Polymarket Prepares $10B Valuation as It Plans US Relaunch

Polymarket targets a $10B valuation with its US relaunch, while rival Kalshi nears $5B amid surging trading volume and funding.

Polymarket is preparing for a United States comeback that could value the platform as high as $10 billion, according to Business Insider.

The blockchain-powered prediction market has already attracted new funding interest, with some investors offering term sheets above the $9 billion mark.

This would represent a sharp leap from its $1 billion valuation in June when it raised $200 million in a round led by Peter Thiel’s Founders Fund.

Kalshi Nears $5B Valuation Amid Growth

Polymarket is not the only prediction platform attracting investor interest. Kalshi, which already operates under CFTC oversight, is reportedly close to finalising a round that would value it at $5 billion.

That valuation is more than double its $2 billion figure from just a few months ago, when Paradigm led a $185 million raise. So far, Kalshi has gained traction thanks to a court ruling from last year that allowed it to list political event contracts.

The CFTC had appealed the decision but dropped its challenge earlier this year. This meant that Kalshi became free to continue expanding its offerings.

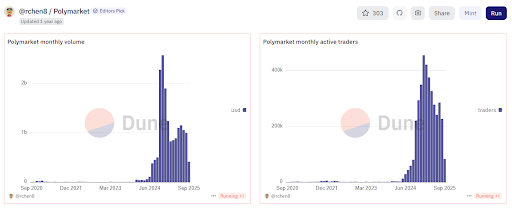

Prediction markets like Polymarket are enjoying strong user engagement | source: Dune Analytics

Prediction markets like Polymarket are enjoying strong user engagement | source: Dune Analytics

Trading volume supports this move. In August, Kalshi processed $875 million in activity, which is close to Polymarket’s $1 billion.

During the first week of the National Football League season alone, Kalshi cleared $441 million, which is another sign of strong user engagement.

How Polymarket and Kalshi Differ

Despite their competition, the two companies follow very different models.

Kalshi runs as a regulated US exchange that requires customers to deposit dollars and complete traditional KYC. This makes it accessible to American traders while maintaining a clear compliance framework.

Polymarket, on the other hand, operates on the Polygon blockchain.

It settles trades in USDC and allows semi-anonymous participation. This has fueled adoption outside the US, and its model appeals to a global user base even though it has faced regulatory pressure inside the country.

Both approaches show contrasting philosophies in terms of regulation and user experience. Yet both are attracting high valuations from major investors.

Prediction Markets Attract Big Capital

Investor enthusiasm shows the rise of prediction markets as a legitimate trading sector. Polymarket’s backers include Founders Fund, while Kalshi counts Paradigm and Sequoia Capital among its supporters.

The Block Data reports that this year has already become the strongest year for prediction market funding.

More than $216 million has been raised across 11 deals, compared with $80 million last year.

Crypto-native companies are also entering the space. Crypto.com and Underdog are launching sports prediction markets across 16 states. On the other hand, Coinbase is exploring its own platform, while X named Polymarket its official prediction partner.

Kalshi has even teamed up with Robinhood and is further blurring the line between prediction trading and traditional finance.

Challenges Facing Prediction Markets

While the valuations of these platforms are climbing, both Polymarket and Kalshi are facing challenges. User engagement tends to fluctuate outside of major events like elections or sports seasons.

This means that sustaining consistent activity may require new categories of prediction contracts.

Another issue is regulatory uncertainty. While Kalshi currently enjoys a favourable position, future changes in policy could tighten restrictions.

Despite the risks, however, investors see strong upside. The ongoing rise in valuations for both Polymarket and Kalshi shows confidence that prediction markets will move beyond niche audiences quickly.

You May Also Like

Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Bill Passes This Month

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets