Solana Price Prediction Eyes $250 But Early Buyers Say Rollblock Could Deliver 20x Faster Returns

Solana price predictions have dominated the trading desks this week, but many analysts point out that Rollblock is where the asymmetrical growth opportunity lies. Institutional flows are pushing Solana higher, yet Rollblock could rally up to 20x this year thanks to its unique deflationary model and revenue share system.

For investors weighing the top cryptocurrencies in 2025, the data suggests RBLK may be the smarter play.

Rollblock (RBLK): Revenue Share Model Creates Real Value

Rollblock (RBLK) is not just another presale; it is a functioning Web3 GambleFi platform with thousands of immersive games, live poker, blackjack, and sports betting. Security is verified through blockchain transparency, while fiat integration via Visa and Apple Pay lowers barriers for new users.

This live platform has already generated more than $15 million and stands out as one of the top crypto projects in the market.

Unlike speculative new crypto coins, Rollblock rewards holders directly through a revenue-sharing model. Each week, a percentage of platform income is allocated to buy back tokens from the market, with most of them permanently burned.

This makes RBLK one of the best crypto to invest in for those seeking yield and scarcity:

- RBLK holders earn weekly rewards from platform revenues

- 30% of income allocated to buybacks

- 60% of repurchased tokens are burned to reduce the supply

- 40% of buybacks distributed to stakers earning up to 30% APY

The presale is selling fast, with over 85% of tokens already purchased at $0.068. Major exchange listings later this year are expected to increase liquidity dramatically, while the presale end date will be announced in just 17 days.

Investor interest is clear on social media. Rollblock’s own campaign states it is “rewriting the rules of online gaming,” with licensed operations and massive token burns ensuring scarcity.

Tokenomics: A Deflationary Framework

Rollblock (RBLK) has a capped supply of one billion tokens. Every week, 30% of the platform’s revenue is dedicated to buybacks, with 60% permanently burned and 40% fueling staking rewards.

This deflationary design is the house edge for investors. For those asking what is a cryptocurrency with true scarcity and utility, Rollblock answers with a working ecosystem that directly benefits holders.

Solana Price Prediction (SOL): Institutional Accumulation Drives The Rally

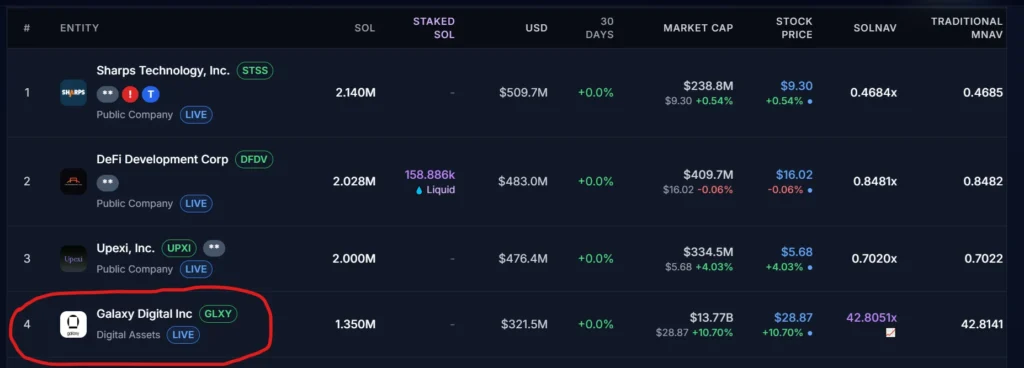

Solana is up 1.71% today to $241.76. Crypto Feed News noted: “Mike Novogratz’s Galaxy Digital just bought 2.2M SOL ($486M) — marking a huge wave of institutional accumulation.

This surge in institutional demand is accompanied by on-chain strength. Solana’s TVL crossed $12.5 billion for the first time, driven by Jupiter Lend amassing $600 million in deposits in just two weeks.

Institutions now hold over 10 million SOL, or 1.8% of the supply, highlighting growing adoption.

Solana remains one of the top altcoins in the market and a leader in smart contracts and staking crypto. However, its market cap of $129 billion limits multiples compared to Rollblock. While SOL’s growth is stable and Solana price predictions of $250 look like a lock, RBLK’s status as a low cap crypto gem makes it the more aggressive bet for outsized returns.

Comparing Rollblock And Solana

| Metric | Rollblock (RBLK) | Solana (SOL) |

| Total Supply | 1 billion (hard cap) | 609.61 million (no cap) |

| Current Price | $0.068 (presale) | $241.76 |

| Market Cap (est.) | $11.7 million raised | $129.52 billion |

| Revenue Share | Yes, weekly buybacks | No direct distribution |

| Potential Multiples | 20–50x upside | 2–3x upside |

Shaping The Next Cycle

The crypto bull run 2025 is defined by projects that provide real value. Rollblock (RBLK) has the rare combination of scarcity, rewards, and adoption that makes it the best crypto to buy at this time.

Rollblock is the asymmetric play of this cycle. Where Solana offers stability, RBLK offers explosive growth and is positioned to outperform all competition in 2025.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

This article is not intended as financial advice. Educational purposes only.

You May Also Like

UK Looks to US to Adopt More Crypto-Friendly Approach

Crucial Fed Rate Cut: October Probability Surges to 94%