Kenvue Inc (KVUE) Stock: Shares Fall 9% After Tylenol–Autism Link Reports

TLDR

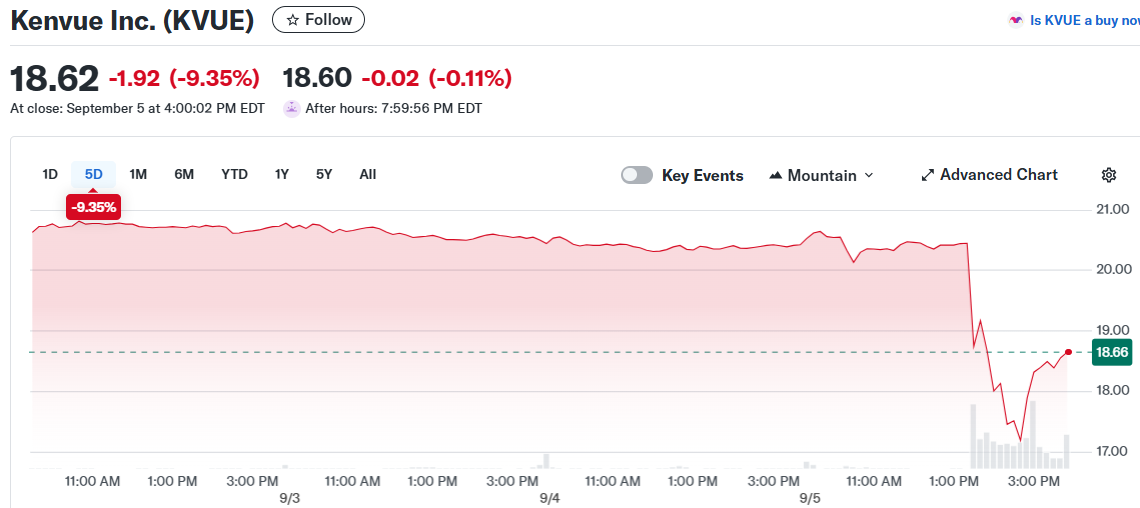

- Kenvue (KVUE) stock dropped 9.35% following reports linking Health Secretary RFK Jr. to concerns about Tylenol and autism

- Reports suggest RFK Jr. might associate Tylenol use during pregnancy with autism risk

- Analysts have lowered price targets due to uncertainty around the health concerns

- The company is currently undergoing a strategic review process

- Stock shows year-to-date decline of 1.06% with current market cap of $39.42 billion

Kenvue stock took a sharp hit Thursday, falling 9.35% as investors reacted to reports connecting Health Secretary RFK Jr. to potential concerns about Tylenol. The consumer health giant found itself in the spotlight after news emerged suggesting the health official might link the popular pain reliever to autism risks.

Kenvue Inc. (KVUE)

Kenvue Inc. (KVUE)

The stock decline came as traders processed reports that RFK Jr. could associate Tylenol use during pregnancy with autism. This development sent ripples through the market as investors weighed potential regulatory or public health implications for one of Kenvue’s key products.

Trading volume spiked as the news broke. Kenvue typically sees average daily volume of 18.1 million shares. The sharp price movement caught many investors off guard given the suddenness of the health-related reports.

Analysts quickly responded to the news by adjusting their outlook. Several firms lowered their price targets for KVUE stock. The downgrades reflect growing uncertainty about how these health concerns might affect future sales and company performance.

The timing comes as Kenvue is already navigating a strategic review process. This internal evaluation was already creating some uncertainty for investors. The new health-related reports have added another layer of complexity to the company’s current situation.

Market Response and Analyst Actions

Wall Street’s reaction was swift and decisive. The stock’s technical sentiment signal moved to “sell” territory. This shift reflects the immediate concern among traders about potential headwinds facing the consumer health company.

The market cap took a substantial hit from the day’s trading. Kenvue’s valuation dropped to $39.42 billion following the decline. This represents a substantial decrease from previous trading sessions.

Price target adjustments came from multiple analyst firms. The revisions reflect the new risk factors analysts must now consider in their models. These downgrades signal professional investors are taking a more cautious stance on the stock.

Current Financial Position

Kenvue entered this turbulent period with mixed year-to-date performance. The stock was already down 1.06% for the year before Thursday’s decline. This modest decline had kept the company relatively stable compared to broader market movements.

The company’s average trading volume of 18.1 million shares provides decent liquidity for investors. This volume level typically allows for smooth entry and exit from positions. Thursday’s elevated trading activity suggests heightened investor interest in the developing story.

Market makers and institutional investors have been closely monitoring the situation. The combination of strategic review uncertainty and new health concerns has created a challenging environment for the stock.

The consumer health sector has faced various regulatory and public perception challenges in recent years. Companies in this space must navigate complex relationships with health officials and regulatory bodies.

Kenvue’s stock performance will likely depend on how these health-related reports develop. Investors are watching for any official statements or regulatory actions that might emerge from the current situation.

The company’s strategic review process continues alongside these new developments. This internal evaluation was designed to optimize operations and improve shareholder value.

The post Kenvue Inc (KVUE) Stock: Shares Fall 9% After Tylenol–Autism Link Reports appeared first on CoinCentral.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Trust Wallet Alerts Users After Security Incident