The ALUM Principles: How Fairness Shapes a Free Economy

Table of Links

Abstract and 1. Introduction

-

A free and fair economy: definition, existence and uniqueness

2.1 A free economy

2.2 A free and fair economy

-

Equilibrium existence in a free and fair economy

3.1 A free and fair economy as a strategic form game

3.2 Existence of an equilibrium

-

Equilibrium efficiency in a free and fair economy

-

A free economy with social justice and inclusion

5.1 Equilibrium existence and efficiency in a free economy with social justice

5.2 Choosing a reference point to achieve equilibrium efficiency

-

Some applications

6.1 Teamwork: surplus distribution in a firm

6.2 Contagion and self-enforcing lockdown in a networked economy

6.3 Bias in academic publishing

6.4 Exchange economies

-

Contributions to the closely related literature

-

Conclusion and References

Appendix

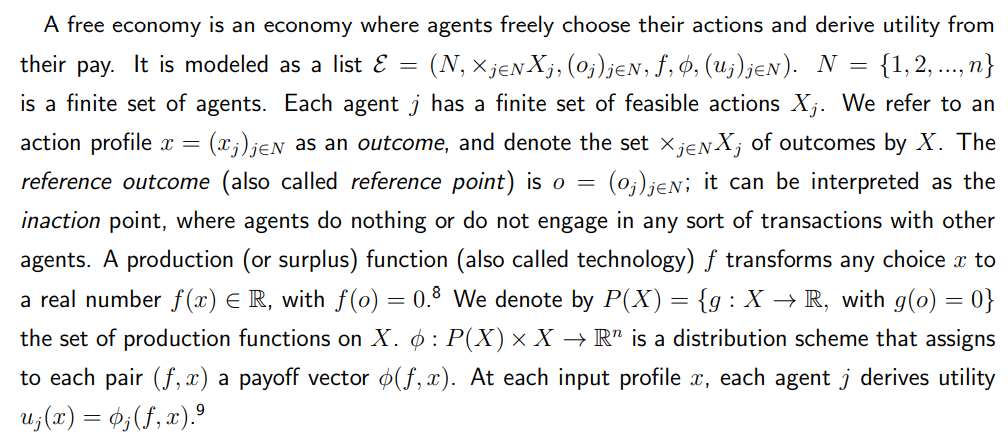

2 A free and fair economy: definition, existence and uniqueness

In this section, we introduce preliminary definitions and the key concepts of the paper. We then show that there exists a unique economy that is free and fair.

2.1 A free economy

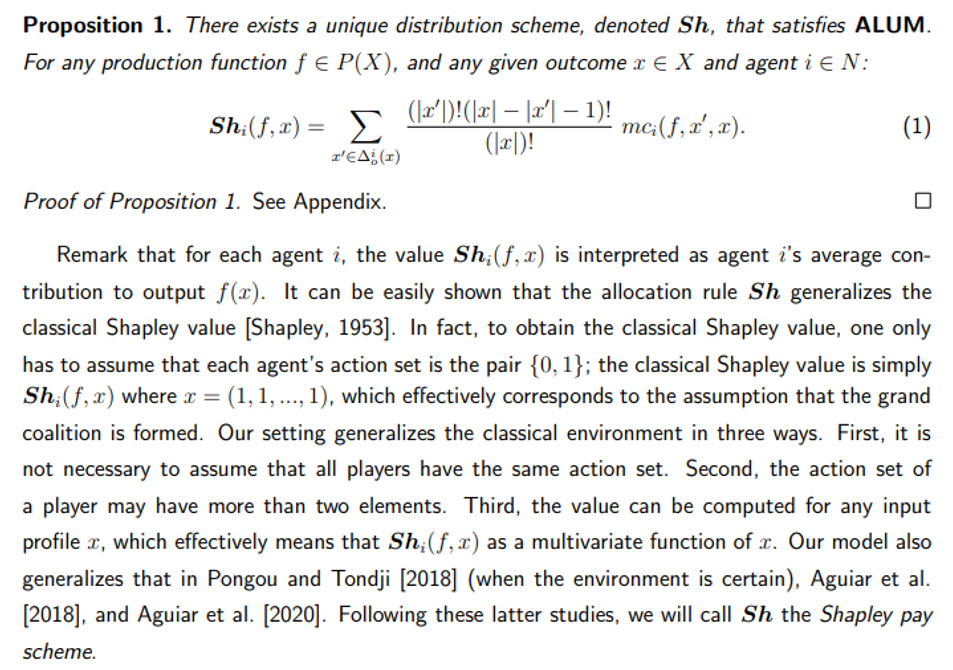

2.2 A free and fair economy

\

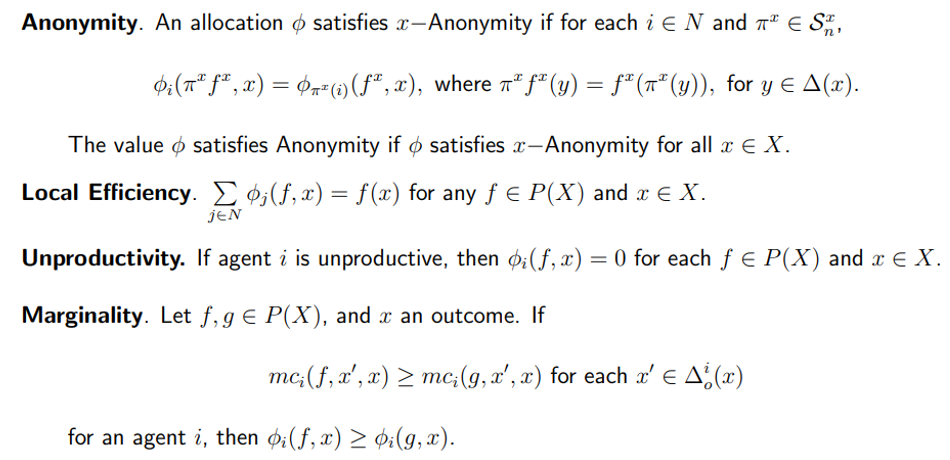

\ \ We now formalize the principles of market justice below.

\ \

\ \ These axioms are interpreted naturally. Anonymity means that an agent’s pay does not depend on their name. It states that every agent is treated the same way by the allocation rule: if two agents exchange their identities, their payoffs will remain unchanged. An important property that is implied by anonymity is symmetry (or non-favoritism), which means that equally productive agents should receive the same pay. Local efficiency simply requires that the surplus resulting from any input choice be fully shared among productive agents participating in the economy. Unproductivity means that an agent whose marginal contribution is zero at an input profile should get nothing at that profile. Marginality means that, if the adoption of a new technology increases the marginal contribution of an agent, that agent’s pay should not be lower under this new technology relative to the old technology. In other words, more productive agents should not earn less compared to less productive agents. Throughout the paper, we abbreviate the four principles as ALUM.

\ \

\ \ Below, we illustrate the notion of a free and fair economy, and provide an example of a free economy that is unfair.

\ \

\ \ \

:::info Authors:

(1) Ghislain H. Demeze-Jouatsa, Center for Mathematical Economics, University of Bielefeld (demeze jouatsa@uni-bielefeld.de);

(2) Roland Pongou, Department of Economics, University of Ottawa (rpongou@uottawa.ca);

(3) Jean-Baptiste Tondji, Department of Economics and Finance, The University of Texas Rio Grande Valley (jeanbaptiste.tondji@utrgv.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[8] We normalize the surplus at the reference point to 0 for expositional purposes. It is possible that the surplus realized at o is not zero, and in this case, f(x) should be interpreted as net surplus at x, that is, the realized surplus at x minus the realized surplus at o. We assume the reference o to be exogenously determined.

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

Tesla (TSLA) Stock; Slips Slightly Despite Accelerated Nine-Month Roadmap for AI5–AI9 Chips