Solana Price: Weak Inflows Threaten to End 30% Monthly Rally

The token has nearly doubled its monthly performance with a 30% gain and trades just below $210. But beneath the surface, on-chain metrics and technicals suggest the momentum could be fading.

Investors Cashing Out Despite Gains

While most traders are celebrating the recent rebound, long-term holders are quietly reducing exposure. Glassnode data shows a sharp decline in their net position change, with more than 1.5 million SOL moving out of long-term wallets. That kind of shift typically signals distribution, not accumulation, and casts doubt on the sustainability of the rally.

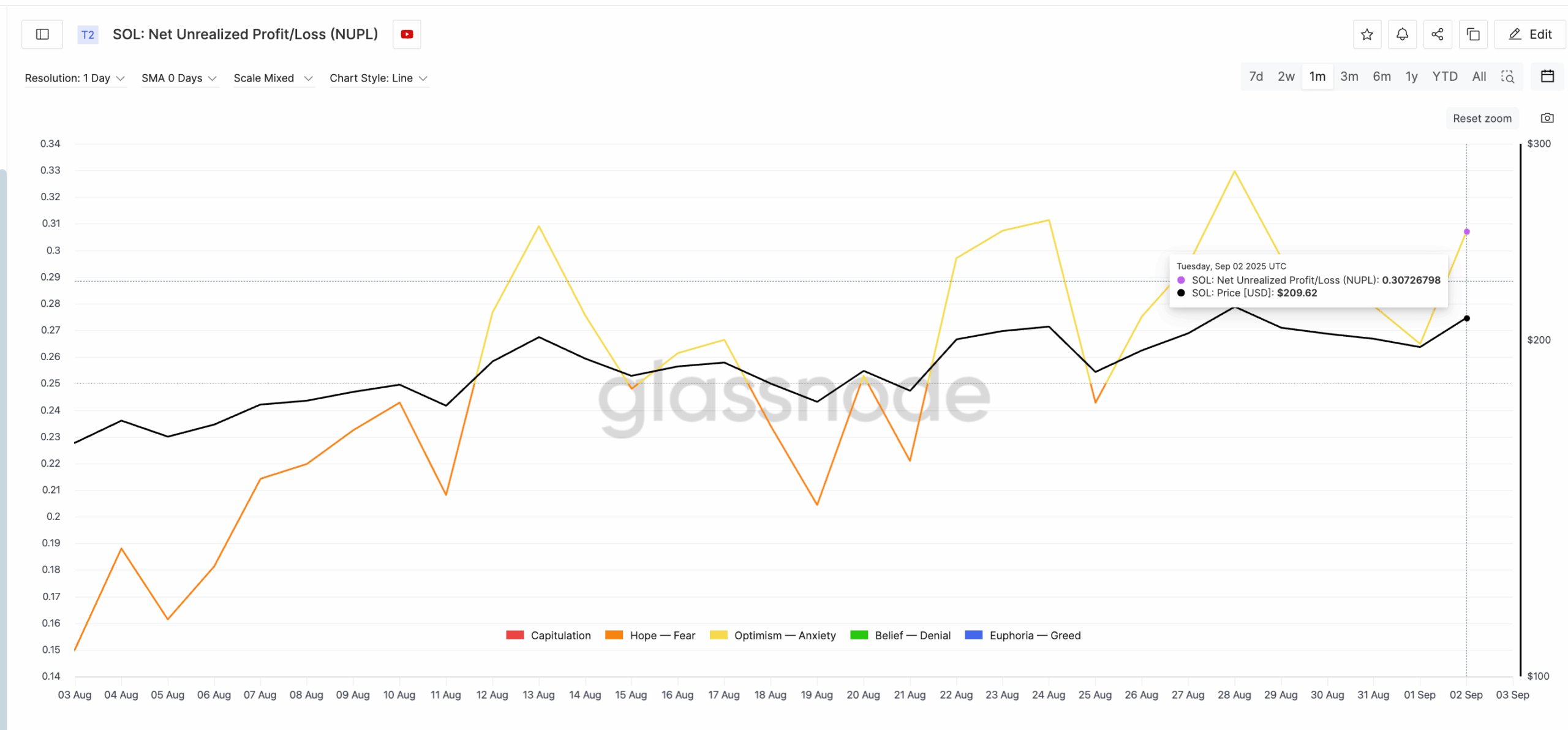

At the same time, the Net Unrealized Profit/Loss (NUPL) index has climbed, highlighting that a large share of the market is sitting on profits. Historically, those conditions invite selling. In late August, a similar setup led to a quick drop from $214 to $205. With the ratio rising again, traders may be preparing to lock in gains rather than push the price higher.

READ MORE:

Ethereum ETFs Fuel Biggest Crypto Trading Month Since January

Technical Barriers Loom

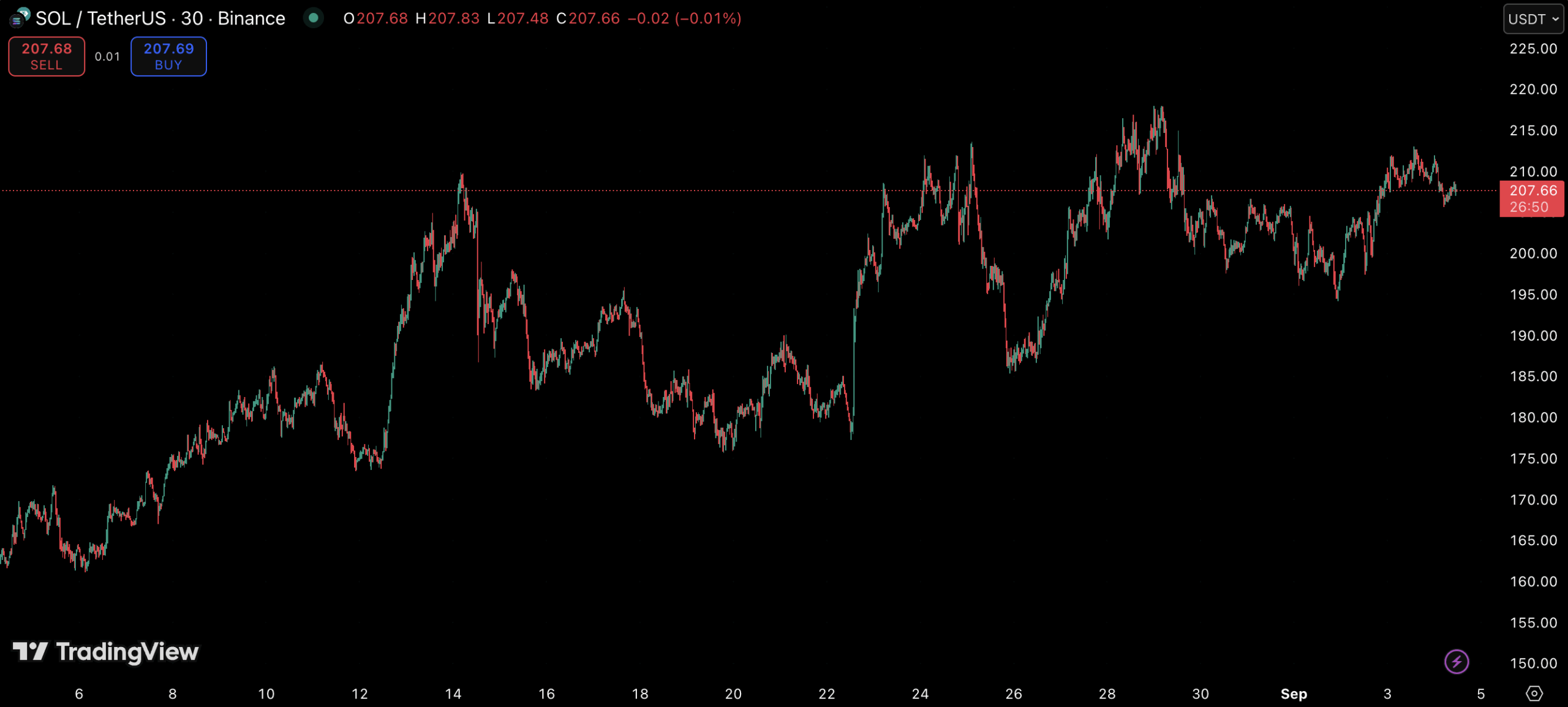

Solana’s chart reflects the same indecision. The $215–$220 zone has acted as a stubborn ceiling, capping every attempt at a breakout. Without a decisive close above this band, the token risks slipping back into its lower range. Adding to the caution, the Money Flow Index shows limited new inflows, meaning fresh capital isn’t arriving to backstop the rally.

What to Watch Next

Unless buyers return in force, Solana’s current structure looks fragile. A convincing move above $220 could flip sentiment and extend the uptrend, but if selling intensifies, a revisit of $200 or lower is on the table. For now, the balance between short-term traders taking profits and long-term holders cutting back has left Solana at a crossroads.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Solana Price: Weak Inflows Threaten to End 30% Monthly Rally appeared first on Coindoo.

You May Also Like

Tom Lee, 2026’yı “Ethereum Yılı” İlan Etti: Fiyat Tahminini Paylaştı!

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings