Gold’s Record-Breaking Rally Puts Spotlight on Bitcoin’s Next Move

Some argue the move sets the stage for BTC’s next surge, while others insist it highlights crypto’s vulnerability to competing safe havens.

A Clash of Narratives

Macro traders like Martyparty believe gold and liquidity conditions act as the market’s “leaders,” with Bitcoin following once the dust settles. The same dynamic played out earlier this year: gold pushed toward the $3,500 zone, Bitcoin dipped, then quickly reversed to new highs. Supporters now expect a similar script.

Skeptics counter that the relationship is zero-sum. Peter Schiff, a longtime Bitcoin critic, points to gold’s $3,480 breakout and silver’s climb above $40 as proof that money is flowing away from digital assets. With Bitcoin slipping below $108,000, he argues the divergence will only widen.

What’s Driving Gold Higher

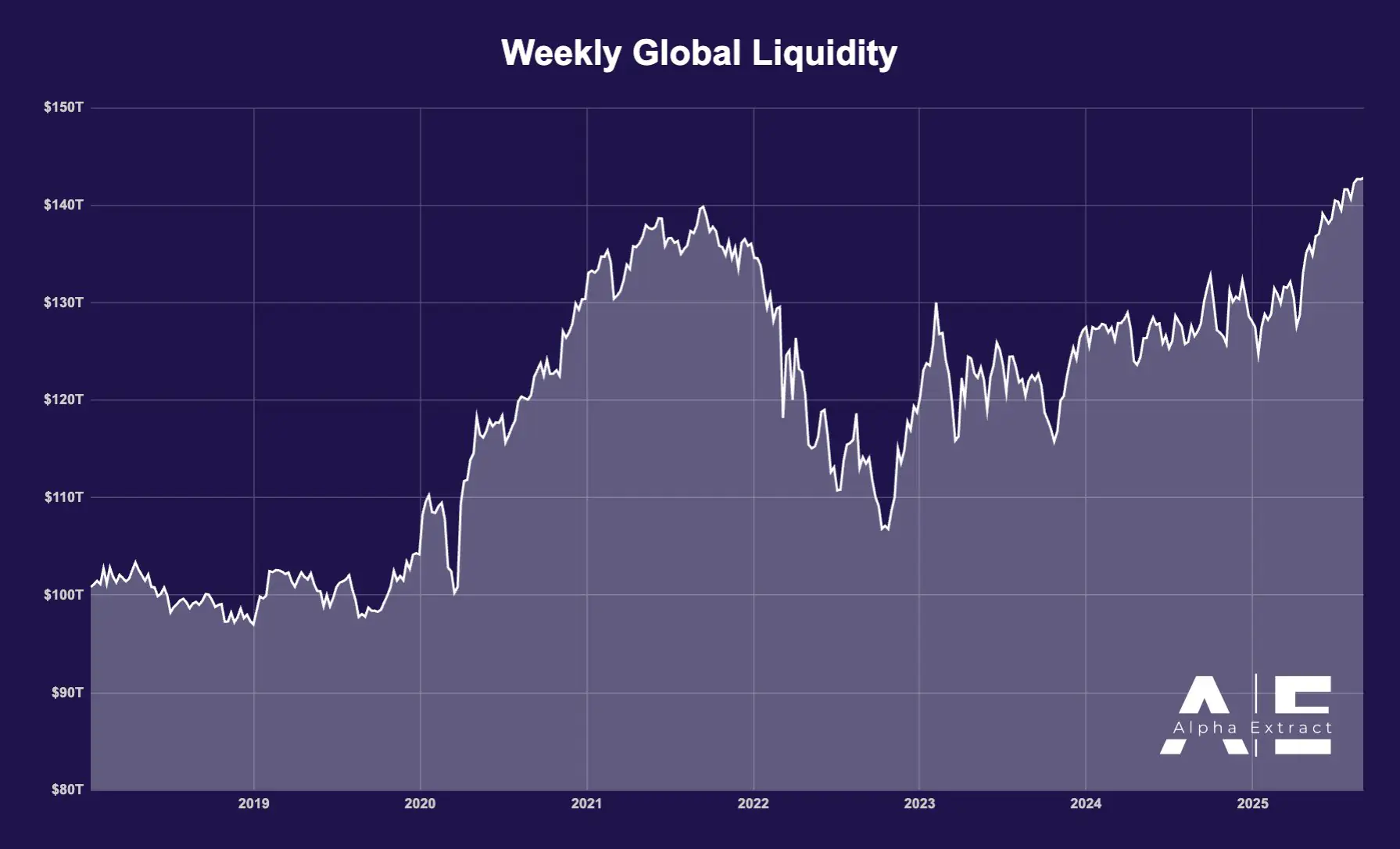

Behind the scenes, liquidity is flooding back into markets. Analysts calculate that global liquidity expanded by over $130 billion in just one week, adding fuel to risk assets. Combined with doubts about the Federal Reserve’s independence, sticky inflation, and rising long-dated yields, investors are piling into traditional hedges.

Gold has gained more than 6% in the past 10 days, topping out at $3,508. Despite some signs of short-term exhaustion, technical models suggest the rally hasn’t peaked, even as medium-term indicators warn of caution.

READ MORE:

Major Pi Network Listing News: Could This Be the Start of a Massive Comeback?

Shifting Role of Reserve Assets

Balaji Srinivasan highlights a deeper shift: the U.S. dollar’s share of global reserves has slipped to 42%, while gold’s role has expanded. He sees Bitcoin as the logical “next step” in that transition, arguing that both assets could benefit from waning confidence in fiat currencies.

Complement or Competitor?

The debate ultimately comes down to whether gold and Bitcoin share the same lane. Are they rivals competing for the same flows, or parallel hedges thriving under the same pressures?

What’s clear is that both are now central to conversations about a changing financial system — one where liquidity injections, fiscal strain, and geopolitical uncertainty may give hard assets their most important role in decades.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Gold’s Record-Breaking Rally Puts Spotlight on Bitcoin’s Next Move appeared first on Coindoo.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Bitcoin 8% Gains Already Make September 2025 Its Second Best