Pundi AI token swap in-depth analysis: deflation model reconstruction and AI data value leap

Written by Yuliya, PANews

The rapid development of AI technology has led to the rise of the DeAI field. As a decentralized AI data layer developed by Pundi X, Pundi AI is committed to breaking the monopoly of centralized platforms on high-quality AI data through data tokenization and economic incentive models. With the brand upgrade and token renaming, $FX will be renamed $PUNDIAI at a ratio of 100:1 on February 25. This article will introduce the token swap process, the logic behind it, the reasons for the upgrade, and the innovative changes it brings in detail.

Reconstructing the AI data value chain

Pundi AI's token swap is not a simple token renaming, but an important part of its AI data ecosystem strategic upgrade. The core of the AI industry lies in computing power, algorithms and data, and the scarcity of data and the monopoly of centralized platforms are the main bottlenecks currently faced. Pundi AI attracts more data contributors through a decentralized approach and promotes the improvement of data quality for AI model training.

The current AI industry faces three major pain points: data monopoly, privacy leakage, and uneven quality:

- Centralized platform monopoly: For example, Google and OpenAI spend $60 million each year to purchase Reddit data, making it difficult for small and medium-sized developers to obtain high-quality resources.

- Data bias and inefficiency: The quality of public Internet data varies, resulting in poor performance of AI models in professional fields (such as healthcare and finance).

- Lack of incentives for contributors: Data providers are unable to obtain reasonable returns, resulting in a “blood-sucking giant” model.

Pundi AI introduced the "Tag-and-Earn" model, which uses browser plug-ins to turn data annotation into an easy and interesting interactive activity, attracting more contributors to participate and providing more diverse and high-quality data for AI models. In addition, Pundi AI tokenizes and trades AI data in the form of NFTs, making data ownership clear and transactions transparent, and promoting data flow and value discovery.

Full stack product matrix

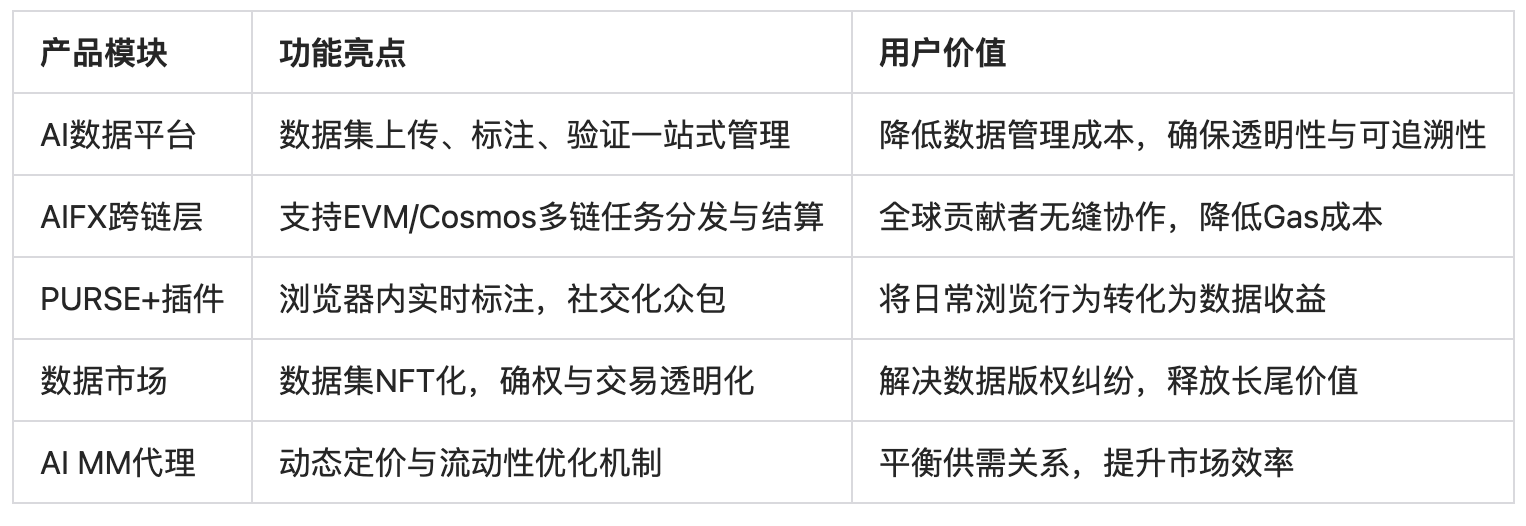

Pundi AI builds more complete decentralized AI data products through token swaps and brand upgrades, including:

- Pundi AI Data Platform: A central platform dedicated to AI data management that supports uploading data in text, image, video, audio and other formats for annotation and verification of the entire process to ensure transparency and traceability.

- Pundi AIFX Omnilayer : A cross-chain AI data processing platform that can distribute AI-related tasks (such as data labeling and verification) to participants around the world. No matter which blockchain network users use, they can seamlessly participate in tasks and receive rewards while reducing transaction costs. For example, if data labeling tasks are published on Ethereum, global users can complete tasks and receive rewards on other chains (such as Base), and the entire process is automatically settled across chains by the platform.

- Purse+ browser plug-in: Purse+ is a browser plug-in that allows you to easily participate in Pundi AI's data collection work while surfing the Internet. When browsing the web, you can use the plug-in to annotate text, pictures or videos for training AI models. You can get $PUNDIAI token rewards for each effective annotation. In addition, the plug-in also supports team collaboration, and you can annotate data and participate in discussions with other users.

- AI Data Marketplace: Labeled data is equivalent to intellectual property, and data contributors can put their data on the market. AI developers, organizations, and researchers can purchase high-quality, screened data sets by category to train AI models. The platform uses $PUNDIAI tokens as settlement currency, automatically completes payment and distribution through smart contracts, and buyers obtain NFT ownership certificates of data.

- AI MM Agent : It is an intelligent market maker system that predicts and responds to market changes by real-time monitoring of the transaction pool (mempool). The main functions include: transaction warning (monitoring large transactions and flash loans), dynamic adjustment of liquidity (automatically narrowing or widening the price range according to market conditions), same-block execution (completing operations in the same block by optimizing Gas fees when necessary), and intelligent risk control (analyzing price trends, trading volumes and volatility of trading pairs such as ETH/USDC). When a large transaction is discovered, the system will quickly adjust the price range of LP tokens to avoid arbitrage by MEV robots while ensuring that higher fee income can be obtained. Through the coordinated operation of these functions, AI MM Agent can not only provide a better trading experience, but also bring stable returns to vePUNDIAI holders. It is an intelligent market-making solution that integrates efficiency, security and profitability.

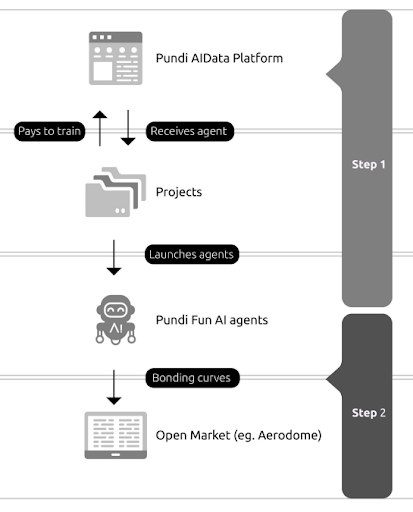

Dual-token model improves utility and governance participation

Pundi AI is building an innovative dual-business ecosystem. In the Web2 field, the platform assists AI companies in obtaining high-quality data and generates revenue through 10% data publishing fees and 10% transaction commissions; in the Web3 field, developers can purchase AI data, train agents, and issue tokens for market making on the platform. This part of the business generates revenue through 1% agent transaction fees, LP fees, 10% project incentive fees, and whitelist application fees. All revenue from these two business lines will be returned to the participants of the ecosystem.

In order to better support this innovative ecosystem, Pundi AI will conduct a token swap, which will reduce the existing 820 million $FX tokens to 8.2 million $PUNDIAI at a ratio of 100:1, significantly increasing scarcity. At the same time, FX has been fully unlocked, which is purely community-driven, with no institutional unlocking pressure, and 65% of the tokens are still staked on the validator nodes, providing potential support for the token price.

Since $FX has been listed on leading exchanges such as Upbit and Coinbase, which support centralized exchanges for exchange, the token swap will be automatically completed by the exchange, and users do not need to do it manually. The number of tokens will be automatically updated at a ratio of 100:1.

For self-custodial holders on the chain, manual replacement is required.

- AIFX Omnilayer (formerly f(x)Core): Automatic swap. Regardless of whether the FX token is staked or unstaked, the system will automatically upgrade it to PUNDIAI without any additional action. Staked tokens will continue to receive rewards according to the original mechanism after the upgrade.

- Base & Ethereum Network: Manual Swap. Please visit the designated page and follow the instructions to manually upgrade the FX token to PUNDIAI. Alternatively, you can choose to bridge the FX token back to the Pundi AIFX Omnilayer to automatically complete the token swap.

After the token swap, $PUNDIAI and $vePUNDIAI will form a dual-token model:

- $PUNDIAI : Circulation and payment medium, used for data transactions, pledges and handling fees.

- $vePUNDIAI : Governance certificate, lock tokens to obtain voting rights, all business income of the ecosystem will be deposited into the protocol income pool, and will be returned to $vePUNDIAI holders in a variety of ways, including weekly project token incentives, LP pool revenue sharing, and protocol income sharing.

This innovative dual business line structure combined with a dual token model draws on Curve's ve mechanism, Pump.fun's AI agent release mechanism, and Aerodrome's ve3,3 voting model, and effectively incentivizes long-term holding through a lock-in mechanism. This design not only balances the two major business segments of AI data services and Web3 developer services, but also ensures the sustainable development of the ecosystem through scientific token economics design, creating long-term value for token holders.

Flywheel effect started?

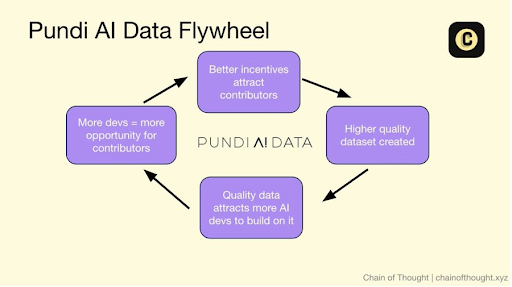

Pundi AI's token swap strategy essentially represents its strategic upgrade and structural reshaping in the field of AI data ecology. This transformation is redefining the operating paradigm of the AI data market by building a decentralized data infrastructure and an innovative token economic model.

Judging from the current market data, Pundi AI is in a critical period of value revaluation. In terms of market size, after completing the 100:1 token swap, the circulating supply is 8.06 million. As an AI token launched on both Upbit and Coinbase, its current circulating market value is at a relatively low level among similar projects. Referring to the valuation level of similar projects in the market, RNDR (fully diluted valuation of approximately US$3 billion), significant scale differences can be observed.

From the historical data, token shrinkage events like Aave (LEND to AAVE) are often accompanied by significant valuation increases. At the industry trend level, as the Grayscale research report positions the "AI data infrastructure layer" as the core track of the crypto economy, the integration of AI+Crypto technology has become an industry consensus.

Pundi AI is building a self-driven ecological closed loop: attracting high-quality data providers through a carefully designed token incentive mechanism, promoting the continuous accumulation of high-quality data assets, and then attracting AI developers to develop and innovate applications based on the platform. The prosperity of the developer ecosystem can create more value realization opportunities for data contributors, forming a virtuous ecological growth cycle. With this full-stack solution, Pundi AI is expected to become an infrastructure-level entrance that drives hundreds of millions of Web3 users to access the AI economic system.

In addition, Upbit will suspend Function X (FX) deposit and withdrawal services at 10:00 am (UTC+8) on February 26, 2025; FX/BTC trading will be suspended from 1:00 pm (UTC+8) on February 28, 2025 until further notice after the name change and token swap are completed. When trading support is restored, the market name will be changed to PUNDIAI/BTC.

You May Also Like

Wall Street bank JPMorgan says stablecoin market could grow to $600 billion by 2028

Copy linkX (Twitter)LinkedInFacebookEmail

Vertical Aerospace Progresses Towards Full Piloted Transition Flight