Ethereum (ETH) Price: Whale Accumulation Drives Price Above Key Level as Analysts Eye $7,500

TLDR

- Ethereum breaks above critical $4,089-$4,283 range with analysts targeting $7,000-$7,500

- Whales accumulated over 450,000 ETH while small holders distributed 500,000 ETH in past week

- ETH faces rejection at $4,500 level after breaking above descending triangle resistance

- Exchange reserves declined by 260,000 ETH since September indicating rising demand

- Futures net taker volume hits record low with more positions betting on price decline

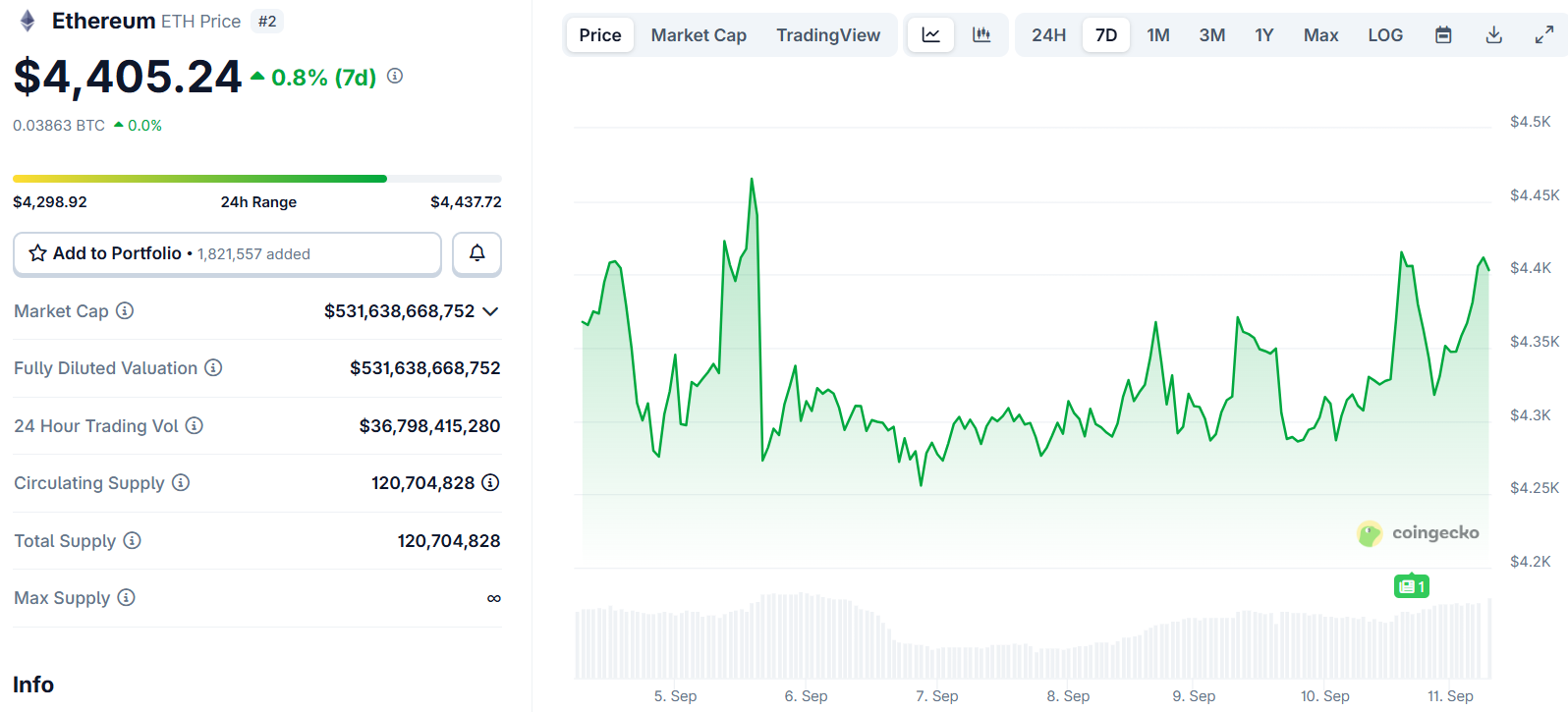

Ethereum price trades above $4,300 after breaking through critical resistance levels. The world’s second-largest cryptocurrency by market cap shows mixed signals as large holders increase positions while smaller investors take profits.

Ethereum (ETH) Price

Ethereum (ETH) Price

ETH recently broke above the crucial $4,089-$4,283 range that had been containing price action. The cryptocurrency is currently trading around $4,283, holding above the key $4,089 support level.

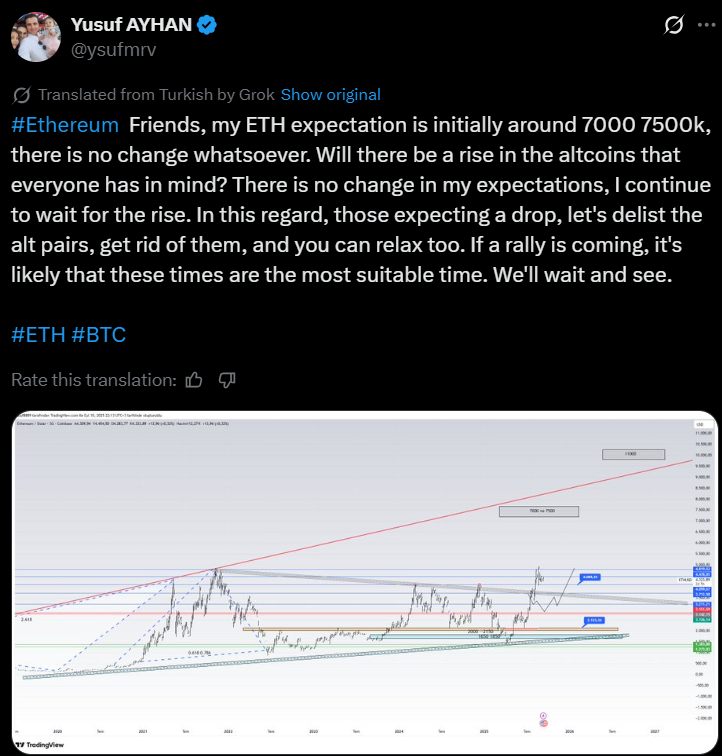

Market analyst Yusuf AYHAN maintains his price target of $7,000-$7,500 for Ethereum. The analyst suggests $11,000 could be possible if the current bull run gains momentum.

Source: X

Source: X

Technical analysis shows ETH defending key support levels multiple times. The deeper safety nets remain at $2,000-$2,150, with stronger support between $1,650-$1,850.

Volume has increased since Ethereum reclaimed the $4,000 level. This typically signals real conviction behind price moves according to technical analysts.

Whale Accumulation Continues Despite Distribution

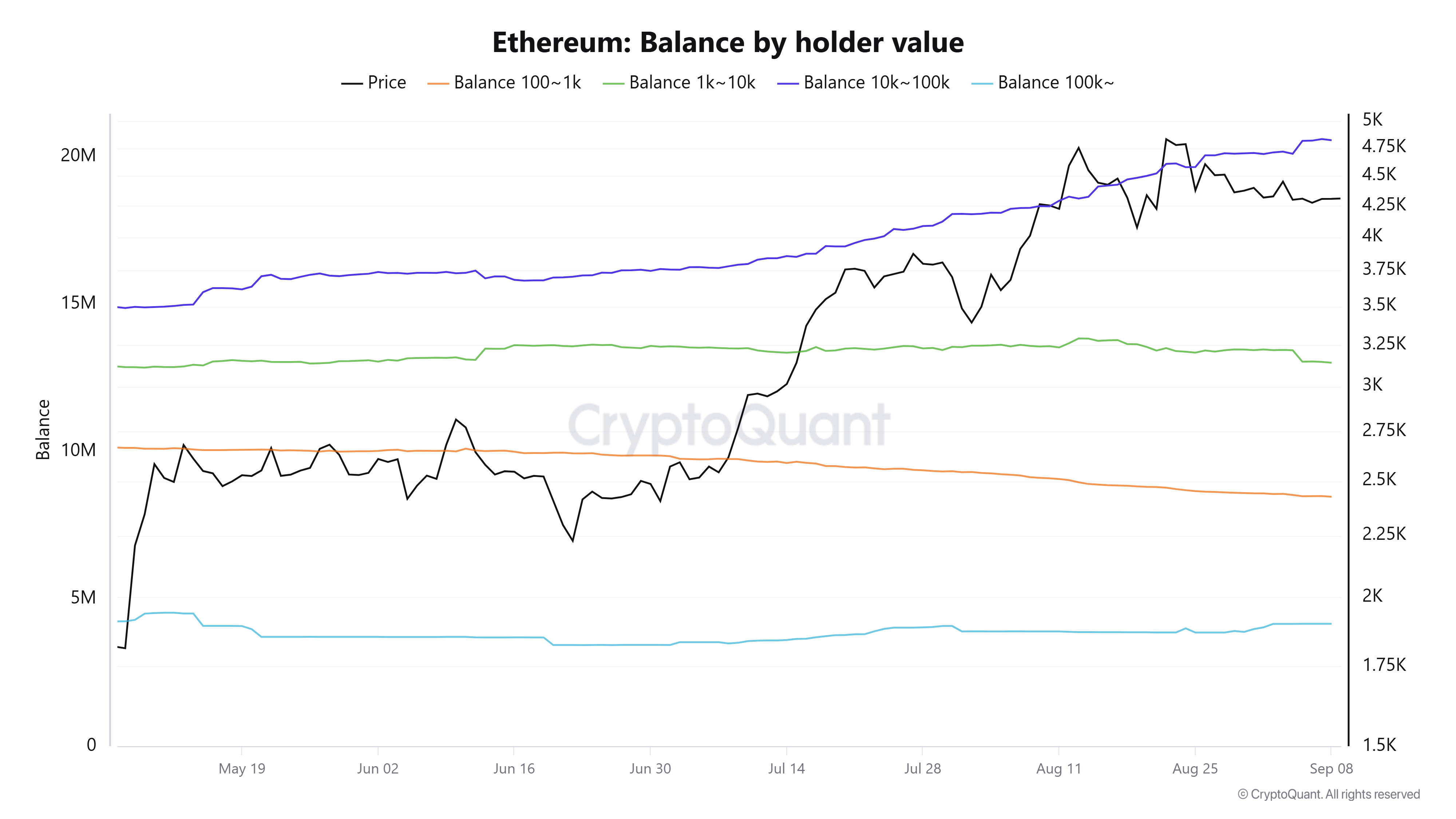

Large holders with balances of 10,000-100,000 ETH increased their collective holdings by over 450,000 ETH in the past week. This accumulation trend began in May and continues despite recent price volatility.

Source; CryptoQuant

Source; CryptoQuant

Demand is also visible in flows to accumulation addresses. These wallets, which have no record of selling activity, have been steadily buying ETH over the past week.

Ethereum exchange reserves decreased by 260,000 ETH since the beginning of September. Declining exchange reserves typically indicates rising demand as investors move funds to private wallets.

Corporate entities also maintained buying activity. BitMine Immersion (BMNR) added about 202,500 ETH to their holdings while SharpLink Gaming added 39,500 ETH.

Small-scale holders tell a different story. Wallets holding between 100-10,000 ETH distributed over 500,000 ETH in the past week.

Short-term holders also increased selling activity. The Mean Coin Age metric shows distribution from investors who bought ETH over the past 90 days.

Mixed Technical Signals

Active addresses and transaction counts declined from previous weeks. This indicates a drop in on-chain activity for the network.

ETH futures net taker volume reached a record low. This metric compares short positions against long positions, showing more traders are betting on price declines.

Ethereum saw $64 million in futures liquidations over the past 24 hours. Long liquidations totaled $31.6 million while short liquidations reached $32.5 million.

The cryptocurrency broke above the upper boundary of a descending triangle pattern. ETH then tested the $4,500 level before seeing rejection at this resistance.

The next major resistance zone sits at $7,000-$7,500 based on Fibonacci extensions. An ascending trendline continues to push ETH higher according to chart analysis.

The Relative Strength Index moves horizontally near its midline. The Stochastic Oscillator sits below neutral but trends upward, indicating mildly bearish momentum.

ETH could fall toward $3,500 if it declines below the 50-day Simple Moving Average and the $4,000-$4,100 support range. The cryptocurrency currently trades around $4,340 following increased whale accumulation activity.

The post Ethereum (ETH) Price: Whale Accumulation Drives Price Above Key Level as Analysts Eye $7,500 appeared first on CoinCentral.

You May Also Like

BlackRock Increases U.S. Stock Exposure Amid AI Surge

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be