Synopsys Inc. ($SNPS) Stock: Shares Drop After Q3 Miss, IP Weakness, and Ansys Integration

TLDR

- Q3 2025 revenue reached $1.74B, missing analyst estimates of $1.77B.

- Non-GAAP EPS was $3.39, below expectations of $3.74.

- Design automation revenue jumped 23% YoY, aided by Ansys contribution.

- IP revenue fell 8% YoY due to China restrictions and foundry challenges.

- Stock plunged over 22% premarket despite long-term growth from Ansys.

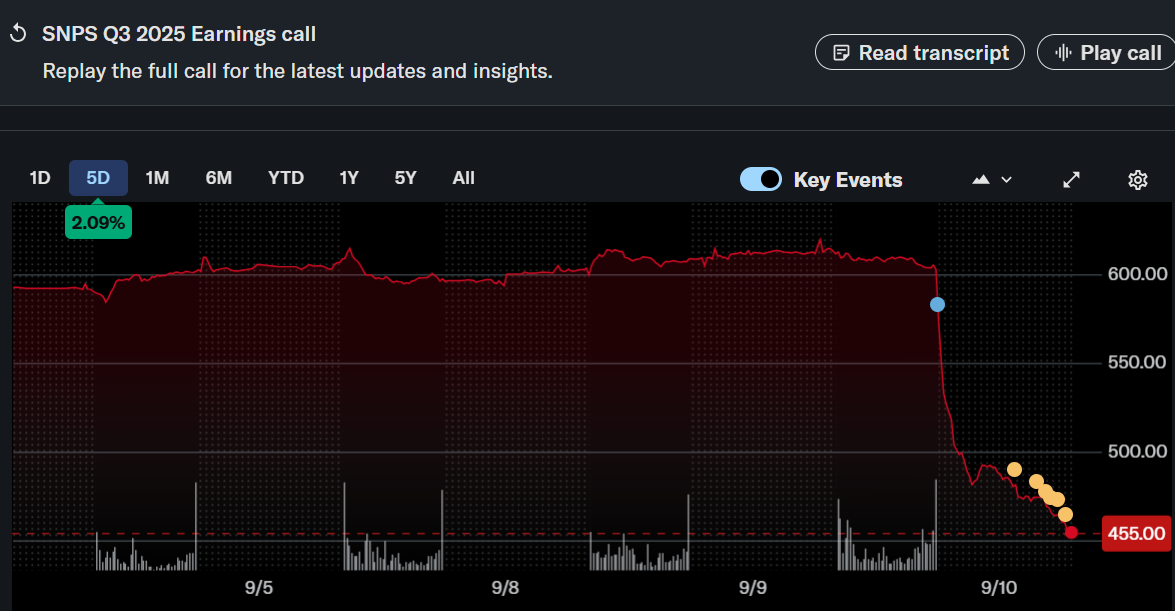

Synopsys Inc. (NASDAQ: SNPS) closed at $604.37 on September 9, 2025, down 0.80%, before plunging 22.40% to $469.00 in premarket trading after reporting Q3 earnings.

Synopsys, Inc. (SNPS)

The results, released on September 9, 2025, highlighted strong revenue growth in design automation but weakness in the company’s Design IP segment, which weighed on investor sentiment.

Earnings Performance

For the quarter ended July 31, 2025, Synopsys reported revenue of $1.74 billion, a 14% increase year-over-year but slightly below analyst expectations of $1.77 billion. Non-GAAP earnings per share came in at $3.39, missing Wall Street’s consensus estimate of $3.74.

The company delivered a non-GAAP operating margin of 38.5%. Free cash flow was approximately $632 million, while cash and short-term investments stood at $2.6 billion. Synopsys closed the quarter with $14.3 billion in debt, partly tied to its recent Ansys acquisition.

Ansys Acquisition and Growth in Automation

A key milestone during the quarter was the completion of the $35 billion Ansys acquisition in July, expanding Synopsys’ customer base and product portfolio. The integration of Ansys simulation solutions has already contributed $77 million to quarterly revenue and strengthened the company’s leadership in next-generation chip design.

Design automation revenue totaled $1.31 billion, up 23% from the prior year, driven by strong demand for electronic design automation (EDA) tools and hardware. Management emphasized that the combined Synopsys-Ansys offering enhances long-term opportunities in semiconductor design and analysis.

Weakness in IP Business

In contrast, Design IP revenue declined 8% year-over-year to $428 million. This underperformance was largely due to U.S. export restrictions affecting design starts in China and challenges with a major foundry customer. Synopsys had invested heavily in building IP solutions for this customer, expecting returns in the second half of 2025, but the customer pulled out due to market issues.

CEO Sassine Ghazi noted that resource allocation and roadmap decisions in the IP unit did not yield intended results, prompting a strategic pivot toward higher-growth opportunities. The company announced plans to reduce its global headcount by roughly 10% by the end of fiscal 2026 to improve efficiency.

Outlook and Guidance

For Q4, Synopsys guided revenue between $2.23 billion and $2.26 billion, with non-GAAP EPS projected at $2.76 to $2.80, both below analyst expectations. For fiscal 2025, management expects revenue between $7.03 billion and $7.06 billion and EPS of $12.76 to $12.80. Free cash flow for the year is projected at about $950 million.

Despite near-term headwinds, analysts highlighted that generative AI remains a long-term growth driver for the company. However, firms like Baird downgraded Synopsys to Neutral, citing uncertainty and weak visibility in the IP segment.

Performance Overview

As of September 9, 2025, Synopsys delivered a year-to-date return of 24.52% and a one-year gain of 30.21%. Over three and five years, returns stood at 77.66% and 194.34%, respectively, outpacing the S&P 500. Despite the latest pullback, the company’s long-term performance remains strong, underscoring its role as a leader in chip design and automation.

The post Synopsys Inc. ($SNPS) Stock: Shares Drop After Q3 Miss, IP Weakness, and Ansys Integration appeared first on CoinCentral.

You May Also Like

The Channel Factories We’ve Been Waiting For

Fed Decides On Interest Rates Today—Here’s What To Watch For