Bitcoin Proxy Metaplanet Stock Tanks 8% amid Rising Short Positions

The stock of Metaplanet, a Bitcoin BTC $115 158 24h volatility: 0.6% Market cap: $2.29 T Vol. 24h: $39.40 B proxy firm, has corrected by 8.37% on the Tokyo Stock Exchange, extending its total correction to 70% from the highs of 1,900 JPY in mid-June. This comes as the short positions pile up from global financial giants like UBS, Goldman Sachs, Morgan Stanley, etc.

Financial Giants Build Short Positions for Metaplanet Stock

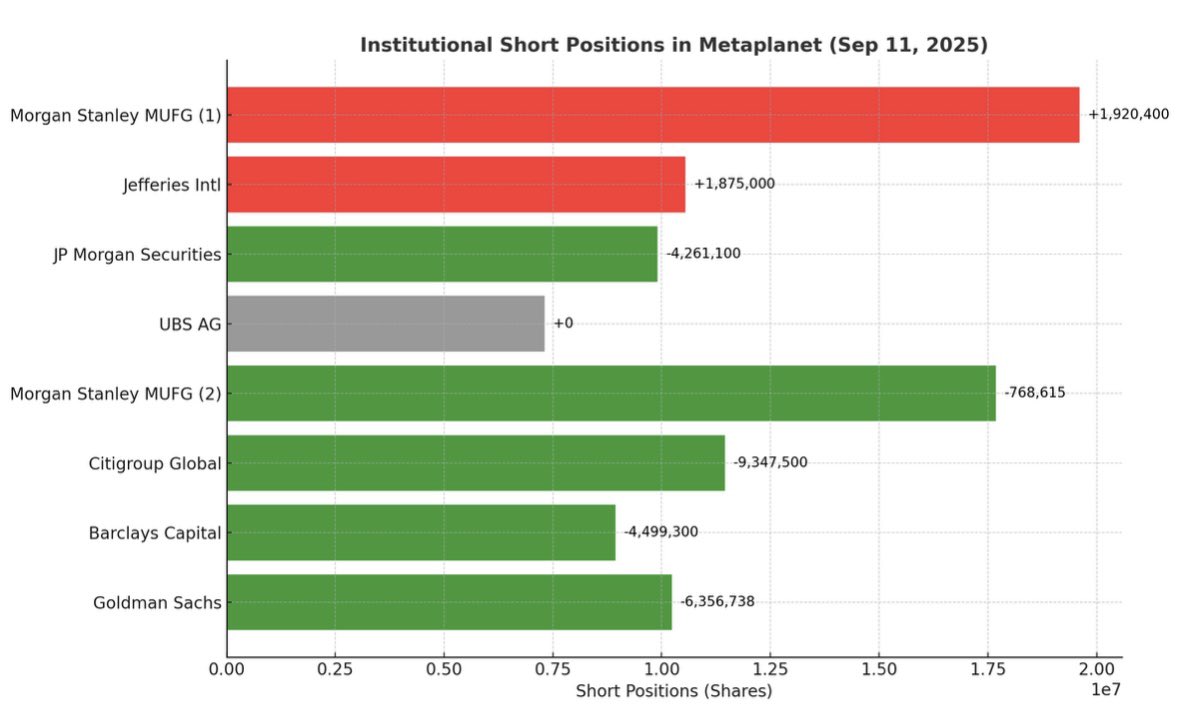

Data from the last week suggests that the institutional short positions in Metaplanet have seen a major shift, with some banks cutting their short positions while others expanding.

Morgan Stanley MUFG remains the largest short holder, controlling nearly 20 million shares (2.83%) after adding 1.92 million. This comes despite the bank trimming 768,000 shares, but it remains the dominant short force.

Metaplanet stock short positions | Source: Vincent

On the other hand, Jefferies International has expanded its short to 10.54 million shares with a 1.88 million increase, while UBS AG re-entered with a new position of 7.31 million. However, banking giants like Goldman Sachs, JP Morgan, Citigroup, and Barclays all reduced exposure significantly.

Market data shows the cost to borrow Metaplanet stocks has surged to an annualized 54% at Interactive Brokers. This signals severe scarcity of lendable stock, which makes shorting increasingly expensive.

Analysts suggest this could leave remaining shorts vulnerable to a squeeze if a positive catalyst, such as Bitcoin purchases, index inflows, or fundraising activity.

More Bitcoin Purchases Ahead?

Earlier this month, Metaplanet and its shareholders have advanced the company’s Bitcoin acquisition strategy with the approval of a major new funding mechanism. At a recent meeting, investors backed a proposal enabling the firm to raise up to 555 billion JPY ($3.8 billion) through the issuance of preferred shares.

This puts the Japanese firm on track to achieve its 30,000 BTC Treasury goal by the year-end. Some market analysts also believe that the recent Metaplanet stock correction could be a buy-the-dip opportunity, as the stock seems undervalued as of now.

Moreover, the current BTC price action is also not supporting an upside. Bitcoin is trying to move to its all-time high once again; however, it faces stiff resistance at $116,000 level as of now.

nextThe post Bitcoin Proxy Metaplanet Stock Tanks 8% amid Rising Short Positions appeared first on Coinspeaker.

You May Also Like

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings

USDC Treasury mints 250 million new USDC on Solana