Ray Dalio Warns Dollar Crisis, Urges 15% in Crypto and Gold

According to recent interviews, Ray Dalio crypto has become a talking point as he warns about America’s rising debt and the weakening dollar.

Dalio, founder of Bridgewater Associates, compares the U.S. economy to “a patient on the brink of a heart attack” due to growing deficits and political interference with monetary policy. He believes both gold and cryptocurrencies can serve as hedges when trust in traditional currencies fades.

U.S. Debt Spiral and Dollar Weakness

Dalio has raised the alarm over the unsustainable U.S. debt path, warning that the cost of interest payments and political divisions could erode confidence in the dollar.

He argues that fiscal policies have left the system fragile, putting the global reserve currency status of the dollar under pressure. For readers in crypto, this concern translates into renewed interest in hedging strategies that balance risk.

Also read: BlackRock CEO Larry Fink: Soaring US Debt May Hand Global Power to Bitcoin

Ray Dalio Crypto and Gold Hedge

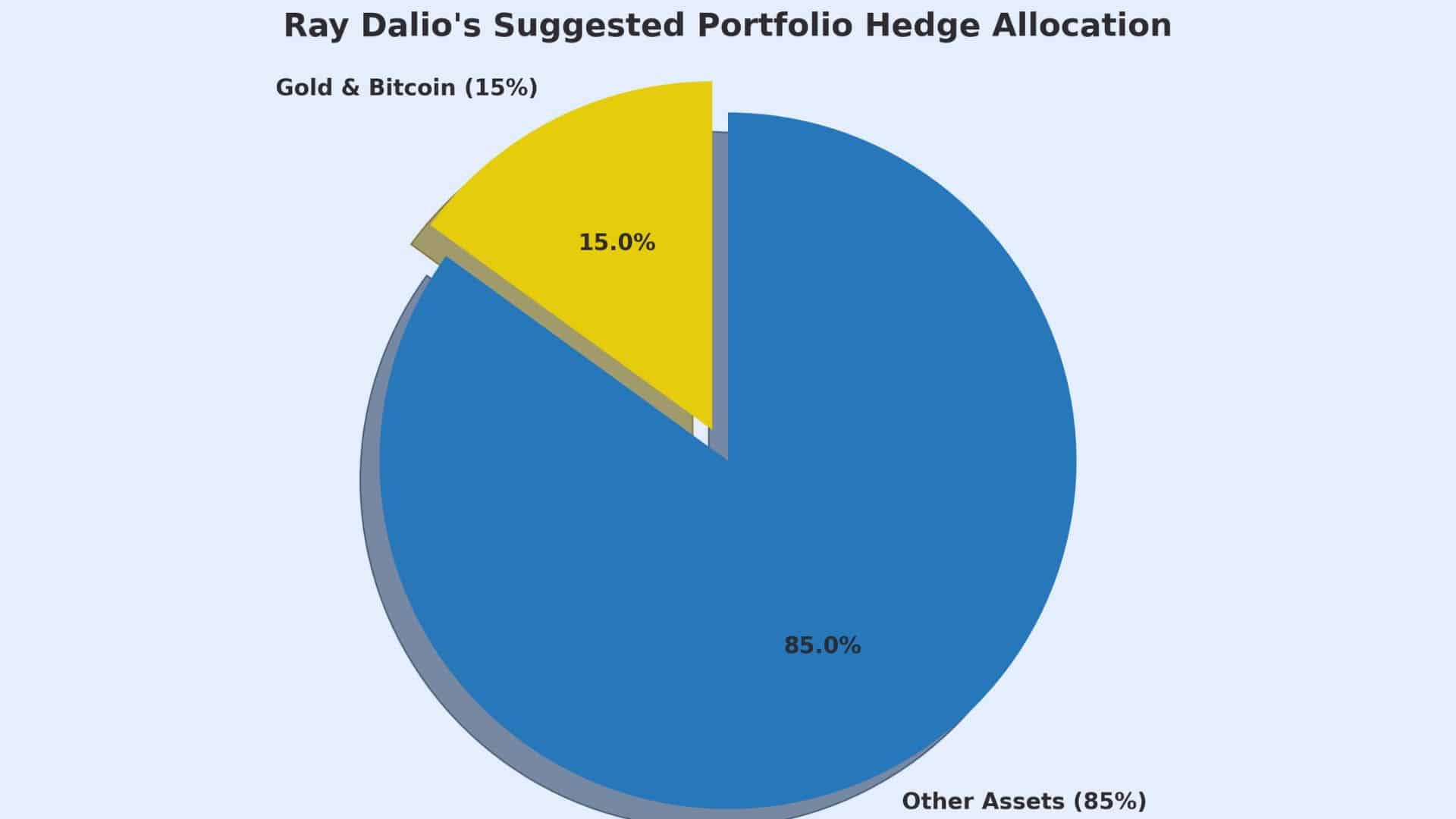

In a shift from earlier cautious advice, Dalio now recommends putting about 15 percent of a portfolio in gold or Bitcoin to safeguard against debt and inflation shocks. He had previously suggested just 1 to 2 percent in Bitcoin. This rise signals how the debt “doom loop” has altered his thinking.

Gold remains his favorite asset, yet he acknowledges that Ray Dalio crypto allocation can play a role when markets question fiat credibility. He sees Bitcoin as a possible hedge, but with caution.

Ray Dalio’s Hedge Play: 15% in Gold and Crypto, 85% Elsewhere

Ray Dalio’s Hedge Play: 15% in Gold and Crypto, 85% Elsewhere

Caution on Bitcoin’s Risks

While recognizing crypto’s hedge value, Dalio points to risks. He notes that Bitcoin’s transparency can attract government surveillance, and its code could face unforeseen vulnerabilities. Despite these warnings, he admits that demand for alternatives grows as debt levels soar. For investors, this means balancing enthusiasm for Ray Dalio crypto strategies with sober awareness of the downsides.

Portfolio Impact and Investor Insight

