Bitcoin Hyper Presale Nears $15M as $7T Cash Pile Turns Attention to $BTC

Given $BTC’s position as the largest and most established crypto with a hefty $2.22T market cap, it’s the leading candidate to attract inflows once cash begins rotating out of money markets.

But when $BTC attracts increased attention, the Bitcoin network is no stranger to congestion. The reason is that it’s primarily optimized for security and decentralization, not high transaction throughput.

As a consequence, $HYPER, which has surpassed $14.7M on presale, could be the next crypto to explode. Investors have high hopes in Bitcoin Hyper, its Layer-2 (L2) solution that’s gearing up to facilitate cheaper and faster transactions on the Bitcoin network.

Bitcoin Hyper to Bring High-Speed Trading & DeFi to Bitcoin

Irrespective of demand pressure, Bitcoin Hyper is under development to address Bitcoin’s pain points.

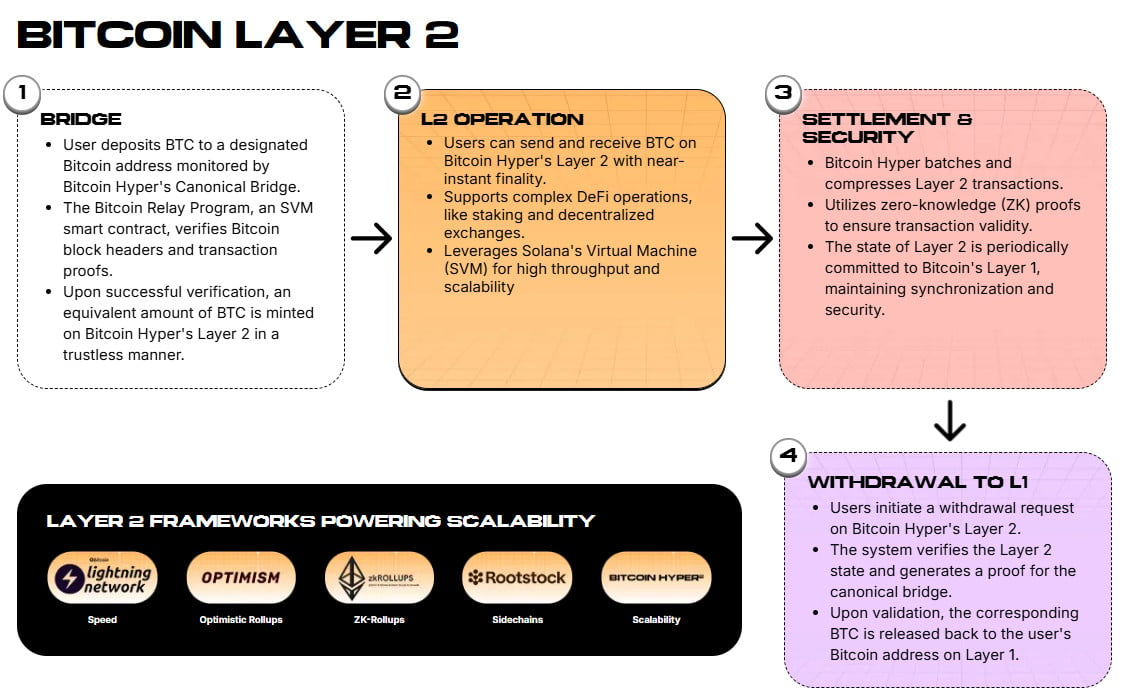

The L2 network, launching this quarter, will leverage a Canonical Bridge and the Solana Virtual Machine (SVM) to raise the bar for the Bitcoin ecosystem, and thus $BTC.

Source: Bitcoin Hyper

You’ll be able to deposit $BTC through the bridge, which verifies transactions before minting equivalent tokens on the L2. It’ll settle transactions almost straight away, enabling super speedy transfers and unlocking access to hot new DeFi opportunities.

The SVM will also be pivotal in boosting DeFi activity on Bitcoin, as it’ll enable smart contract execution at Solana-level speeds.

This alone is a major boon, as the native Bitcoin network typically doesn’t support dApps. It was designed for security and decentralization, unlike Ethereum, which was built for programmability.

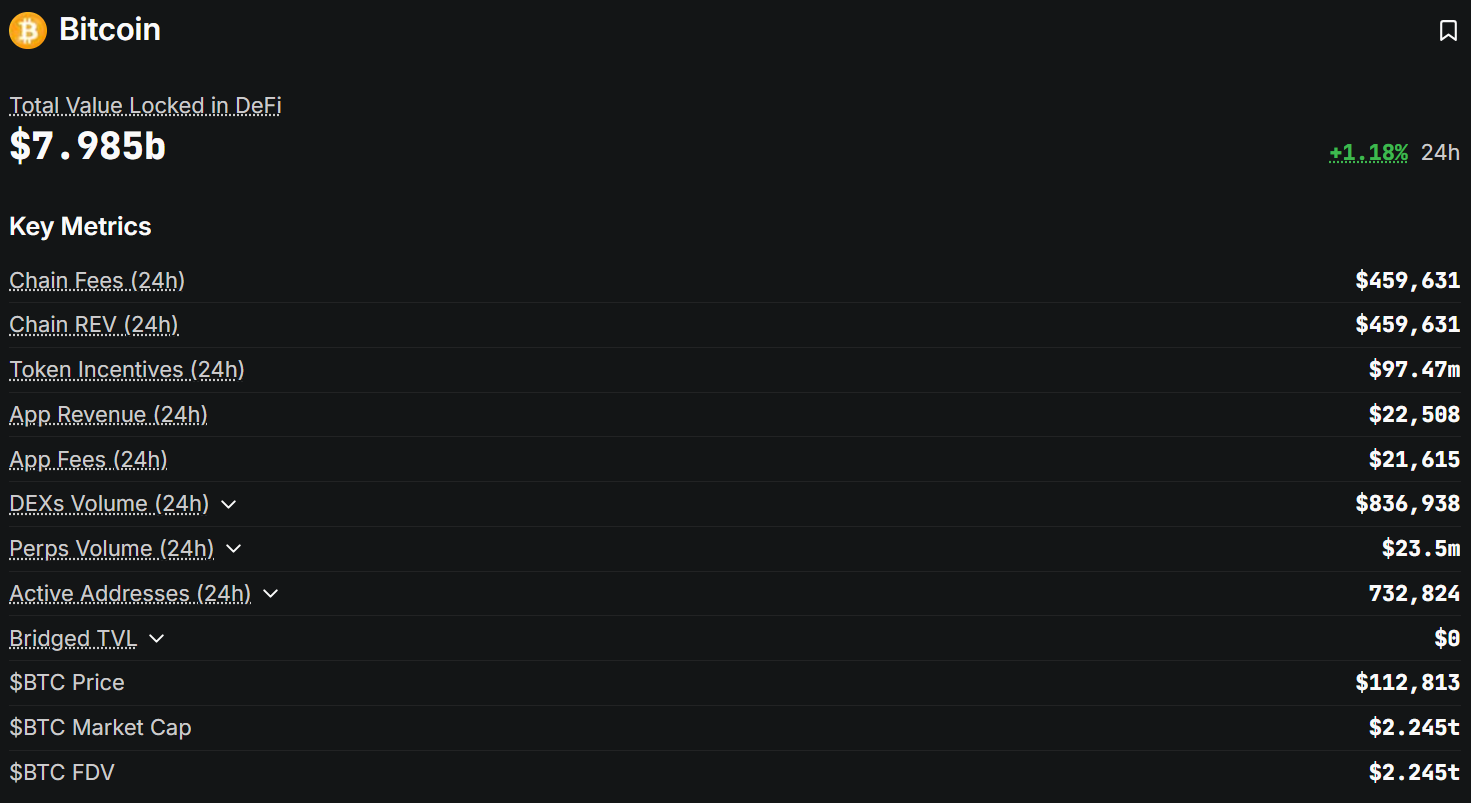

Owing to this, Bitcoin has a $7.985B Total Value Locked (TVL), a far cry from Ethereum’s $91.61B TVL. But after Bitcoin Hyper goes live, this might soon change.

Source: DeFiLlama

Both the Canonical Bridge and SVM will also lower transaction fees on the L2, but in different ways.

Bitcoin’s gas fees currently average at $0.786 compared to Ethereum’s $0.553, so the Hyper L2 is a cost-efficient alternative that could outperform its rival for everyday transactions.

Right now, Bitcoin can also only process 11.91 transactions per second (tps), around 42.09% lower than Ethereum’s 20.57 tps. The L2 network will address these bottlenecks.

On the L2 network, $HYPER will grant lower transaction fees, plus staking rewards (currently at a 75% APY) and governance rights to token holders.

Not forgetting that a whopping 30% of $HYPER’s total token supply is earmarked for ongoing development, indicating the L2’s commitment to the project’s long-term success.

Join the $HYPER Presale for a Potential 1,452% ROI

As $BTC continues to attract mainstream attention, Bitcoin Hyper is stepping in to solve the Bitcoin network’s bottlenecks. In turn, it should make $BTC even more attractive to all.

By tackling congestion, enabling DeFi opportunities, and lowering fees, it’s a fantastic solution to bring the #1 crypto to greater heights.

To support the network and reap the ecosystem’s perks, you can buy $HYPER on presale for as little as $0.012885. And there’s no better time to do precisely that; its price will increase tomorrow and is anticipated to reach $0.2 this year – a 1,452% ROI.

Bitcoin Hyper does way more than just build on Bitcoin but elevates its potential. In turn, $HYPER might be the next big crypto to 1000x.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis