PUMP price jumps 13% as Pump.fun reclaims top launchpad spot

PUMP has posted double-digit gains as Pump.fun regains its position as the leading Solana memecoin launchpad. The token’s rebound reflects renewed market momentum after weeks of trailing rivals.

- PUMP price rose 13% after Pump.fun regained the top Solana launchpad spot, deploying 18,446 tokens in 24 hours.

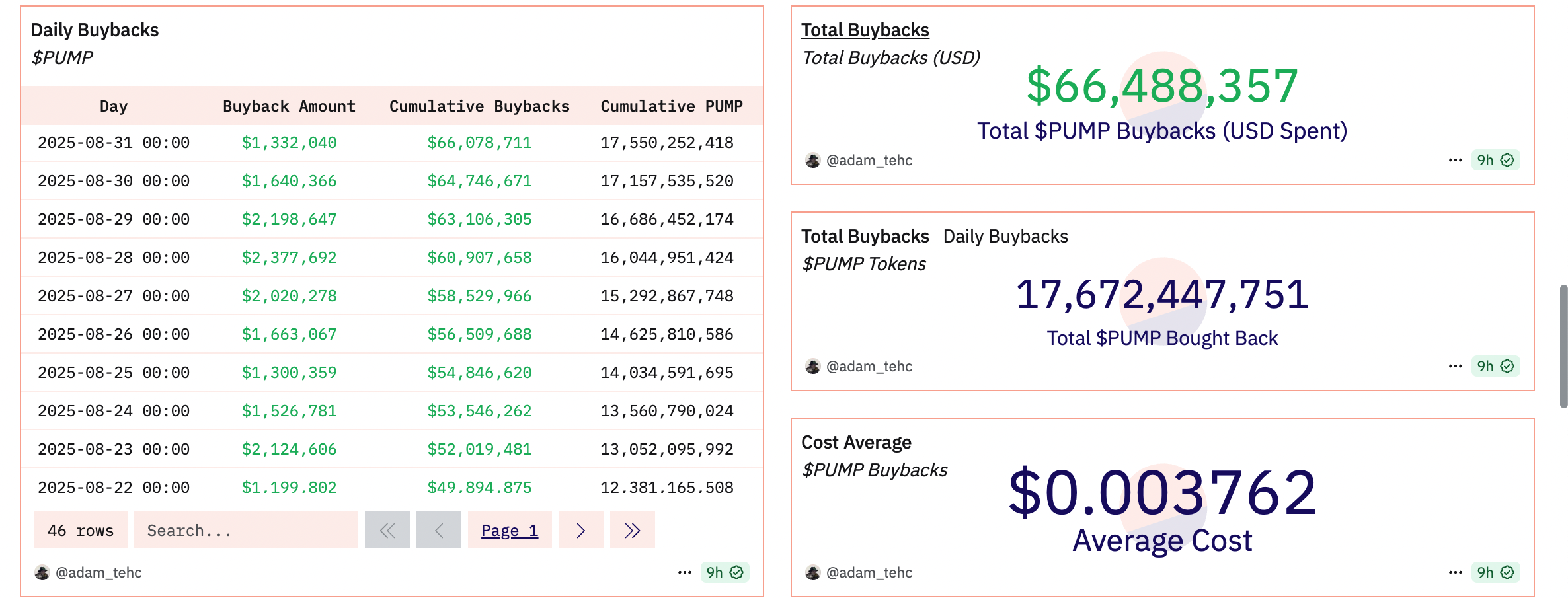

- Over $66M in buybacks has supported price stability, with retail holders now topping 71,003 wallets.

- Pump.fun now holds 77% market share, outpacing LetsBonk.fun’s 12%, with $4.2B in recent trading volume.

The PUMP (PUMP) token has risen by 13% in 24 hours, trading at $0.0037 at the time of writing. Over the past seven days, the token has gained roughly 37.7%, per market data from crypto.news. The uptick aligns with Pump. fun’s return to dominance on the Solana memecoin launchpad scene.

Pump.fun is now leading the daily token deployment race, with 18,446 new tokens launched on the platform in the last 24 hours alone. By comparison, its closest rival, LetsBonk.fun, saw just 4,342 token launches during the same period, according to data from Dune Analytics.

The rally also comes as Pump.fun intensifies its token buyback strategy, aiming to reduce sell pressure and support price stability. In total, over $66.4 million has been used to repurchase more than 17.6 billion PUMP tokens, with average daily buybacks ranging from $1.3 million to $2.3 million over the past week, including its most recent $409,646 on Sept 1.

Pump.fun’s rivalry with LetsBonk Fades

Pump. fun’s resurgence follows a period of weakness in July, when another Solana-based launchpad LetsBonk.fun dominated the memecoin launchpad space. During that month, LetsBonk claimed the majority of market share, while Pump.fun struggled and saw revenue drop to a 10-month low of just $1.72 million in a single week.

However, recent data show a reversal. Pump.fun now holds 77.2% market share and posted $4.2 billion in trading volume over the past week. In contrast, LetsBonk’s share has shrunk to under 12%, with volume dipping to $686 million.

Growing retail participation boosts PUMP price and revenue

Beyond price movements and launchpad activity, Pump.fun is seeing increased retail engagement. The total number of unique PUMP holders has crossed 71,003, with smaller wallets holding fewer than 1,000 PUMP tokens now making up 46.5% of the total distribution. This growing base of retail holders points to rising community interest and broader token decentralization.

DefiLlama data shows that Pump.fun has earned over $779 million in total revenue since its inception. Despite the short-term dip in July, the platform’s revenue is still strong, supported by rising activity and fees generated from token launches.

While the current momentum looks steady, it remains to be seen if the buyback strategy will continue at current levels and if Pump.fun can maintain its market share amid ongoing competition and memecoin volatility. In the meantime, the project has regained its position as the top memecoin launchpad on Solana, and the next few weeks will tell if this is a turnaround or a temporary bounce.

You May Also Like

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

XRP Crowned South Korea’s Most-Traded Crypto of 2025