For everyday investors, Dalio’s view provides a roadmap. A 15 percent allocation split between gold and Bitcoin allows for risk-adjusted exposure to safe-haven assets. It is not a call to abandon equities or bonds but rather a reminder to diversify when trust in traditional finance wanes.

The phrase Ray Dalio crypto now signals more than a passing comment; it reflects a shift in mainstream portfolio theory.

Conclusion

Based on the latest research, Ray Dalio crypto may serve as a strategic hedge against mounting debt and a weakening dollar. Holding around 15 percent of a portfolio in gold or Bitcoin can improve return-to-risk balance in uncertain times.

The focus stays on gold, with Ray Dalio crypto positioned as a credible alternative. Investors should consider this balanced approach to protect against currency devaluation while maintaining flexibility.

Also read: Bitcoin ETF Inflows Hit $33.6B in Q2: Harvard, Hedge Funds, and Wall Street Pile Into Crypto

Summary

Ray Dalio warns that rising debt and political risks could weaken the dollar, urging investors to hedge wisely. He now suggests putting 15% of portfolios into gold or Bitcoin. While gold remains his top choice, a crypto strategy is gaining traction as an alternative. His advice offers a clear path for protecting wealth in uncertain times.

Glossary of Key Terms

Hedge: An investment used to reduce exposure to risk.

Fiat currency: Government-issued money not backed by a physical asset.

Safe-haven asset: Investment that holds value during market stress.

Debt spiral: Situation where borrowing costs rise as debt grows.

FAQs for Ray Dalio Crypto

Q1. What percentage of Bitcoin or gold does Ray Dalio recommend?

He suggests allocating about 15 percent of a portfolio to gold or Bitcoin.

Q2. Does Dalio prefer crypto over gold?

No, he still prefers gold but accepts crypto as a hedge against debt risks.

Q3. Why is Dalio worried about the dollar?

He warns that high U.S. debt and political interference threaten the dollar’s global role.

Q4. Is Bitcoin safe, according to Dalio?

He sees value but highlights risks like surveillance and technical flaws.

Read More: Ray Dalio Warns Dollar Crisis, Urges 15% in Crypto and Gold">Ray Dalio Warns Dollar Crisis, Urges 15% in Crypto and Gold

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim