BNB Rally Gains Steam as Key Resistance Turns Into Support

TL;DR

- BNB flipped last year’s high into support, holding strong demand around the $780–$800 zone.

- Leveraged shorts cluster at $895, where a breakout could trigger cascading liquidations upward.

- Open interest at $1.49B signals heavy leverage, raising chances of sharp, liquidation-driven moves.

Breakout Above Yearly High

BNB moved above last year’s high, which has now turned into a support level. Analyst Crypto Bully called it “one of the best looking charts” and noted that the market is paying little attention to it.

The token trades at around $880 at press time, with a daily volume of $1.10 billion. BNB has gained 1% in the past 24 hours and 3% over the week. The zone around $800 is marked as demand. Any return toward this area could attract bids, though falling back into the previous yearly range would weaken the setup.

Meanwhile, BNB is consolidating under $900 after a strong run. With no major resistance levels overhead, the token is in price discovery. In this phase, the market has no defined ceiling, and movement depends on how long demand holds above support.

Crypto Bully explained,

The $780–$800 area remains the key level for buyers to watch.

Liquidity Cluster at $895

Market watcher CW pointed out a concentration of leveraged short positions near $895. They said, “these positions will be liquidated significantly if price rises to $895.” Liquidity data shows dense order levels at this point.

If the asset pushes higher, forced closures of short positions could add buying pressure. This may accelerate the next move upward. For now, BNB is trading in the $875–$885 range, with $895 identified as the level that could open further upside.

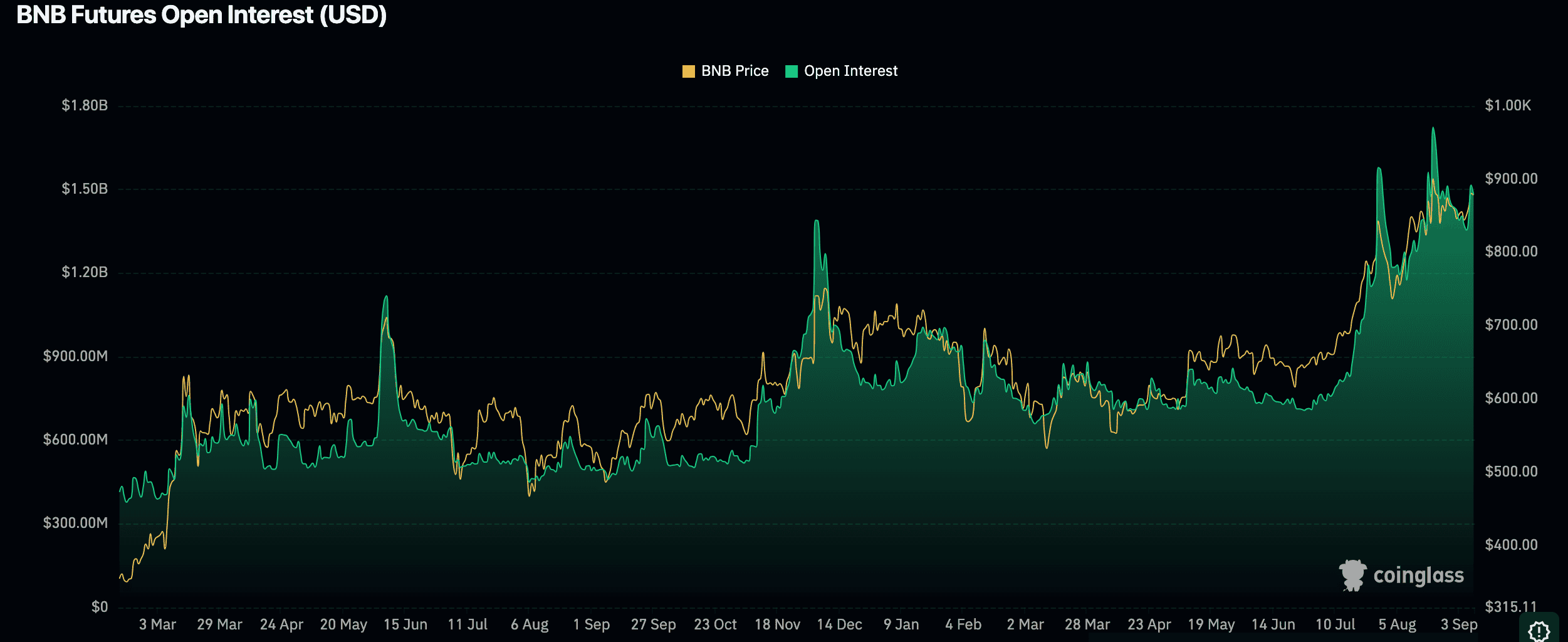

Open Interest Near Peak Levels

Futures open interest in BNB has reached $1.49 billion, one of the highest levels recorded. This shows a sharp rise in leveraged positions, with both long and short traders active at current prices.

Source: Coinglass

Source: Coinglass

High open interest combined with increasing price has seen sharp swings. If the asset goes further up, short liquidations may enter in the way of gains. Should the market go down, long liquidations may actually generate selling pressure. The extra high open interest indicates that the next move will be fast-paced and will come from liquidations.

The post BNB Rally Gains Steam as Key Resistance Turns Into Support appeared first on CryptoPotato.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis