Bitcoin Bulls Double Down: The ‘Uptober’ Hyper Fuels Both $BTC and Bitcoin Hyper ($HYPER)

The whole idea is a fun mix-up of ‘up’ and ‘October,’ and it’s built on the belief that Bitcoin’s performance in Q4 is often a preview of what’s to come. But is this just hopeful thinking, or does the data actually back up the hype?

Let’s see.

The Numbers Don’t Lie: A Look at the ‘Uptober’ Track Record

Looking at the data, it seems the ‘Uptober’ believers may be on to something. Since 2013, Bitcoin has only had two down months in October. Once in 2014, when the market was reeling from the Mt. Gox scandal and a regulatory crackdown.

And the second time in 2018, as the market cooled off after the crazy ICO boom of 2017. Every other October was firmly in the green.

In October 2021, it surged 27% thanks to the hype around the first-ever U.S. futures-based $BTC ETFs.

Unleash Bitcoin’s Full Potential

For years, Bitcoin has reigned supreme as the undisputed king of digital assets, a true store of value. But its slow transaction speeds and high fees are slowing it down, preventing it from becoming a dynamic everyday currency.

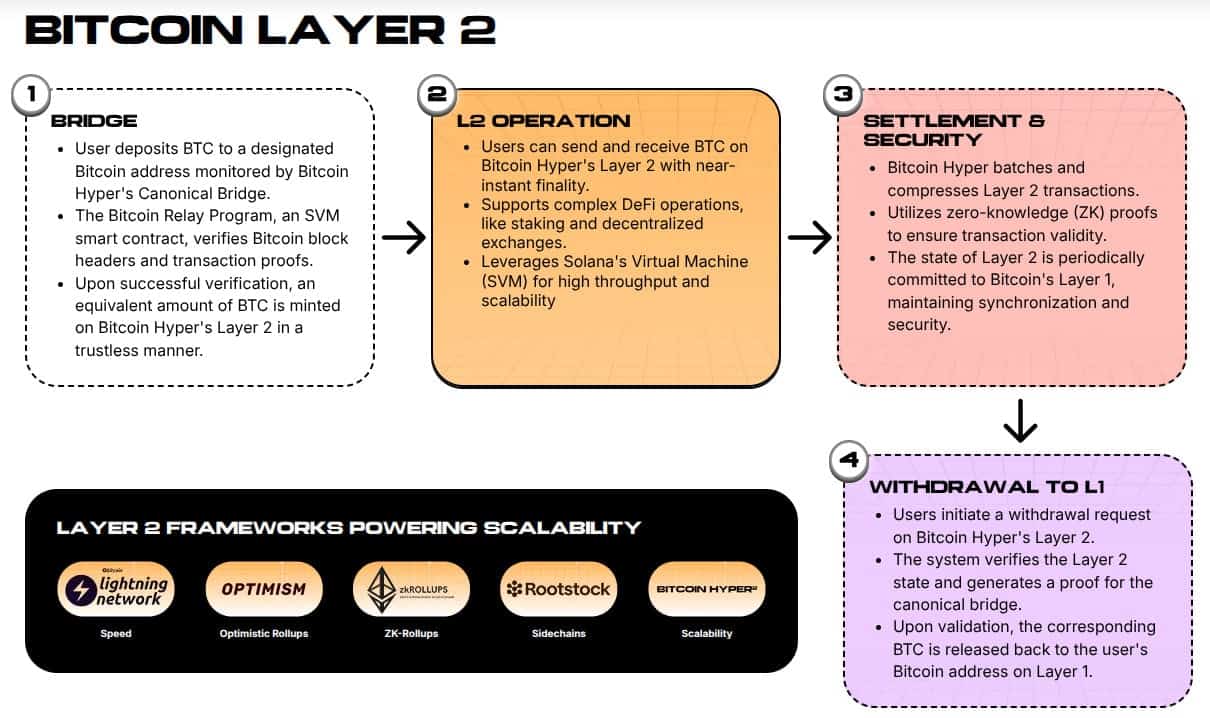

Bitcoin Hyper ($HYPER) is the key to unlocking that cage and its power. This is a game-changing Layer 2 solution using the Solana Virtual Machine (SVM). It’s like building a superhighway right on top of the old dirt road of Bitcoin.

This upgrade allows for blazing-fast transactions at very low fees, opening the door for complex applications, DeFi, and everything else you’ve come to expect from modern crypto networks.

The market is clearly hungry for this innovation, with over $13M already pouring into the presale. Bitcoin isn’t going anywhere, but it’s about to get a major performance boost.

Beyond the HODL: Putting Your $BTC to Work

In times past, you HODLed and waited. With Bitcoin Hyper ($HYPER), you can do more. By using the secure, non-custodial Canonical Bridge, you can seamlessly convert your native Bitcoin into a version that’s ready to use on the Hyper network.

Suddenly, your $BTC isn’t just sitting idly in a wallet; it’s an active asset. You can stake it to earn passive income, participate in governance, or use it to explore a new universe of decentralized applications.

At the heart of it all is the $HYPER token, the native currency that powers the network and covers gas fees.

With a hard cap of 21B tokens and a clear plan for exchange listings, this project is designed for long-term growth and utility. Don’t just watch from the sidelines. It’s time to stop holding your Bitcoin and start making it work for you.

Buy your Bitcoin Hyper ($HYPER) now for $0.012845 and take advantage of the 81% staking rewards on offer.

Bitcoin’s Double-Barrelled Upgrade

This is not just a repeating historical pattern. We’re witnessing a perfect storm. The market, emboldened by the ‘Uptober’ trend, is gearing up for a strong end to the year.

At the same time, we’re seeing the first true contenders for Bitcoin’s evolution emerge. Projects like Bitcoin Hyper ($HYPER) are engineering a fundamental shift. They’re transforming the OG digital asset from a static vault into a dynamic engine of innovation.

Don’t just watch the numbers climb, start building with them.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Bitcoin 8% Gains Already Make September 2025 Its Second Best