC’s approval of generic listing standards paves the way for quicker crypto ETF approvals in the future.

- New standards require cryptos to be classified as commodities or feature regulated futures contracts.

- Industry experts anticipate a surge in crypto ETF filings and increased integration between traditional and digital asset markets.

Hashdex’s Crypto Index US ETF, trading on Nasdaq under the symbol NCIQ, has expanded to include XRP, Solana (SOL), and Stellar (XLM), adding to its existing holdings of Bitcoin (BTC) and Ether (ETH). The move aligns with recent regulatory developments that ease the process of listing innovative digital assets, following the SEC’s approval of generic listing standards earlier this year. These standards are designed to facilitate a broader adoption of cryptocurrencies by institutional investors and retail consumers through familiar financial structures.

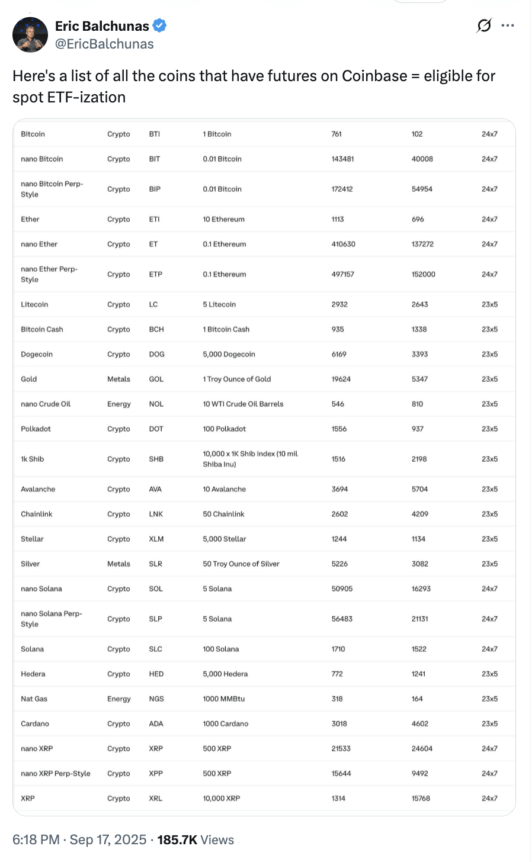

Under the new rules, a cryptocurrency must be either classified as a commodity or feature futures contracts traded on reputable exchanges to qualify for ETF listing. Moreover, eligible cryptos must be monitored under the US Intermarket Surveillance Group, ensuring higher standards of market oversight and security. This regulatory clarity is expected to energize the market, prompting numerous firms to file new ETF proposals that incorporate a diversified mix of digital assets.

Market analysts expect this regulatory momentum to influence broader adoption of crypto funds, blurring the lines between traditional equities and digital assets. The recent approval of Grayscale’s Digital Large Cap Fund, which includes multiple cryptocurrencies such as BTC, ETH, XRP, SOL, and Cardano (ADA), exemplifies this evolving trend and signals a move toward more multi-asset crypto investment vehicles.

SEC Chair Paul Atkins has championed efforts to streamline cryptocurrency ETF approvals, including the proposed “innovation exemption,” a regulatory sandbox allowing blockchain projects to experiment freely without fear of immediate sanction. This shift in policy reflects a broader move by regulators to modernize the U.S. financial system to better accommodate digital finance and blockchain innovation.

Source: Eric Balchunas

Source: Eric Balchunas

This regulatory evolution has been partly driven by the U.S. government’s recent efforts to reduce barriers and foster innovation in digital assets. Policies now emphasize comprehensive market oversight and classifying most cryptocurrencies as commodities, aligning with global trends in crypto regulation and encouraging further integration of blockchain technologies into mainstream finance.

This article was originally published as Hashdex Crypto Index ETF Boasts New Altcoin Exposure for Greater Gains on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Q4 2025 May Have Marked the End of the Crypto Bear Market: Bitwise

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon