After the airdrop, the price fluctuated upward. What are the characteristics of Grass, a web crawler project that combines AI and DePIN?

Author: Research institution ASXN

Compiled by: Felix, PANews

Recently, Grass, a web crawler project combining AI and DePIN, has once again launched an airdrop "feast". On October 28, the Grass Foundation announced that the first round of GRASS token airdrops were open for collection. Due to too many people claiming, the Phantom wallet was once down. As of November 4, Dune data showed that 82.75% of the GRASS airdrop tokens (about 64,781,717 tokens) had been claimed by users, involving 1,830,287 addresses for airdrop claims.

The airdrop craze also once "boosted" the GRASS token. Since the announcement of the airdrop, GRASS has shown a soaring trend, from around $0.65 to $1.86, and is now trading at $1.63. This article aims to analyze the technical characteristics of the Grass project from a technical perspective.

Grass is a decentralized data layer and network focused on web scraping, real-time contextual retrieval, and AI data collection. Its main goal is to decentralize and democratize web data collection through incentive mechanisms while compensating users for contributing resources.

The Grass network currently captures more than 100TB of data every day. As of now, Grass nodes are spread across 190 countries and have more than 2.5 million nodes.

It manages all processes from initial data collection to processing and validation, while compensating and incentivizing participants.

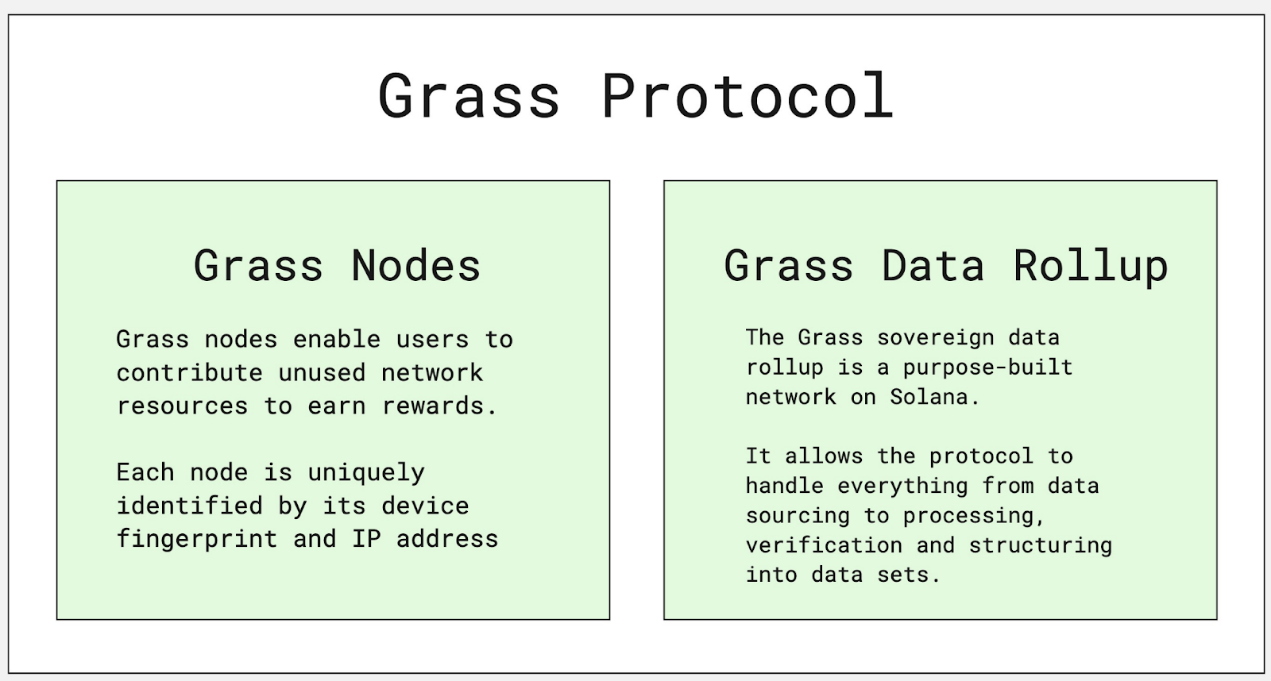

The Grass Agreement consists of the following parts:

- Grass Node

- Sovereign Data Rollup

Grass nodes allow users to contribute idle network resources to earn rewards. Each node is uniquely identified by its device fingerprint and IP address.

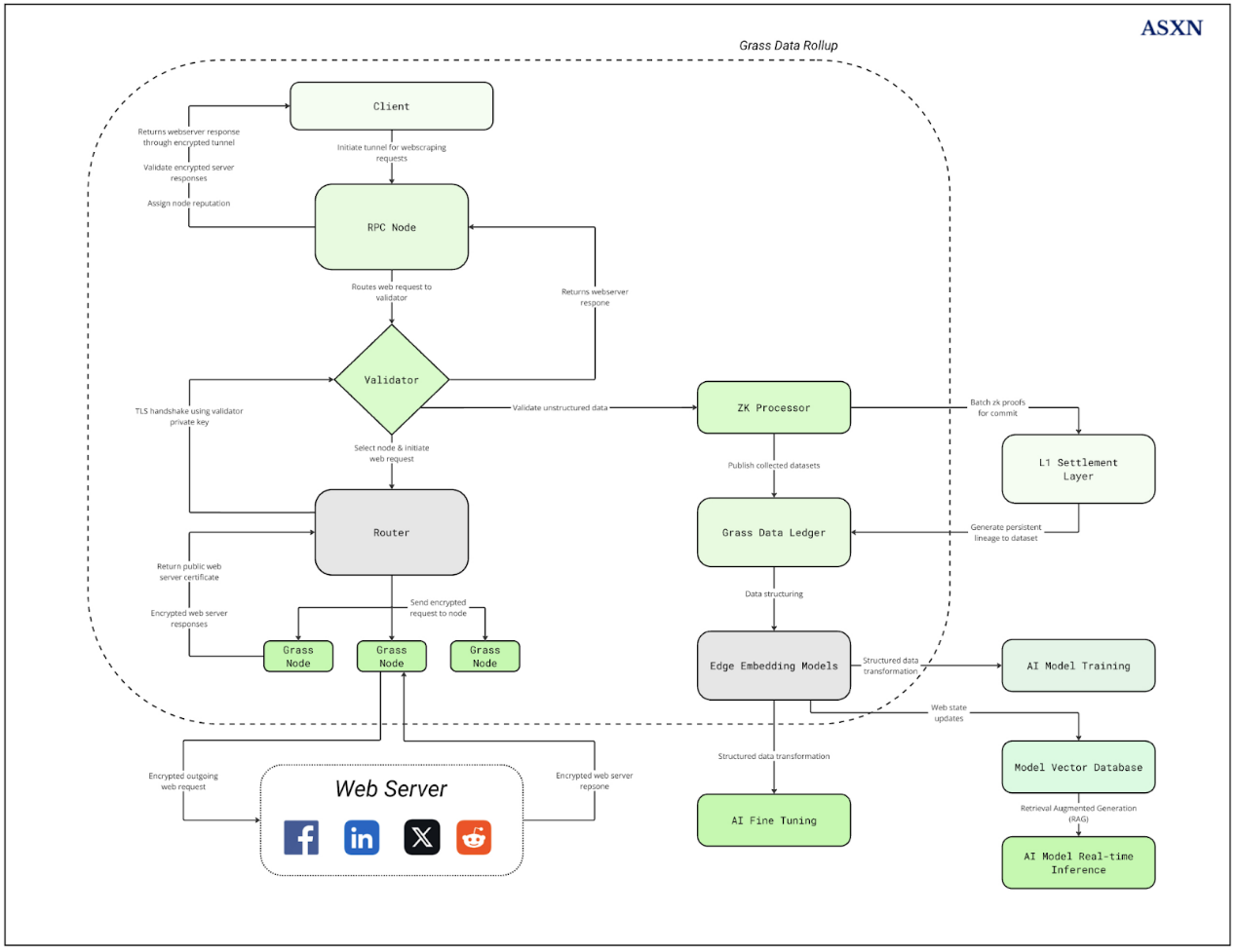

The GRASS Sovereign Data Rollup is a purpose-built network on Solana that enables the protocol to handle all transactions from data source to processing, validating, and structuring datasets.

The network is built around validators that issue data collection instructions, routers that manage the distribution of web requests, and nodes that users use to contribute their idle network resources.

GRASS uses a data ledger for hash storage, a Merkle tree bundling system, and on-chain root data publishing.

GRASS nodes can be deployed via a browser extension, desktop application, or Android-based mobile application.

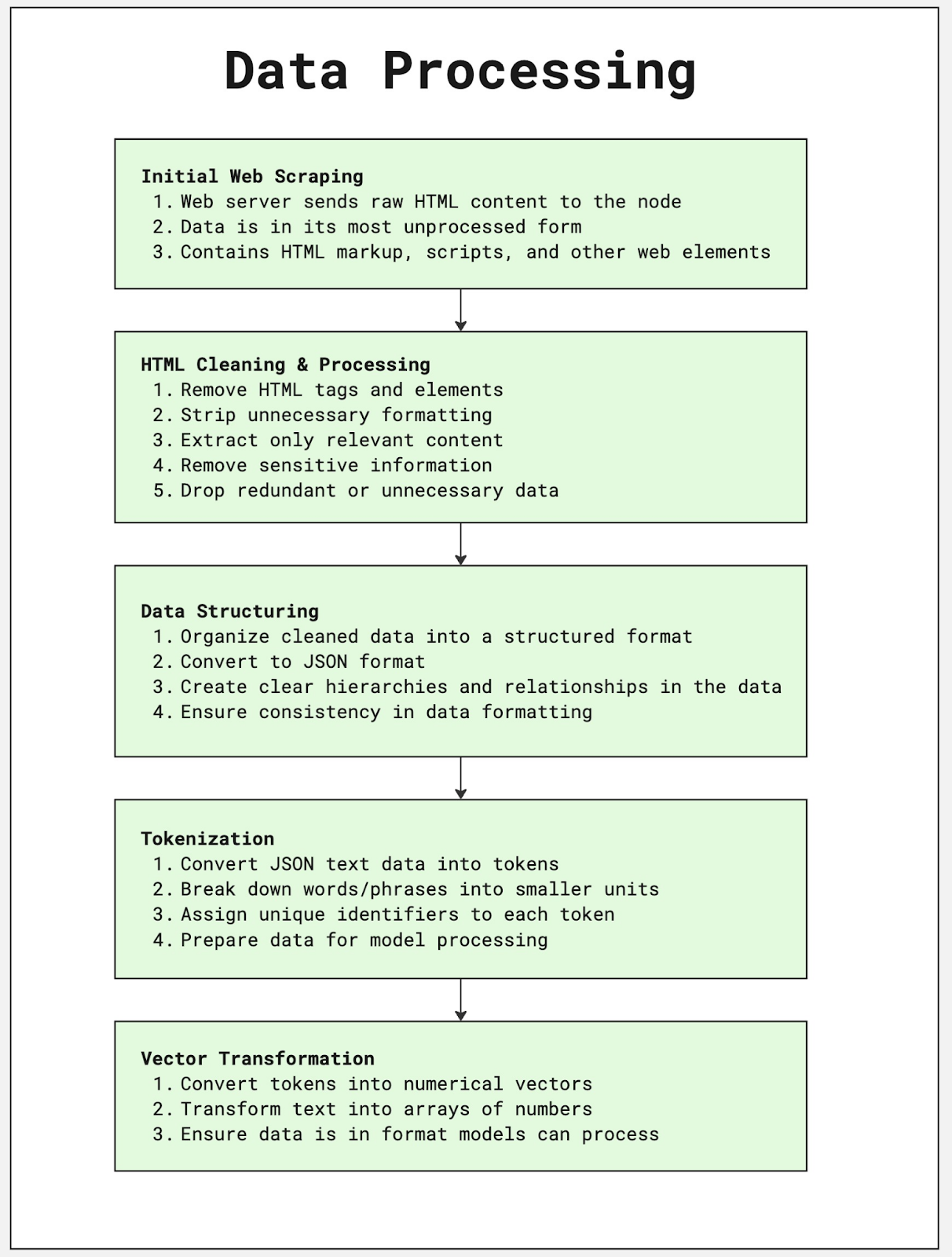

For data processing, the protocol uses an HTML to JSON conversion system, custom Python cleanup scripts, data structure tools, and vectorization processes, while developing embedded models for edge processing.

Security and authentication are maintained through Zero-Knowledge Transport Layer Security (ZK TLS), proof generation for web requests, web session logging, a decentralized database for hash storage, and anti-data poisoning measures.

GRASS also ensures the integrity and quality of the data through various means, including a contributor ranking system, a consensus mechanism for quality control, a distributed work system, and a reputation scoring system.

Data management is handled through multiple storage solutions, including Hugging Face (which supports up to 10TB/day of free storage), self-hosted MongoDB for proprietary datasets, and partnerships with decentralized data providers.

Recently, the team opened up their dataset UpVoteWeb, which contains 600 million Reddit posts and comments on HuggingFace: https://huggingface.co/datasets/OpenCo7/UpVoteWeb

Related reading: Decentralized Data Layer: New Infrastructure for the AI Era

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge