Dogecoin ETF: A Joke Gone Institutional

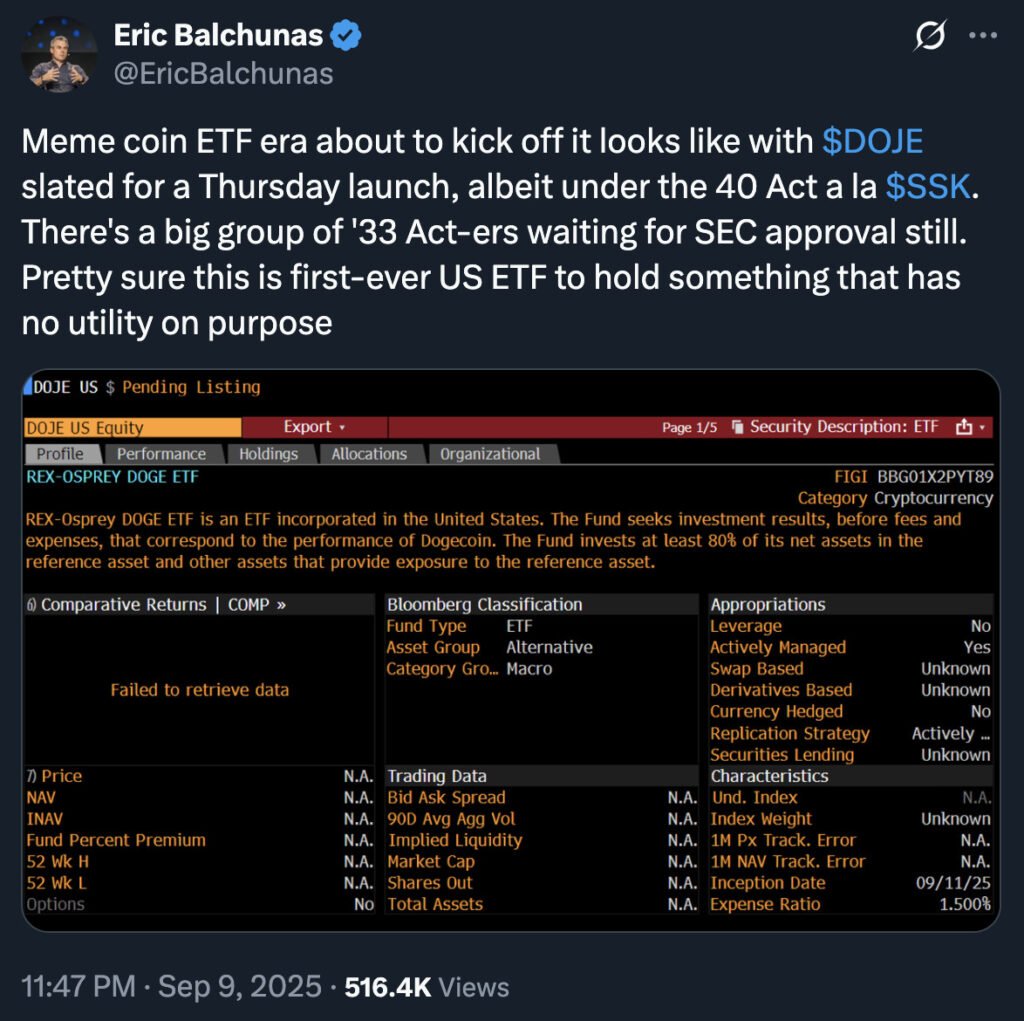

On Thursday, the Rex-Osprey Dogecoin ETF (ticker: DOJE) goes live. Unlike Bitcoin spot ETFs, which are approved under the Securities Act of 1933 and simply hold BTC in custody (BlackRock’s version keeps coins parked with Coinbase), this Dogecoin fund had to squirm its way through a very different legal loophole: the Investment Company Act of 1940. That framework was designed for diversified mutual funds — not single-asset gambles — which is why DOJE had to route exposure through a Cayman Islands subsidiary and use derivatives. Translation: Wall Street lawyers earned their retainers.

Meme coin ETF begins, source: X

Speculation With a Smile

Crypto loves to celebrate new ETFs as milestones, but this one feels different. Critics argue DOJE institutionalizes pure casino energy. Why pay fund fees when you could just buy Dogecoin directly on Coinbase in five minutes, as Brian Huang of Glider points out? He calls the ETF a “ridiculous” way to wrap a single asset — like packaging Tesla stock into a “diversified fund” with a hefty expense ratio.

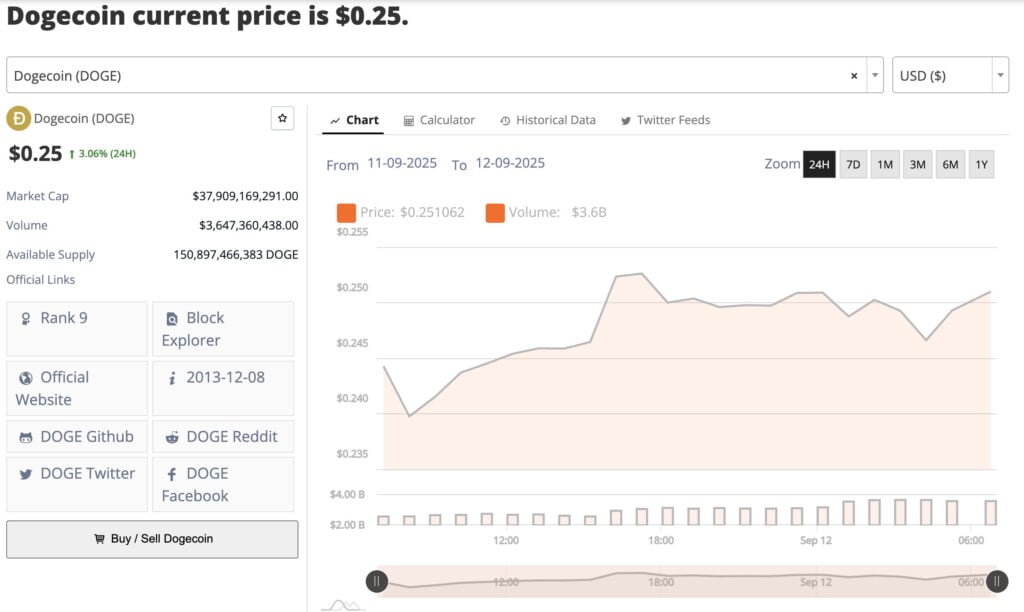

And yet, that’s Dogecoin’s magic trick. Born in 2013 as a joke fork of a fork of a fork (Bitcoin → Litecoin → Luckycoin → Dogecoin), it somehow clawed its way into the top 10 by market cap. It spawned the entire memecoin category, a subculture often dismissed as a distraction from “serious” blockchain projects. Its tokenomics mock Bitcoin’s scarcity fetish — instead of a 21M cap, DOGE has unlimited supply, with 10,000 new coins minted every minute (that’s 5 billion a year). Scarcity maxis hate it; Doge holders don’t care.

Dogecoin is sitting at 0.25c, Source: BNC

The Bigger Picture

Here’s where it gets interesting. By late August, 92 crypto ETP applications were sitting with the SEC — everything from serious altcoins to joke tokens like Pengu (tied to Pudgy Penguins NFTs). The fact that Dogecoin is cutting the line ahead of more “serious” projects says something brutal about crypto’s reality: cultural capital moves faster than technical capital.

Meme vs. Market

So, do we need a Dogecoin ETF? From a functionality standpoint, no. From a narrative standpoint, maybe. For skeptics, this is Wall Street legitimizing a meme while fleecing investors with fees. For optimists, it’s another bridge between retail culture and institutional money.

Here’s the uncomfortable truth: Dogecoin doesn’t need a use case beyond existing as a mirror to the absurdity of modern markets. In that sense, it’s the most honest token of all. A Dogecoin ETF doesn’t blur the line between meme and market — it obliterates it.

If a memecoin can become a regulated ETF, then anything is on the table. And maybe that’s the point.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

MicroStrategy Eyes New Bitcoin Milestone With Another Purchase