Oklo Stock: Jumps as Nuclear Company Announces $1.68 Billion Nuclear Fuel Facility

TLDR

- Oklo (OKLO) stock rose 1.4% after-hours following announcement of a $1.68 billion nuclear fuel recycling facility in Tennessee

- The facility at Oak Ridge will produce metal fuel for Aurora nuclear reactors, beginning operations in the early 2030s

- Company is focusing on AI applications with partnerships for data center cooling solutions alongside nuclear power plants

- Two Oklo projects were selected for the U.S. Department of Energy’s Nuclear Reactor Pilot Program, more than any other company

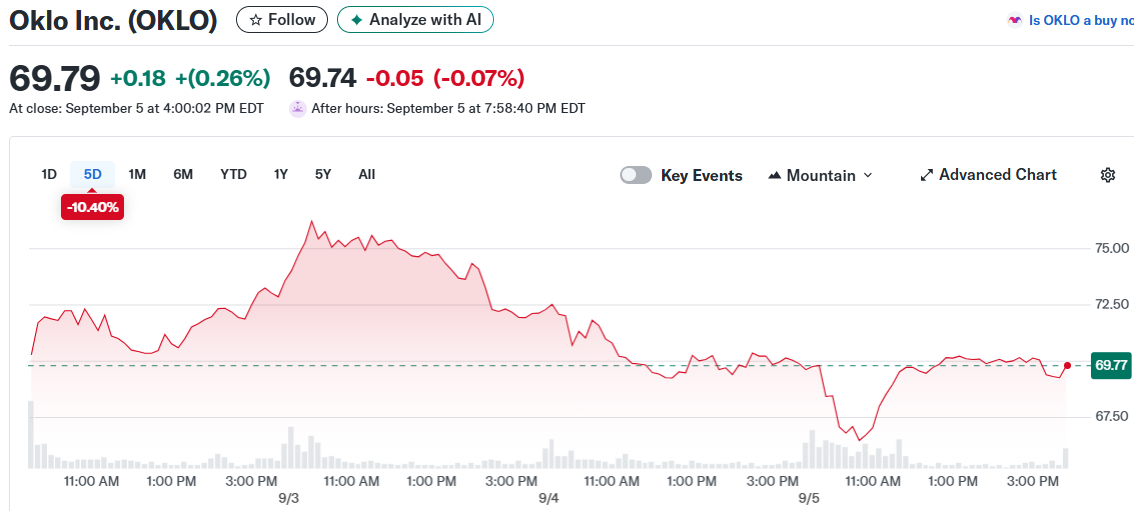

- Stock has gained over 225% year-to-date despite falling 3.7% Thursday after upsizing stock offering to $540 million

Oklo stock climbed 1.4% in after-hours trading Thursday after the nuclear startup announced plans for a major fuel recycling facility. The move comes as the company positions itself in the growing intersection of nuclear energy and artificial intelligence.

Oklo Inc. (OKLO)

Oklo Inc. (OKLO)

The company revealed it will invest up to $1.68 billion in a fuel recycling facility at Oak Ridge, Tennessee. This facility will produce metal fuel specifically designed for Oklo’s Aurora nuclear reactors.

Production at the Tennessee site is expected to begin in the early 2030s. The facility addresses a critical supply chain issue facing advanced nuclear reactors.

Most next-generation reactors require High-Assay, Low-Enriched Uranium (HALEU) fuel. This fuel type produces more power per unit volume than traditional nuclear fuel.

Currently, Russia controls the majority of global HALEU production. Oklo’s facility aims to establish a secure domestic supply chain for this specialized fuel.

Government Support Builds Momentum

The Department of Energy recently selected 11 projects for its Nuclear Reactor Pilot Program. Oklo secured two project selections, while its subsidiary Atomic Alchemy received a third.

No other company received more than one project selection in the program. The program targets having three operational reactors by July 4, 2026.

This government backing comes as the Trump administration has promoted nuclear power. The administration has canceled funding for solar and wind projects while supporting nuclear initiatives.

Oklo went public in 2024 through a merger with AltC Acquisition. OpenAI founder Sam Altman helmed the SPAC and served as board chair until April.

AI Focus Drives Strategy

Unlike traditional nuclear companies, Oklo specifically targets AI providers as customers. The company announced a collaboration with Vertiv in July to develop thermal management solutions.

These solutions will serve hyperscale data centers located alongside Oklo’s nuclear power plants. Both data centers and nuclear reactors generate substantial heat requiring industrial cooling systems.

The International Energy Agency projects data center power consumption will account for nearly half of U.S. electricity demand growth between 2025 and 2030. This creates a substantial market opportunity for nuclear-powered data centers.

Oklo is also exploring partnerships with the Tennessee Valley Authority. The discussions include recycling TVA’s used fuel and potential power sales from future Oklo facilities.

The stock fell 3.7% Thursday after the company upsized a stock offering to nearly $540 million from the previously planned $400 million. Despite this decline, shares have more than tripled this year with gains exceeding 225%.

The post Oklo Stock: Jumps as Nuclear Company Announces $1.68 Billion Nuclear Fuel Facility appeared first on CoinCentral.

You May Also Like

Tom Lee, 2026’yı “Ethereum Yılı” İlan Etti: Fiyat Tahminini Paylaştı!

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings