DOGE prototype owner's new favorite "Neiro" is popular: multiple MEMEs with the same name have received hundreds of millions of funds, and unauthorized "protests" have been made

Author: Nancy, PANews

Dogs are undoubtedly the leading narrative of MEME culture, and the deceased Shiba Inu internet celebrity Kabosu is the prototype of MEMECOIN's ancestor DOGE. Recently, Kabosu's owner announced that he had adopted a rescue dog named "neiro" and quickly became a hot MEME hype target. Under the general decline of many MEME coins, multiple neiro coins with the same name have won hundreds of millions of dollars in daily trading volume, and "smart money" has made a lot of money. But this FOMO phenomenon has also caused "protests" from Kabosu's owner.

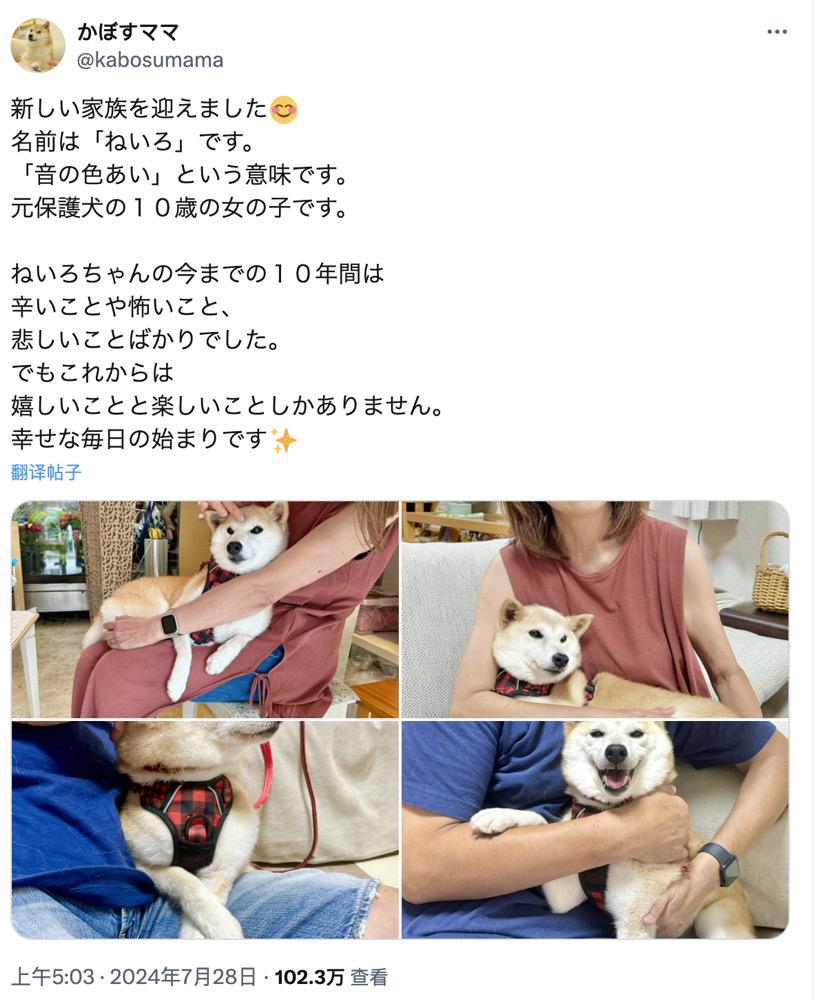

Similar to the tortuous experience of Kabosu, who was originally rescued and adopted and was on the verge of euthanasia, "neiro" is a rescue dog with only ten years of rescue history. According to Kabosu's owner @kabosumama's introduction on social media in the early morning of July 28, the name of this new family member means a happy beginning.

With the huge traffic and popularity of Kabosu, the new favorite neiro naturally caused a huge response, including the appearance of the same-name MEME coin on Solana and Ethereum. According to DEX Screener data, the highest increase of "Neiro" on Solana reached 181912.8%, the highest increase of "NEIRO" was about 117324.2%, and the highest increase of "Neiro" on Ethereum was 75.9 times. And the MEME coin also received a lot of capital participation. In the past 24 hours, the total transaction volume of "Neiro" and "NEIRO" on Solana exceeded US$250 million, and the "Neiro" on Ethereum reached US$15.8 million. But in terms of market value performance, as of the time of writing, the market value of the earliest created "NEIRO" still reached US$23.4 million after the price fell.

With high popularity, the developer made a lot of money. According to Lookonchain monitoring, when deploying Neiro on Solana, the developer spent 3 SOL (552 US dollars) to buy 97.5 million Neiros, and then sold 68 million Neiros at a price of 15,511 SOL (2.85 million US dollars) through multiple wallets, realizing a profit of 15,508 SOL (2.85 million US dollars). According to further analysis by Bubblemaps, Neiro developers have made a profit of 5.7 million US dollars, and still own 6% of the supply after purchasing through multiple addresses, but the developer denied it, saying "This is false information. Most of these addresses belong to friends of DEV. Dev currently holds about 1.6% of the supply and does not plan to sell it in the near future."

At the same time, smart money also reaped rich returns. For example, according to @ai_9684xtpa monitoring, a smart money made a profit of $1.93 million with only $80,000 through trading Neiro, with a return rate of up to 2397%. And this address is most likely not a rat warehouse, because it participated in many MEME transactions in a month with the idea of "buying lottery tickets", and the winning rate was only 31.25%.

But the hype surrounding neiro has also caused dissatisfaction from @kabosumama himself, "I've seen a lot of tokens related to Kabosu and Neiro. To be clear, I do not endorse any crypto project except $dog from Own The Doge (@ownthedoge). Because they own the original Doge photos and IP (which I gave them), and are committed to doing only good deeds, charity work, and Doge culture every day." The Kabosu owner emphasized in the tweet.

According to the official website, Own The Doge is the only DAO that has obtained the exclusive IP license for Kabosu. This licensing transaction took Own The Doge three years to complete, and during this period, it also cooperated with legal experts in the United States and Japan to negotiate the acquisition. Finally, in April this year, it announced the purchase of image copyrights related to the Dogecoin prototype Kabosu, but did not disclose the purchase price. In the past, Own The Doge has cooperated on multiple projects, including related NFTs, charity auctions, and movies. The organization has donated more than 2 million US dollars to charities that support dogs and children, and is currently the largest cryptocurrency donor to Save the Children.

This means that these Neiro-related MEME coins are at risk of infringement. Perhaps affected by this, Neiro’s official X account on the Solana chain has been frozen due to violations, and the Telegram group is no longer accessible.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

China holds rates at 1.40% despite Fed cut and economic slowdown