ai16z was named by a16z partner and became popular. The issuing platform behind it, daos.fun, focuses on DAO venture capital for the MEME market.

Author: Nancy, PANews

In the past two days, the MEME coin ai16z, which was "named" by a partner of the well-known crypto venture capital a16z, has become popular. Its soaring market value has not only attracted the attention of many Degens, but also made the DAO fundraising platform daos.fun behind it a focus of heated discussion and widespread participation. This is another MEME track incubation product of Alliance DAO after Pump.fun and Moonshot.

AI imitates the investment decision of a16z partner, and its market value reaches up to $100 million after being pushed by his own posts

In the crypto venture capital world, a16z (Andreessen Horowitz) is known for its unique investment vision and precise strategies. Recently, ai16z, an AI-driven venture capital fund with a name similar to a16z, has quickly gained high attention among the endless MEME projects.

"The goal of ai16z is not to create an AI robot that imitates Marc Andreessen, but to beat him in the field where he is best." It is understood that ai16z was created by developer Shaw, who calls himself a "full-stack developer, multimedia artist, and creator of various intelligent systems."

, which

The project caught the attention of a16z partner Marc Andreessen the day after it was created. On the morning of October 27, Andreessen tweeted, "GAUNTLET THROWN (Challenge has been issued), and attached a screenshot of the ai16z X account." Andreessen also wrote in a subsequent tweet with a screenshot of the ai16z fund's avatar: "Hey, I have that T-shirt."

From the price trend, MEME coin ai16z started to soar after Andreessen sent two tweets. DEX Screener data shows that since its creation on October 26, ai16z has risen by about 50 times in just two days, and its market value has once reached the $100 million mark. Although the price of ai16z has now fallen sharply, it is enough to show the appeal of a16z. It is worth mentioning that before this, a16z also played a certain role in the rise and popularity of the leading AI MEME coin Goat.

DAO fundraising platform for MEME coins, supported by Alliance DAO

The popularity of MEME coins such as ai16z also brought high exposure to the issuing platform behind it, daos.fun. Daos.fun is considered to be the hedge fund version of Pump.fun, which allows users to raise funds for the DAO fund they created in exchange for DAO tokens such as ai16z.

According to the official introduction, daos.fun allows creators to raise the required amount of SOL tokens within one week, and adopts a fair sale method to allow everyone to participate at the same price. If the fundraising fails, the original route will be returned; if the fundraising is successful, the creator can use the raised funds to invest in Solana ecological projects, and the DAO tokens purchased by each participant can be exchanged for the fund's underlying assets on the platform or directly sold.

Once the fund expires, the DAO wallet will be frozen, and the SOL portion of the profit will be distributed 50% to the creator and 50% to the investor. Non-SOL tokens will be distributed according to the proportion of investors' holdings in DAO tokens. Holders can redeem DAO assets by destroying the corresponding DAO tokens, or sell them on DEX. The premise is that the current market value of the DAO token must be greater than the fundraising amount. It should be noted that unlike Pump.fun, which is open to everyone, daos.fun adopts an invitation system, and creators need to be officially reviewed.

In fact, daos.fun is another product supported by Alliance DAO in the MEME track besides Pump.fun and Mootshot. This product combines the DAO venture capital concept that was popular in the last bull market. But it seems that users are only looking for the speculative opportunities of DAO tokens, rather than the potential profits after the end of DAO in the next year.

“The launch and trading of DAOs for MEME coins could be a catalyst for widespread DAO adoption, which is why we launched daos.fun, allowing anyone to create a DAO and trade MEME coins in a unique way. Anyone can raise up to $15,000 (currently capped) to issue DAO tokens, and fund creators will use smart wallets to buy and sell MEME coins. All created DAOs have an expiration time (ranging from 3 months to 1 year). At expiration or when the creator closes the DAO, the tokens in the DAO will be automatically distributed to the DAO members. We have implemented multiple protections, such as allowing voting to remove DAO creators and take over creator wallets, or assigning a specific program ID to the DAO.” Imran Khan, co-founder of Alliance DAO, disclosed.

At a time when the PvP phenomenon in the MEME market is becoming increasingly serious, the launch of daos.fun not only lowers the threshold for VC creation, but also provides investors with the opportunity to obtain more professional management of funds. However, the specific benefits of investors depend on the capabilities and resources of the DAO funds they participate in.

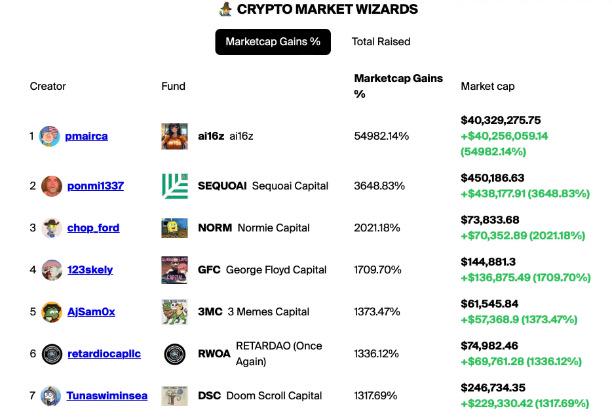

Judging from the rankings of daos.fun, there are currently only 7 funds that have raised more than 100 SOL tokens. Although many related DAO tokens have seen astonishing increases, only ai16z has the highest market value, and the rest are all below US$500,000.

You May Also Like

SUI Price Consolidation Suggests Bullish Breakout Above $1.84

Stijgt de Solana koers door $1 miljard RWA en de institutionele adoptie?