Bitcoin Slips Under $110K as Bulls Fail to Hold the Line

Bitcoin’s struggle with resistance around $112K has become the stuff of déjà vu. Once again, bulls tried to turn that ceiling into a floor — once again, they got smacked back down. Popular trader BitBull summed it up bluntly: “Until BTC reclaims $114K on the daily, every rally is just a bull trap.” In other words, don’t get too comfy — the longer Bitcoin hangs out below that level, the bigger the correction risk.

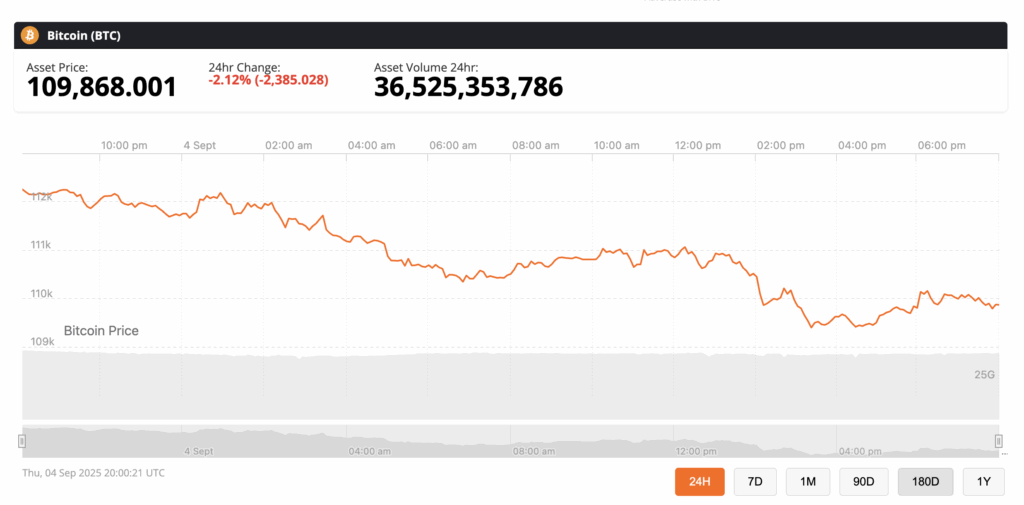

Bitcoin slipped again on Thursday, source: BNC

Where Support Might Hold

The optimists haven’t left the building yet. Swissblock argues that $110K is “critical support” thanks to a heavy-volume trading zone sitting right there. Lose it, and we’re looking at a fast-track ticket to the psychological $100K level. But if Bitcoin can bounce, the next upside gauntlet is at $113.6K–$115.6K, followed by an even beefier wall near $118K. In short: still lots of resistance above, not much room for error below.

Macro Backdrop: Gold Shines, Fed Wobbles

Zooming out, U.S. jobs data pointed to a cooling labor market, fueling expectations of a Fed rate cut on Sept. 17. That would normally be rocket fuel for risk assets — but inflation is still lurking, and some analysts warn the Fed may only have room for a “one and done” cut. That uncertainty isn’t helping crypto sentiment.

Meanwhile, gold is flexing hard. It’s not just beating Bitcoin, it’s outpacing stocks too. As The Kobeissi Letter put it: “Markets are pricing in higher long-term inflation and more deficit spending.” Translation: shiny rocks are winning this round.

Bottom Line

Bitcoin’s flirting with a cliff edge. Support at $110K is crucial, $100K is the next safety net, and $114K is the breakout line in the sand. Right now, though, the spotlight belongs to gold — and Bitcoin’s playing second fiddle.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun