UK and US Step Up Crypto Cooperation – What It Means for Altcoins Like $SUBBD

UK Chancellor Rachel Reeves and US Treasury Secretary Scott Bessent reportedly agreed to deepen cooperation on digital assets this week, a move insiders say could reshape adoption trends across both sides of the Atlantic.

Source: X/@RachelReevesMP

Executives from Coinbase, Circle, Ripple, Barclays, Citi, and Bank of America were present at discussions, highlighting how seriously both governments are taking crypto’s role in financial markets.

Any deal is expected to touch on stablecoins – an area where US policy under President Donald Trump has leaned pro-adoption, while UK regulators have remained cautious.

Greater policy clarity often sparks capital rotation into other avenues of crypto, from established altcoins to emerging presales like $SUBBD, which aim to capture new adoption cycles.

Why UK-US Alignment Matters

The UK is now looking to mirror the Trump administration’s crypto-friendly stance, which many insiders view as pivotal to unlocking adoption. Under Trump, stablecoins became a policy priority, and London’s shift toward that playbook signals that Britain wants to compete more aggressively for capital and innovation.

Stablecoins are expected to be central to any deal. That’s significant because they’ve been one of the most controversial areas of regulation in the UK.

Source: @AbsGMCrypto

In November 2023, the Bank of England floated proposals to cap individual holdings between £10K ($13,650) and £20K ($27,300). Advocacy groups slammed the idea as both costly and unworkable, warning it would stifle growth.

Aligning those rules with the US could smooth cross-border investment, foster regulatory sandboxes for blockchain testing, and ultimately attract more institutional flows into the market.

Investor Signals and What They Mean for Altcoins

Adoption trends in the UK show a clear appetite for digital assets, even with regulatory and banking hurdles.

It’s estimated that around one in four UK adults would consider adding crypto to their retirement funds. A survey by insurance firm Aviva also found that one in five UK adults (more than 11.6M) said they have held crypto at some point, and two-thirds of them still do. That persistence suggests long-term conviction rather than fleeting speculation.

Source: X/@coinbureau

Yet these same investors often face resistance from banks. Roughly 40% of 2K surveyed crypto investors in the UK said their banks had blocked or delayed payments to crypto providers, often citing fraud or volatility concerns.

This friction highlights why a UK–US alignment on rules matters. If banks and regulators ease their stance in sync with Washington, crypto could be legitimized as an investable asset class, opening the door for broader institutional inflows.

Today’s market isn’t just about memes and momentum. Utility-driven projects that tap into real markets have a better chance of sustaining growth in a more regulated environment.

One of the clearest examples is $SUBBD – a crypto that fuses AI tools, crypto payments, and creator monetization. In an environment where policy clarity fuels adoption, platforms like SUBBD could capture both attention and capital.

SUBBD ($SUBBD) and the Web3 Creator Economy

The content creator market has exploded in recent years and is forecast to be valued at around $1.35T by 2033. Yet the market remains dominated by intermediaries that can take more than half of a creator’s earnings. SUBBD ($SUBBD) wants to change that.

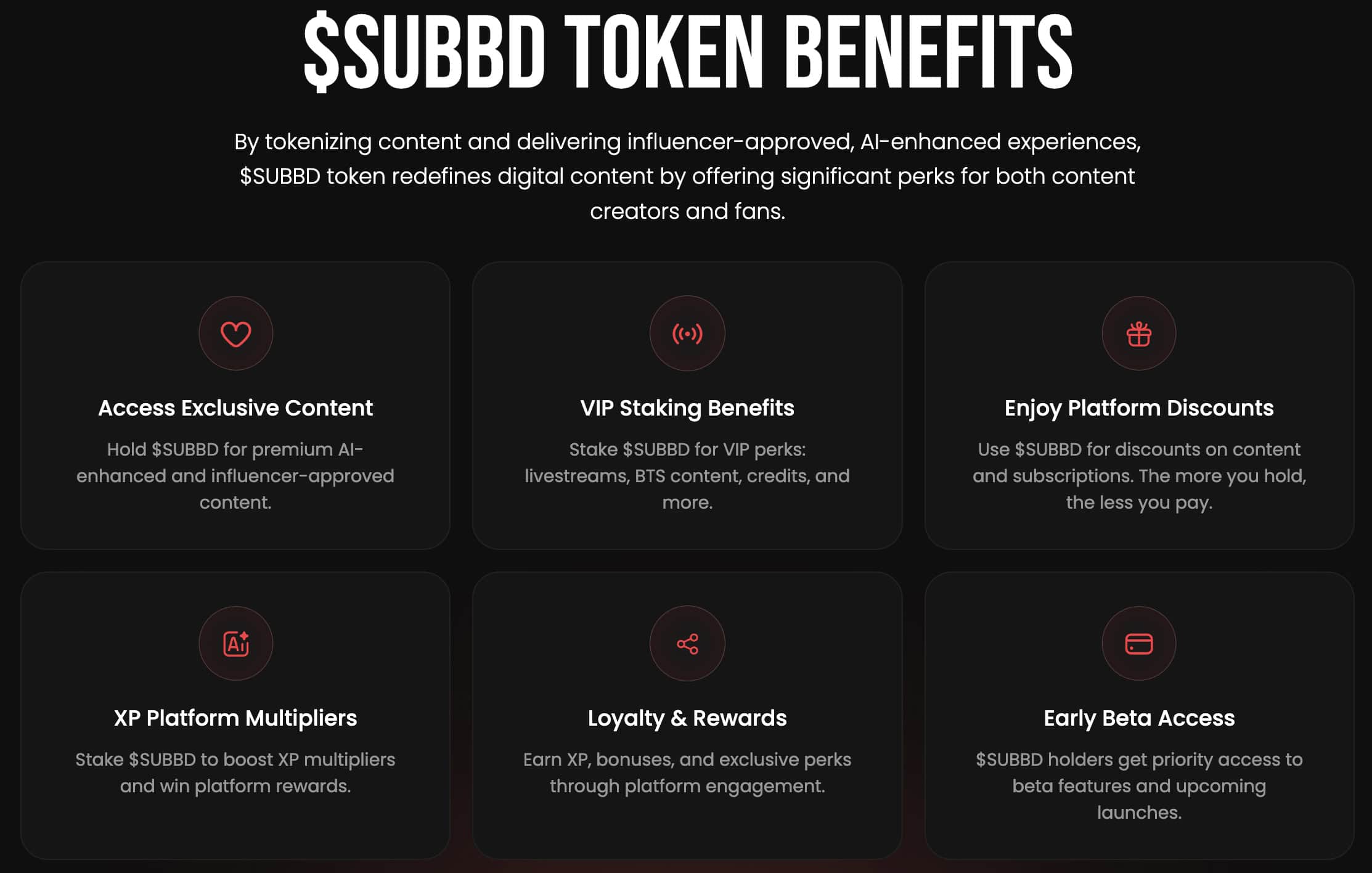

SUBBD offers AI tools that handle everything from content generation and automated chat to editing and monetization support. This helps creators scale output while freeing up time, while fans benefit from interactive AI avatars and personalized digital experiences.

The platform already commands a reach of more than 250M followers across its ambassadors and official channels: a signal of strong market positioning even before launch.

The presale has already raised over $1.15M, with tokens priced at $0.05645. If the UK–US regulatory push brings more legitimacy to crypto payments and stablecoins, platforms like SUBBD are positioned to onboard millions into a fairer, AI-powered creator economy.

Want to find out more? Visit the $SUBBD presale site today.

You May Also Like

UK Looks to US to Adopt More Crypto-Friendly Approach

Crucial Fed Rate Cut: October Probability Surges to 94%