Solana News Today: Could SOL Price Top $300 In 2025 & Why Early Rollblock Investors Are Set For 2,500% Gains

Solana is holding above $200, with analysts debating whether it can top $300 in 2025, but another name is stealing attention. Rollblock’s presale has already raised $11.5 million, with its token soaring 500% before launch.

The project’s early traction highlights a sharp contrast to most new coins, combining adoption with revenue-backed rewards. As Solana charts a steady recovery, Rollblock’s momentum suggests early investors could be staring at gains rarely seen this early in a project’s life.

Rollblock’s Presale Momentum Signals Strong Future

Rollblock (RBLK) is rapidly transitioning out of a promising presale into a project with demonstrable momentum in the crypto market. With more than $11.5 million raised and over $15 million in wagers already placed on its iGaming platform, the project is demonstrating utility that goes beyond speculation.

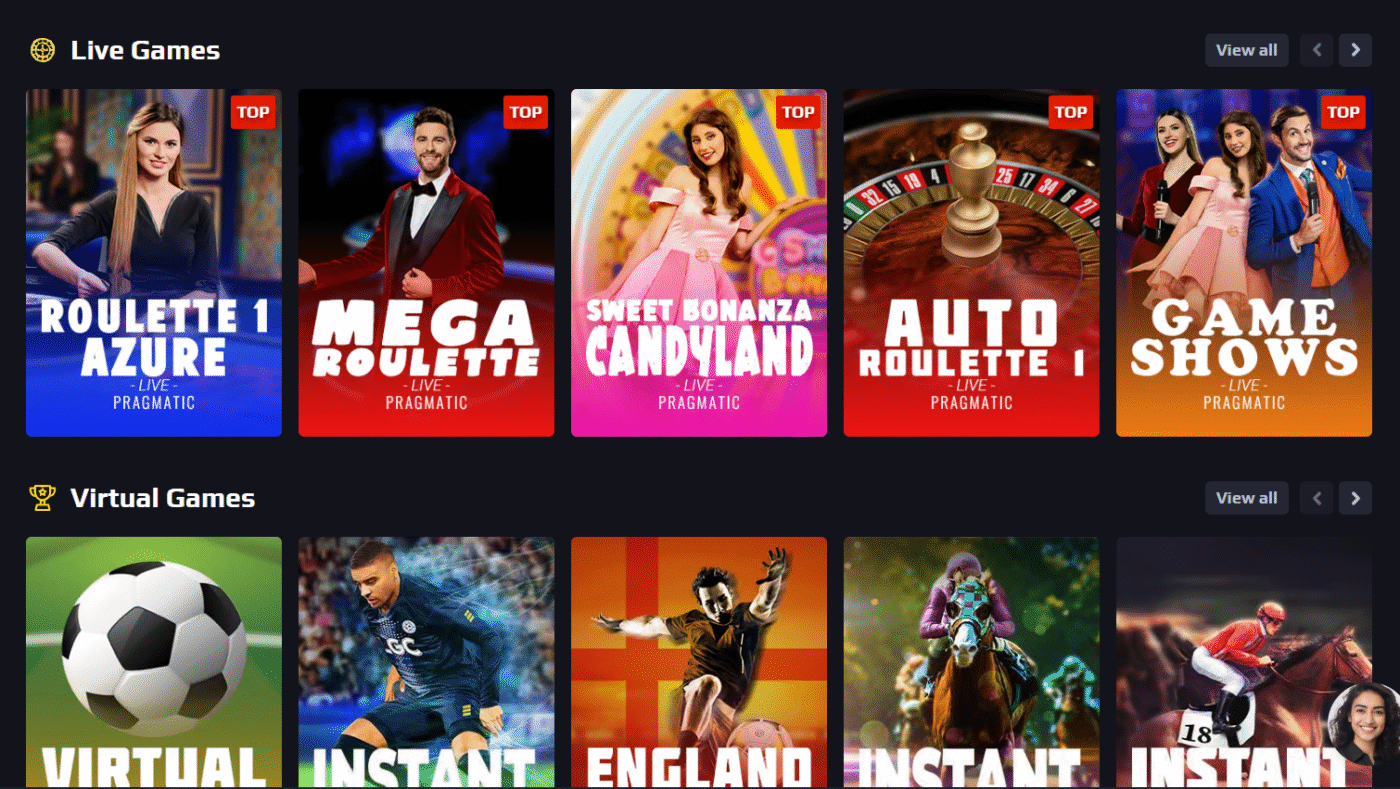

A community of 55,000 registered users and a library of 12,000 games, including poker, blackjack, roulette, and a full sportsbook, highlights just how quickly adoption is spreading.

Unlike most early-stage tokens that rely on future promises, Rollblock already runs a licensed, independently audited platform where users can play, earn, and stake in real time. The RBLK token is pegged to the platform revenue. Every week, 30% of revenue is allocated to buybacks, with the majority burned to restrict supply and the rest staked to deliver rewards of up to 30% APY.

This balance of transparency, utility, and scarcity has helped the token surge 500% to $0.068 during the presale.

Key drivers behind Rollblock’s rise include:

- $11.5M raised in presale and $15M+ wagers already processed

- Licensed under Anjouan Gaming and verified by SolidProof

- Weekly burns paired with staking rewards up to 30% APY

- A 12,000+ game library plus sportsbook integration

Since then, analysts have estimated that RBLK will reach $1 in 2025. For early investors, this signals potential returns of 2,500% as momentum continues to build.

Solana Regains Strength: Could $300 Be Within Reach Next Year?

Solana has been quietly regaining strength after dipping to $126 earlier in the summer. The chart now shows the token trading above $200, sitting at $204.88 at press time, with support from its 30- and 60-day moving averages.

Buyers have stepped in steadily over the past two months, pushing momentum back toward July’s peak at $218. Volume is healthy, indicating that market participants are happy to accumulate at present levels.

Source

Analysts identify the $190 zone as the support that should be strong enough to sustain the uptrend. On the positive side, a fresh break above $220 may be the gateway to another strong push. There are already predictions that Solana will be in the range of $250 by the end of the year, with the market conditions being favorable.

Going even further ahead, analysts are positive that SOL could hit as high as $300 in 2025, as long as the network does not stop its active developer work and the ecosystem remains in demand. In the meantime, Solana is squarely back on track following its mid-year slump.

Rollblock Poised to Outshine Bigger Names

Rollblock has already raised 11.5 million and experienced a presale boom of 500%, marking momentum that competitors are taking note of and potentially even outperforming experienced tokens, including Solana. Its licensed platform, steady revenue model, and weekly buybacks give RBLK an edge that extends beyond hype. While Solana eyes $300 in 2025, Rollblock’s blend of adoption and scarcity positions it as a project with the potential to outpace traditional market leaders.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Solana News Today: Could SOL Price Top $300 In 2025 & Why Early Rollblock Investors Are Set For 2,500% Gains appeared first on Blockonomi.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim