WLFI price prediction: Can $0.23 hold after volatile Trump token launch?

- The Trump-backed WLFI token launched at $0.33 but quickly dropped nearly 50% to around $0.23.

- A recent 47 million token burn aims to reduce supply and support the price.

- Holding $0.23 is critical for a possible rebound toward $0.27–$0.30; falling below risks a slide to $0.20 or lower.

- About 25% of tokens are reportedly held in Trump-affiliated wallets, raising concerns over market manipulation.

- Security issues and volatile trading keep the WLFI outlook mostly bearish to neutral in the short term.

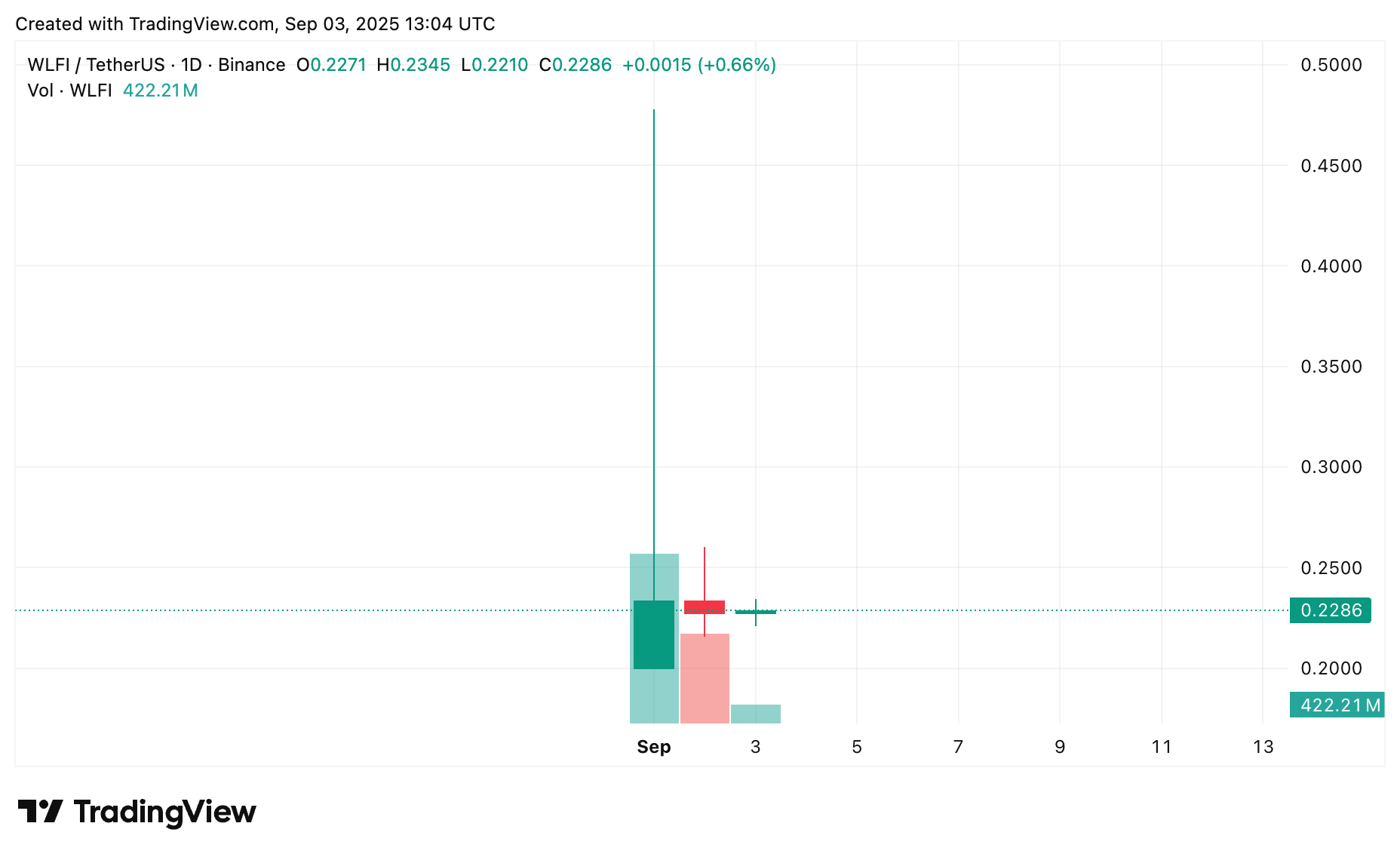

The Trump-backed WLFI token made a splash this week, launching at about $0.33 and rocketing up before quickly crashing back down to around $0.23.

That’s nearly a 50% drop from the highs. A lot of hype, a lot of heat, and even a big 47 million token burn meant to tighten supply and give the price a lift.

Now, everyone’s watching that $0.23 mark, let’s dive into our WLFI price prediction. Will price hold steady and fuel a rebound, or are we looking at another leg down as the doubters pile in?

Table of Contents

- WLFI price prediction: Current price action

- WLFI price prediction based on current levels

WLFI price prediction: Current price action

World Liberty Financial (WLFI) is trading near $0.23, down 5–8% intraday after a volatile start. The quick surge to $0.33 didn’t last, and traders are adjusting their short-term expectations accordingly.

The recent token burn — 47 million units, or roughly 0.19% of total supply — was a deliberate attempt to introduce scarcity and revive buying interest.

Upside market factors

If WLFI can hold the line at $0.23, there’s a decent shot it bounces back toward the $0.27 to $0.30 range. That kind of move would likely be fueled by traders chasing short-term wins, especially with the recent token burn tightening up supply.

The Trump connection is still generating buzz — and as long as media outlets keep covering it, that attention alone could be enough to give WLFI a lift. If momentum builds, hitting $0.30 again isn’t a stretch — and from there, a return to its $0.33 debut doesn’t seem so far-fetched.

A stronger rally could form if we see more token burns or real ecosystem updates. That kind of progress would help shift the story from pure hype to something with real substance.

Downside risks

If WLFI dips below $0.23, things could go south in a hurry. With so much short-term money in the mix, a drop to $0.20 or even $0.18 wouldn’t be a shock — it’s a fragile market, and people are quick to hit “sell.”

And here’s the elephant in the room: reportedly, about a quarter of the tokens are sitting in Trump-affiliated wallets. That’s a massive chunk in the hands of a few — and for a lot of traders, it’s a red flag that screams “proceed with caution.”

Security issues have also added downside pressure. At launch, reports of wallet breaches and security flaws raised red flags for cautious investors. Until those concerns are addressed transparently, confidence in WLFI’s future may remain shaky.

WLFI price prediction based on current levels

At the moment, the WLFI price prediction is hovering between $0.23 and $0.30. Everyone’s waiting to see if it breaks out or falls apart from this narrow range.

- Breaking above $0.27 on solid volume could open the door to $0.30 — and possibly a retest of the $0.33 launch price if speculative interest heats up.

- But if $0.23 breaks down hard, expect a slide to $0.20 or $0.18, especially if more sellers jump in and confidence tanks.

The WLFI outlook remains mostly bearish to neutral. Any optimism tends to be short-lived and media-driven rather than backed by substantial progress. With high volatility and limited transparency in play, any projection comes with a fair amount of risk.

As it stands, the World Liberty Financial price forecast is murky — this one’s for the risk-takers, not the long-haul investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Holywater Raises Additional $22 Million To Expand AI Vertical Video Platform

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement