Dogecoin Momentum Weakens As Whales Favor Accumulating Rollblock Ahead Of A Potential Surge

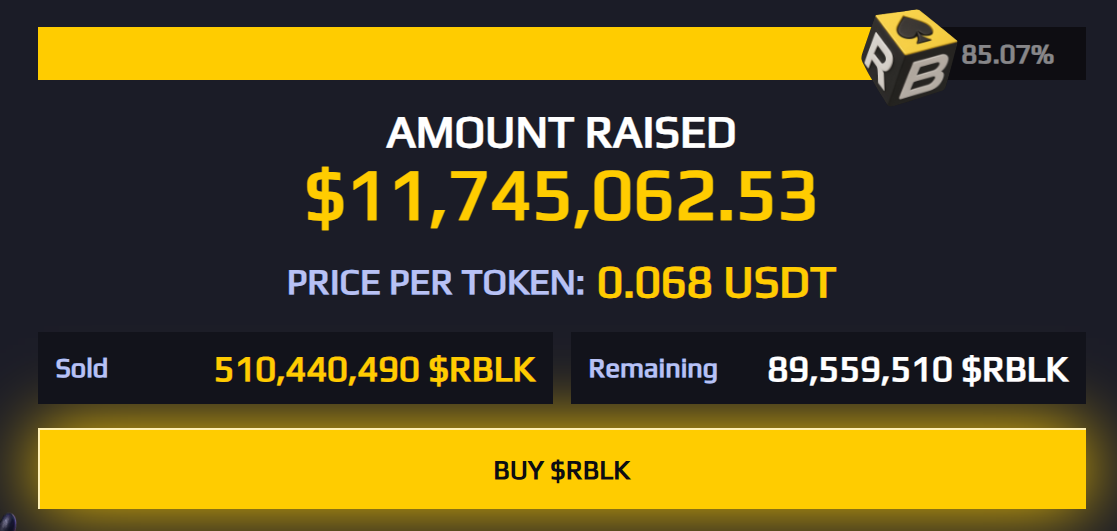

Dogecoin’s price momentum has started to weaken, with traders growing cautious as it struggles to maintain intense upward pressure. Meanwhile, attention is shifting toward Rollblock (RBLK), which has already delivered over 500% gains so far in presale. With more than $11.7 million raised and adoption metrics climbing, whales appear to be rotating capital into Rollblock, anticipating a sharper upside potential in the months ahead.

Whales Favor Accumulating Rollblock Ahead Of A Potential Surge

Rollblock’s presale is live and has already raised $11.7 million from over 55,000 investors, highlighting strong market confidence in the project. This early momentum has drawn the attention of whales, who see Rollblock as a high-upside opportunity backed by real adoption rather than speculation.

A key driver of this interest is Rollblock’s deflationary model. Unlike inflationary tokens such as Cardano, RBLK uses revenue to repurchase tokens each week, with 60% burned and 40% rewarded to stakers. This shrinking supply dynamic creates a sustainable system that consistently benefits long-term holders while enhancing scarcity.

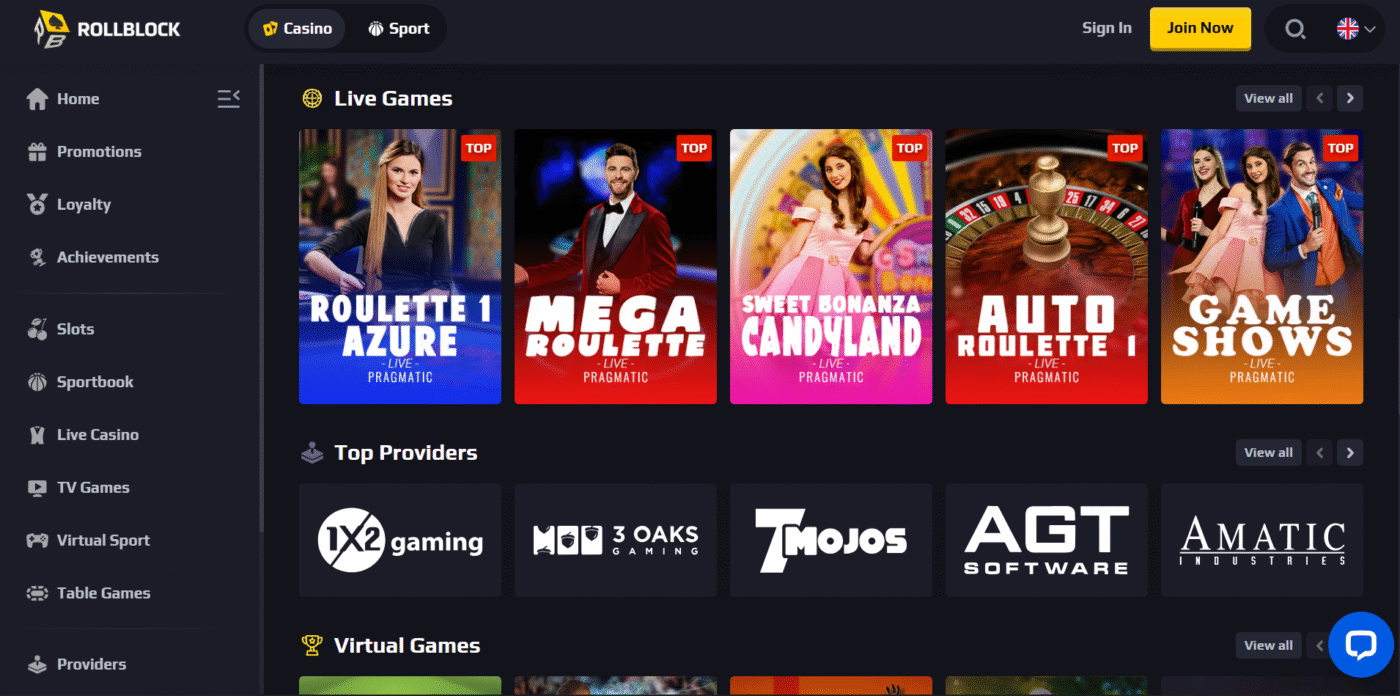

Beyond tokenomics, Rollblock’s gaming ecosystem is gaining traction. Built on Ethereum, it features over 12,000 AI-powered games ranging from poker and blackjack to live dealer options and sports wagering on global events like the World Cup and UFC.

Here are the key features of Rollblock (RBLK):

- Weekly revenue buybacks with 60% burned and 40% redistributed to stakers.

- 12,000+ AI-powered games, including poker, blackjack, live dealers, and crash titles.

- Sportsbook integration covering global events like the Club WC and UFC.

- On-chain transparency ensures that Ethereum smart contracts secure every wager.

With RBLK trading at just $0.068, whales are betting big on a surge once momentum accelerates post-listing.

Dogecoin Momentum Weakens Despite ETF Approval and Whale Activity

Dogecoin (DOGE) is also experiencing some recovery with a current value of $0.2919 and an impressive 8.22% rise per day, as the chart shows. But, underneath this temporary spike, there is a weak momentum. The coin has struggled to maintain rallies beyond critical resistance areas, despite a 162% increase over the last year, and usually reverts as buying pressure dwindles.

The recent signing of the Dogecoin ETF by Rex-Osprey, which will be launched in September 2025, is a milestone. It gives DOGE a place in the regulated investment market, similar to how Bitcoin ETFs once transformed institutional sentiment. At the same time, Robinhood’s transfer of 200 million DOGE points to strategic repositioning, possibly linked to liquidity management ahead of the ETF launch.

If DOGE fails to build on this momentum, it could retest the $0.24–$0.25 range. On the upside, a sustained breakout above $0.30 would be the first real sign of renewed strength heading into the ETF launch.

Rollblock Positioned to Outperform Dogecoin in Long-Term Value Creation

Despite the excitement around the SEC-approved Dogecoin ETF and Robinhood’s 200M transfer, DOGE still struggles to maintain lasting momentum. Reliance on hype leaves investors cautious, even with regulated products ahead. Without a strong push above $0.30, sideways action remains likely. Meanwhile, Rollblock’s adoption, deflationary tokenomics, and $11.7 million presale success highlight a project already proving utility, positioning it to outperform Dogecoin in long-term value creation.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Dogecoin Momentum Weakens As Whales Favor Accumulating Rollblock Ahead Of A Potential Surge appeared first on Blockonomi.

You May Also Like

USD/JPY Price Forecast: Resilient Pair Holds Critical Gains Near 157.00 Monthly Peak

‘Groundbreaking’: Barry Silbert Reacts to Approval of ETF with XRP Exposure