TRON (TRX) Price: Network Slashes Transactions Fees by 60% Driving 17% Rally

TLDR

- TRON governance reduced transaction costs by 60%, cutting average transfer fees from 4.4 TRX to 2.1 TRX

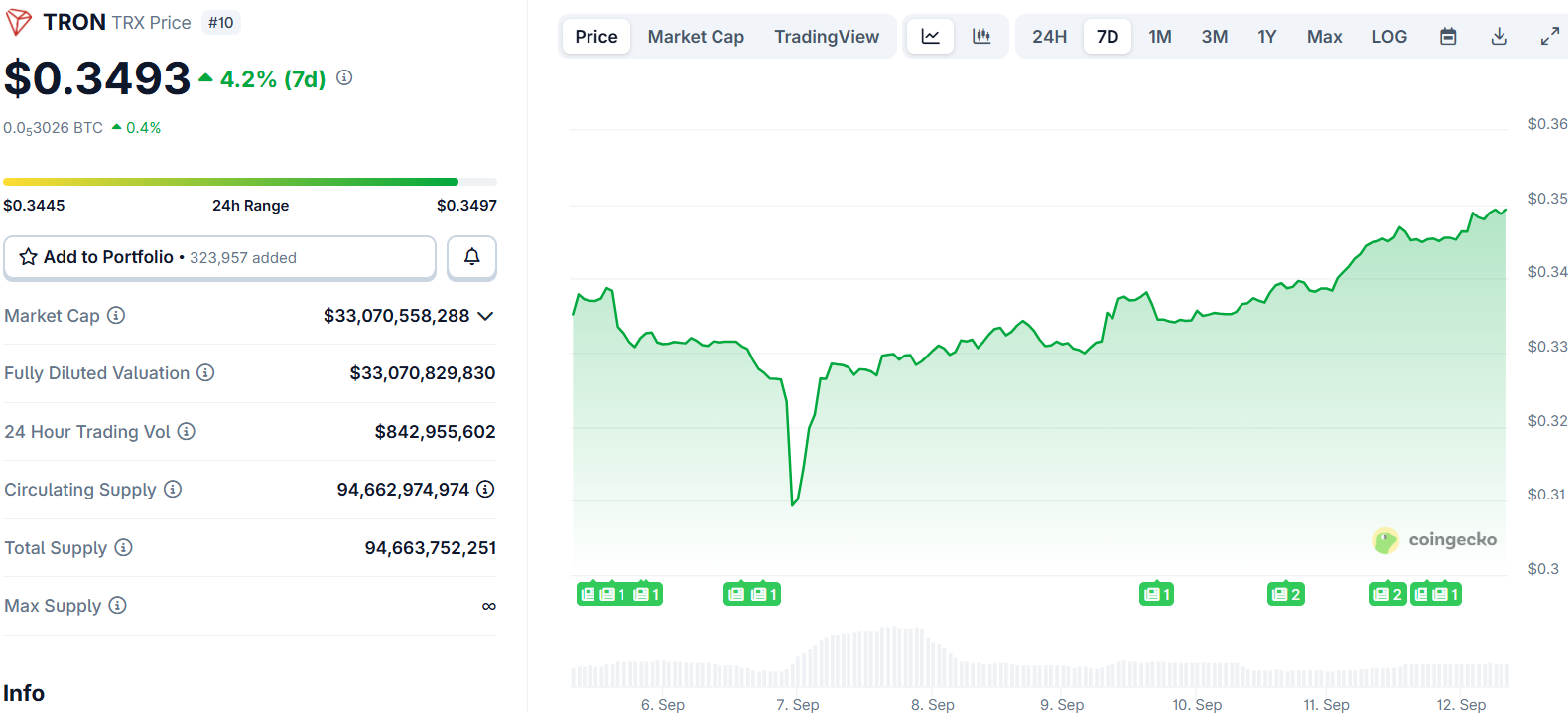

- TRX trades at $0.3447, up 2.4% in 24 hours despite cooling trading volumes

- Network processes over $21 billion daily in USDT transfers, creating steady demand

- TRON Inc. expanded treasury by $110 million and launched Ledger Enterprise app

- Technical analysis shows support at $0.32 with resistance near $0.36

TRON (TRX) is trading at $0.3447 at press time, marking a 2.4% gain over the past 24 hours. The token has moved between $0.3094 and $0.3448 in the last week.

Tron (TRX) Price

Tron (TRX) Price

The price recovery comes after TRON’s governance made a major change to network costs. Super Representatives voted on August 29 to lower the Energy Unit Price from 210 SUN to 100 SUN.

This decision cut transaction costs by 60% across the network. Average fees for TRC20 transfers dropped from 4.4 TRX to 2.1 TRX according to CryptoQuant data.

Total weekly fees fell from 272 million TRX in mid-August to 23.1 million TRX. The reduction makes TRON more appealing for users who make frequent transfers.

TRON processes more than $21 billion daily in USDT transfers. This represents about half of all global Tether volume.

Every transaction requires TRX for gas fees. This creates steady demand for the token regardless of market conditions.

The fee cut should strengthen TRON’s position as the top settlement layer for Tether. Lower costs may attract up to 45% more users who previously found the network too expensive.

Market data shows some cooling in trading activity. Spot trading volume fell 10.6% to $702 million over the past day.

Derivatives volume dropped 18.7% to $252 million according to Coinglass data. Open interest declined 1.3% during the same period.

Corporate Treasury Growth

TRON Inc. expanded its treasury by $110 million on September 2. The company’s largest shareholder backed this expansion.

The firm already holds over 365 million TRX worth around $126 million. TRON Inc. plans to raise $1 billion to grow its TRX holdings further.

This strategy follows MicroStrategy’s approach with Bitcoin. Corporate buying reduces available supply and shows long-term confidence.

Since TRON Inc. listed on Nasdaq through a reverse merger in July, TRX has gained about 10%. The listing happened on July 24, 2025.

Technical Market Position

TRX currently trades above the 20-day simple moving average at $0.3401. Most longer-term moving averages remain in buy territory.

Source: TradingView

Source: TradingView

The token sits in the middle range of Bollinger Bands. Support levels appear at $0.32 while resistance sits near $0.36.

Momentum indicators show mixed signals. The MACD indicates a mild sell signal while RSI remains neutral at 54.

A break above $0.36 could open the path toward $0.38-$0.40. Failure to hold $0.32 support might lead to a pullback toward $0.30.

TRX remains just 20% below its all-time high of $0.4313 set in December 2024. The token has gained 125% since last year and 28% over recent months.

TRON launched a Ledger Enterprise mobile app on September 11 to improve secure USDT transfers on the network.

The post TRON (TRX) Price: Network Slashes Transactions Fees by 60% Driving 17% Rally appeared first on CoinCentral.

You May Also Like

Silver Prices Edge Closer to a Pivotal Support and Resistance Test

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam

![[Newspoint] Overpaid troll](https://www.rappler.com/tachyon/2026/02/Screenshot-2026-02-23-at-8.11.02-PM.png?resize=75%2C75&crop=439px%2C0px%2C1070px%2C1070px)