Polkadot Caps DOT Supply at 2.1 Billion: Tokenomics Shift Sparks Excitement

Polkadot completes a supply cap on DOT of 2.1 billion and puts an end to the unlimited issuance, adding scarcity to their tokenomics. Big change ahead.

Polkadot has already made a major modification to its tokenomics, restricting its issue of DOT to 2.1 billion tokens. Polkadot Polkadot DAO Referendum 1710 was passed by 81%.

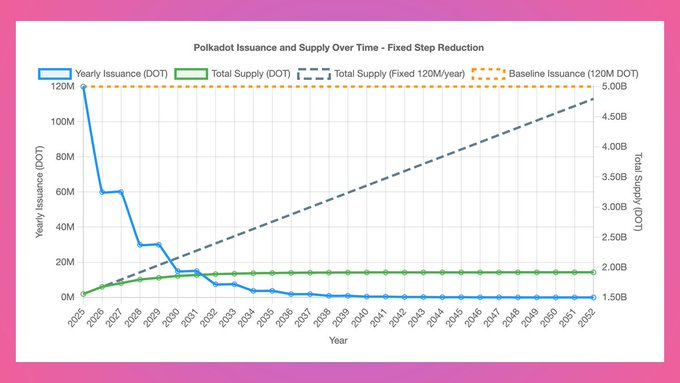

The move terminates the past model of unlimited issuance that produced about 120 million DOT per year.

Source – X

At present, there are approximately 1.6 billion DOT tokens in circulation. The new cap proposes the progressive reduction of the issue of tokens after the initial two-year period, that is, after March 14, 2026, or Pi Day.

This gradual decanting strategy will minimize inflation and raise token scarcity. It is projected that the total supply will be approximately 1.91 billion by 2040.

This is the opposite of the previous model, which forecasted the existence of a supply above 3.4 billion tokens by the same year.

A Tokenomics Model of Scarcity

It is a shift in the economic design of Polkadot with this new structure. It gives predictability in supply and encourages long-term orientation in response to the market.

Most investors appreciate the limited supply because it creates a sense of scarcity, which they consider a strong attribute in the token’s value proposition.

Referendum 1710 defines a phased issuance reduction strategy that will intermittently slow down the creation of DOT. The overall supply will reach the hard cap by 2160.

Such a change is one of the wider trends in decentralized finance towards more sustainable, inflation-aware tokenomics.

Market Response and Future Perspective

Although the community strongly supported the supply cap, the price of DOT fell by almost 5 percent after the announcement. The token is trading at around 4.20. Analysts interpret this as Polkadot preparing to launch its 2.0 upgrade, which will enable it to scale better and become easier to develop.

The updated tokenomics will also be accompanied by an expansion into the ecosystem of Polkadot, such as the introduction of a new capital markets department that will provide a bridge between conventional finance and the investments of the blockchain.

The governance revolution shows the willingness of Polkadot to achieve sustainable growth and competitiveness in the market compared to competitors such as Ethereum.

The supply cap of Polkadot establishes a new trend in the field of DeFi governance, integrating decentralized voting with rational financial management.

This decisive vote of the DAO indicates a general communal commitment to restrict tokenomics to long-term value.

You May Also Like

Michael Saylor Teases Another Bitcoin Buy As MSTR Stock Dips to Five-Month Lows

Here’s the XRP Price If UK Parliament Declares Ripple Key to Global Payments