InfoFi faces a cold reception: regulatory upgrades, shrinking revenue, and platform transformation dilemmas

Original author: Geek

Original translation: Luffy, Foresight News

I wouldn't be surprised if we've reached the end of the InfoFi era, or are approaching it.

Since the rise of InfoFi, many people have made considerable profits from it, some have accumulated 5 figures, and some have even made 6 figures. But now, there are some signals that deserve our high attention.

Threshold rule changes

Strictly speaking, I don’t think this upgrade of Kaito is a completely bad thing. It may effectively prevent a large number of accounts from using AI to generate low-quality content to “brush up” the volume, while improving the quality of the content.

However, after the upgrade, not only small accounts were affected, but many large accounts were also not spared. This led to a large number of users who relied on Kaito to choose to leave, because after the upgrade, they had almost no chance of making money through the platform.

In response to this, some project owners have chosen to remove the threshold to attract small trumpeters to join. This just shows that in most cases, the small trumpet group is crucial.

My opinion is that Kaito seems confused about the direction of this upgrade, and many project parties clearly don’t like this “threshold restriction.” However, it is undeniable that Kaito has performed quite well in the past few months.

The token distribution plan is poor

For content creators (yappers), today’s typical 0.5%-1% token distribution ratio is far from enough, as these tokens are often valued very low when they are launched.

In the early days, some accounts could earn 4-5 figures through 1-2 months of promotional activities; but now, even if they participate in 3-6 months of activities, they can only earn 3-4 figures, which makes many people feel discouraged.

Even top accounts, even if they produce high-quality content, find it difficult to earn substantial four-digit income.

Why is this bad news for creators who rely on InfoFi? Before InfoFi's rise, many creators earned a healthy income by promoting their content as brand ambassadors or influencers. However, the compensation offered by projects on Kaito now simply cannot compare to external partnerships. Given this fact, it's no surprise that more and more creators are choosing to leave the InfoFi platform.

Capital Launchpad’s dominance is evident

On July 22, Kaito's "Capital Launchpad" was officially launched. The first project to be launched was Espresso, and more projects subsequently joined.

This is undoubtedly a great product for Kaito, but I do have a few concerns:

- None of the projects that went through Kaito’s initial coin offering have yet been listed on the public market;

- None of these projects have announced a launch date;

- Most projects have overvalued valuations and token unlocking plans that are not investor-friendly.

My additional perspective: Kaito was originally built as a platform specifically for InfoFi, and later decided to add additional platform features (such as Launchpad), which is a great initiative in itself. However, recently, more and more projects have chosen to join the "Capital Launchpad" rather than participate in the "Creator Leaderboard." For an InfoFi platform, this trend is clearly not optimistic.

However, this is just an obvious phenomenon that I have observed, and it seems that not many people question it.

Project owners prefer to work directly with KOLs rather than through the Kaito platform.

It is clear that the project parties are no longer so keen to participate in InfoFi cooperation.

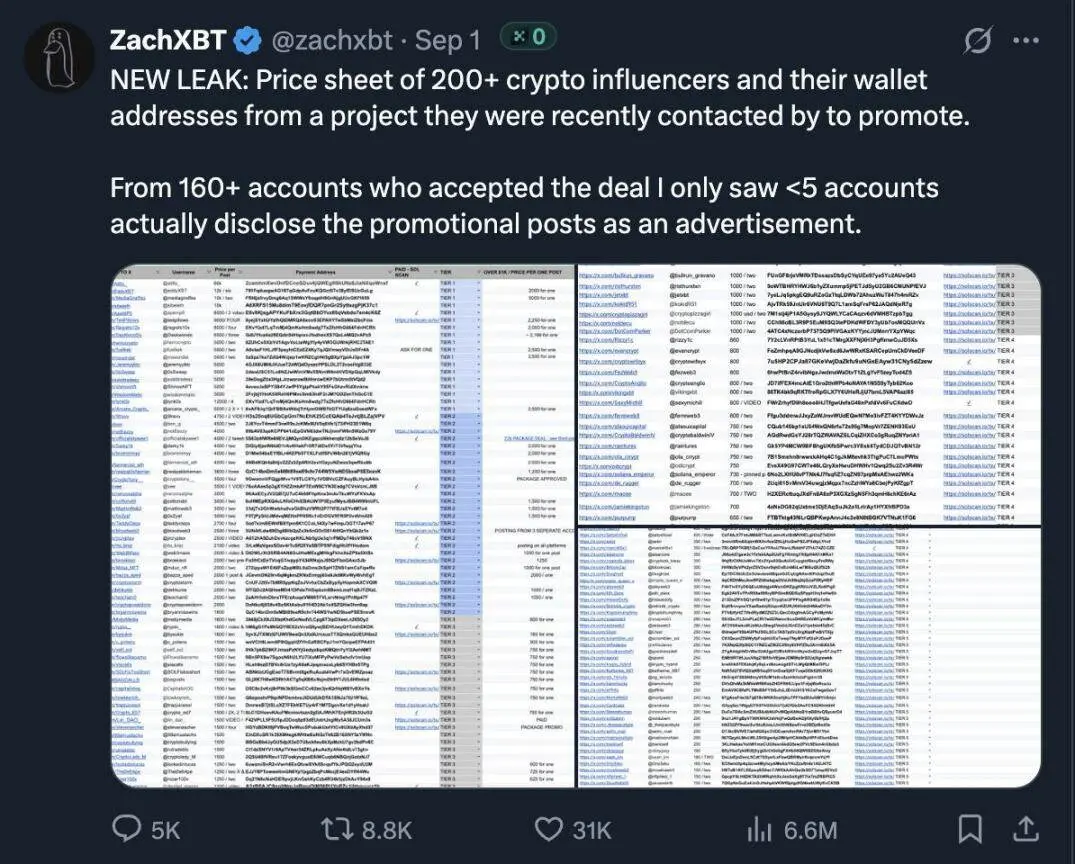

Recently, Zachxbt published a Google Sheet listing a number of accounts that received compensation from a project. I mention this not because I’m surprised, but because the amounts paid are quite substantial, especially compared to the projects on Kaito’s “Creator Leaderboard.”

I believe this has made many people realize that there are many ways to make money besides InfoFi. Since human nature is to "find ways to make more money," I believe this poses direct competition to Kaito.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Optimizely Named a Leader in the 2026 Gartner® Magic Quadrant™ for Personalization Engines