What Is TVL? Understanding Total Value Locked in 2025

Total Value Locked (TVL) is a key metric that combines the total value of digital assets locked, staked, or committed in a specific blockchain, DeFi platform, or decentralized application (dApp). TVL serves as an indicator of the health, popularity, liquidity, and usability of a DeFi platform or blockchain.

A higher TVL generally signals stronger user confidence and greater platform adoption, as more capital is committed and available within the protocol. It also reflects the liquidity available for trades, loans, and staking activities. By contrast, a lower TVL indicates negative market sentiment toward the protocol, lower activity on that platform, and a decline in perceived value.

In this article, we will explain what TVL is in crypto? Its benefits, limitations, and why it matters for DeFi and crypto investors. We will also show you how TVL is calculated, then explore the top ten DeFi protocols and blockchains by TVL in 2025, and explain how to analyze TVL across different blockchains and platforms.

What Is Total Value Locked (TVL) in Crypto?

Total Value Locked (TVL) is a metric that combines the total value of digital assets locked in a decentralized finance (DeFi) protocol or decentralized application. TVL shows how much money is being staked, lent, borrowed, or otherwise used within smart contracts on that network. In addition, it is an indicator of the liquidity, popularity, and overall health of protocols.

A higher TVL usually means more users are committing their funds, which can signal strong network activity and deeper liquidity for trading or lending. On the flip side, a lower TVL may suggest diminished confidence or activity in the project, which in turn indicates a decline in the overall health of the protocol.

TVL is generally expressed in US dollars by multiplying the quantity of each asset locked by its current market price and summing across all assets. As you read further, we will discuss how crypto TVL is calculated to help you determine whether a project is undervalued or overvalued.

Why TVL Matters for DeFi and Crypto Investors?

TVL matters for DeFi and crypto investors because it indicates a protocol’s community trust and adoption rate, liquidity, security, and overall health. As a proxy for user trust, a high TVL signals that many users trust the protocol enough to lock their assets in it. This trust is due to market sentiments and the project’s perceived security and reliability.

When users trust a protocol, they often share their opinions with others, leading to increased adoption and engagement with a DeFi platform. As a result, investors can compare TVL across projects to identify which protocols are gaining traction and which may be losing user interest.

Aside from trust and adoption rate, TVL is used alongside other metrics to evaluate the economic significance and health of DeFi projects, helping investors make informed decisions.

While TVL is an essential metric in the DeFi space, it should not be the sole metric for investment decisions, as it can fluctuate with token prices and may not fully capture a protocol’s sustainability.

What are the Benefits and Limitations of TVL as a Metric?

The benefits of TVL as a metric include measuring protocol popularity, indicating liquidity, and enabling comparisons to identify which protocols are undervalued. The limitations of TVL as a metric are inflated TVL, impermanent loss, and security risks.

Why Is TVL a Good Metric?

TVL is a good metric because it measures protocol popularity, indicates liquidity, and helps investors compare protocols to determine which one has more potential.

- Measures Protocol Popularity: A high TVL shows that many users trust the protocol enough to lock their funds. This can signal a strong community and healthy user engagement, which are essential for the protocol’s long-term sustainability.

- Liquidity Indicator: TVL represents the total value of assets locked in a decentralized finance protocol, indicating the amount of capital available for trading, lending, borrowing, and liquidity provision. A higher TVL means more liquidity, which reduces slippage for traders and makes lending and borrowing more efficient.

- Track Project’s Growth: Changes in TVL over time show how a protocol or blockchain is growing or shrinking. A steadily rising TVL suggests increasing adoption and trust, while a sudden drop may signal user exit or declining trust and confidence.

- Helps Compare Protocols: Investors and analysts use TVL to compare different DeFi projects or blockchains. By looking at TVL, you can determine each platform’s viability, identify which ones attract more capital and which are more trustworthy, and gauge relative market share.

Limitations and Risks of TVL

The limitations and risks of TVL are inflated TVL, impermanent loss, and security risks.

- Inflated TVL: Inflated TVL happens when decentralized finance protocols offer huge incentives, like unsustainable token rewards, to temporarily attract deposits or lock assets. This can overestimate the value of the protocol and its popularity among users, even though much of the capital might leave as soon as the rewards dry up.

- Impermanent Loss: Another limitation of TVL is impermanent loss, which affects liquidity-providing protocols like decentralized exchanges (DEXs). When you add tokens to a liquidity pool, the price of those tokens can shift compared to when you hold them, sometimes resulting in losses. So, although the protocol’s TVL might look healthy, individual liquidity providers might not be earning positive or risk-adjusted returns.

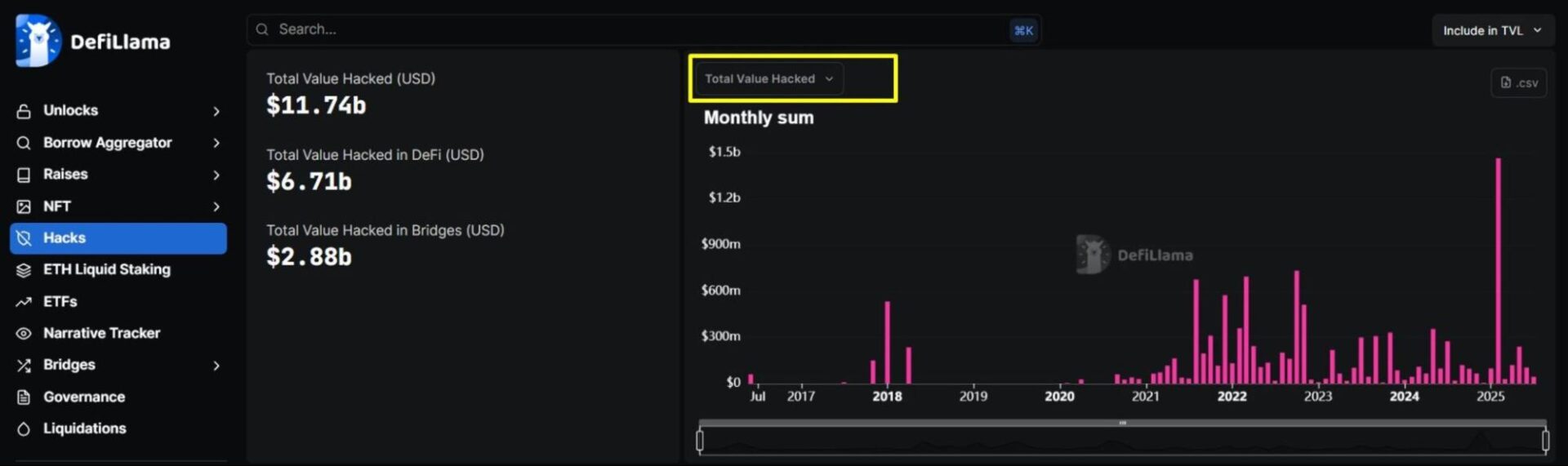

- Security Risks: DeFi protocols rely on smart contracts, and if those contracts have bugs or vulnerabilities, they can be exploited. So, a high TVL doesn’t guarantee that funds are safe; protocols with weak audits or poor security practices can lose millions overnight through exploits or rug pulls.

Risks Associated With High TVL

While a high TVL can indicate a protocol’s popularity and health, it comes with specific risks. These risks include smart contract vulnerabilities, the attraction of fraudulent actors, and liquidity concentration risks.

Since the potential rewards for fraudsters will increase with more locked tokens, protocols with high TVL can attract attention from fraudulent actors who aim to manipulate or exploit the system. When large amounts of funds are locked in a specific DeFi platform, any flaws or bugs in the smart contracts can lead to significant losses for investors and a sharp decline in the total value locked.

Beyond smart contract vulnerabilities, liquidity concentration risks can also be a challenge. If a few large investors hold a significant portion of the locked assets, a sudden withdrawal of their digital assets can cause a liquidity crisis and market instability, which can negatively impact the protocol’s health.

How Is TVL Calculated in Crypto?

TVL in crypto is calculated by adding up the total value of all the tokens locked inside a protocol’s smart contracts. This includes tokens staked, lent, provided as liquidity, or otherwise deposited in the protocol. To get the TVL in USD, multiply each token’s amount locked by its current market price, then sum up the value of all the different tokens.

If a protocol accepts multiple assets like ETH, stablecoins, or native governance tokens, each asset is priced individually and combined to get the final total.

Formula: TVL = Sum of (Quantity of each locked asset × Current market price of that asset in USD) across all assets locked in a DeFi protocol or blockchain. Here is a step-by-step process on how to calculate total value locked (TVL) with an example:

- Identify the Locked Crypto Assets: List all cryptocurrencies and tokens locked in the protocol (e.g., ETH, BTC, USDC, DAI).

- Determine the Quantity of Locked Assets and Calculate the Value: Find out the number of units locked for each asset and multiply the quantity of each asset by its current market price in USD (e.g., 5 BTC × $120,000 = $600,000 or 2000 DAI × $1 = $2,000).

- Sum Values Across all Assets: Add the USD values of all locked digital assets to get the total value locked (e.g., $600,000 + $2,000 = $602,000).

Example using a hypothetical protocol:

| Asset | Quantity | Current Price (USD) | Value (USD) |

| ETH | 500 | 3,000 | 1,500,000 |

| BTC | 20 | 120,000 | 2,400,000 |

| DAI | 10,000 | 1 | 10,000 |

| USDC | 10,000 | 1 | 10,000 |

| Total TVL | $3,920,000 |

In the example above, the protocol’s total value locked is $3.920m.

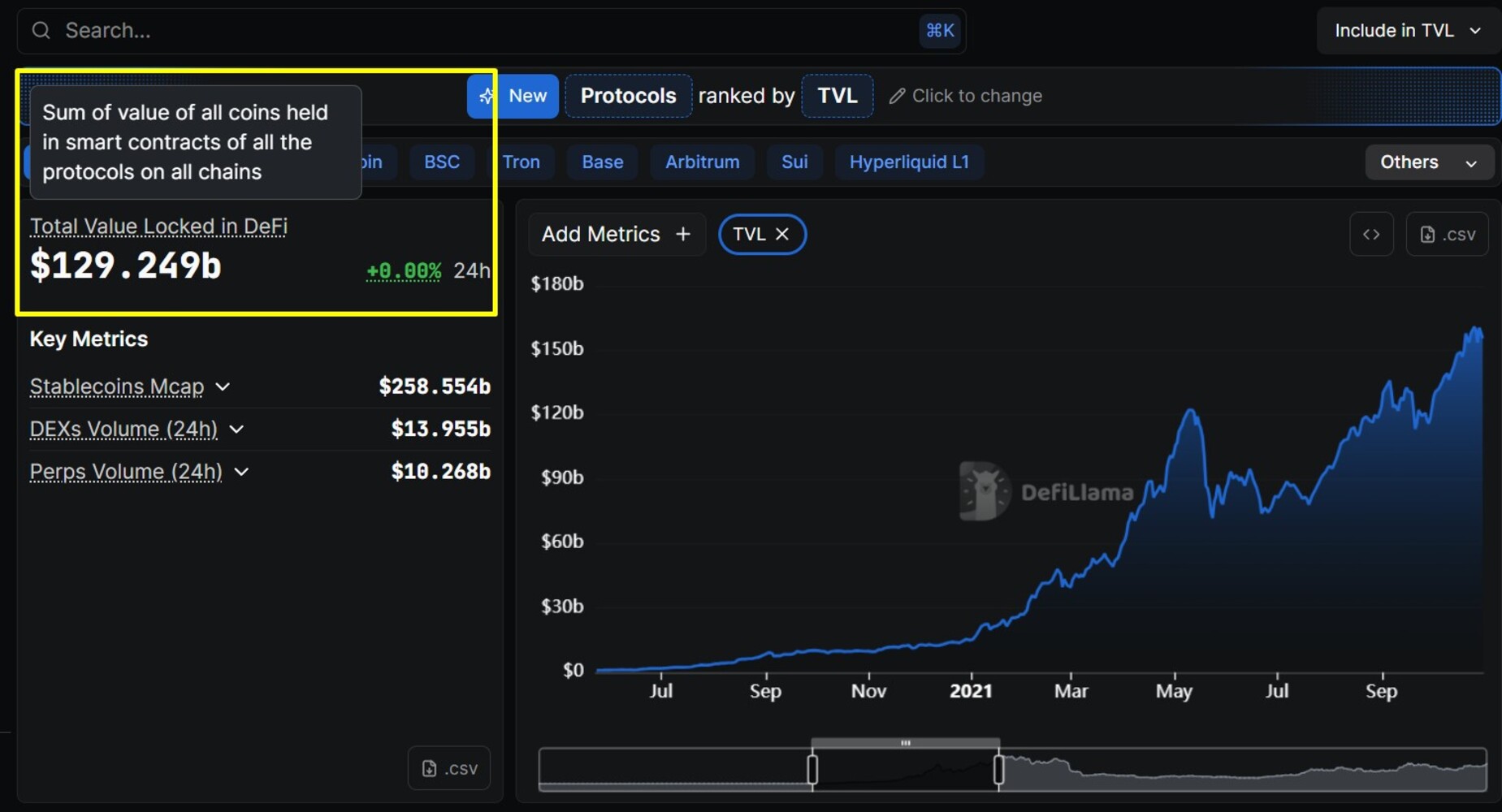

Tracking and calculating TVL manually can be challenging because it involves constantly monitoring multiple token balances, price changes, and smart contracts. Instead of manual computation, rely on platforms that handle TVL calculations. Data sites like DeFiLlama or DappRadar track TVL in real time, so you can conveniently see up-to-date TVL figures on their websites.

What Factors Influence TVL?

The factors influencing TVL are yield opportunities, market conditions, token incentives, and security reputation.

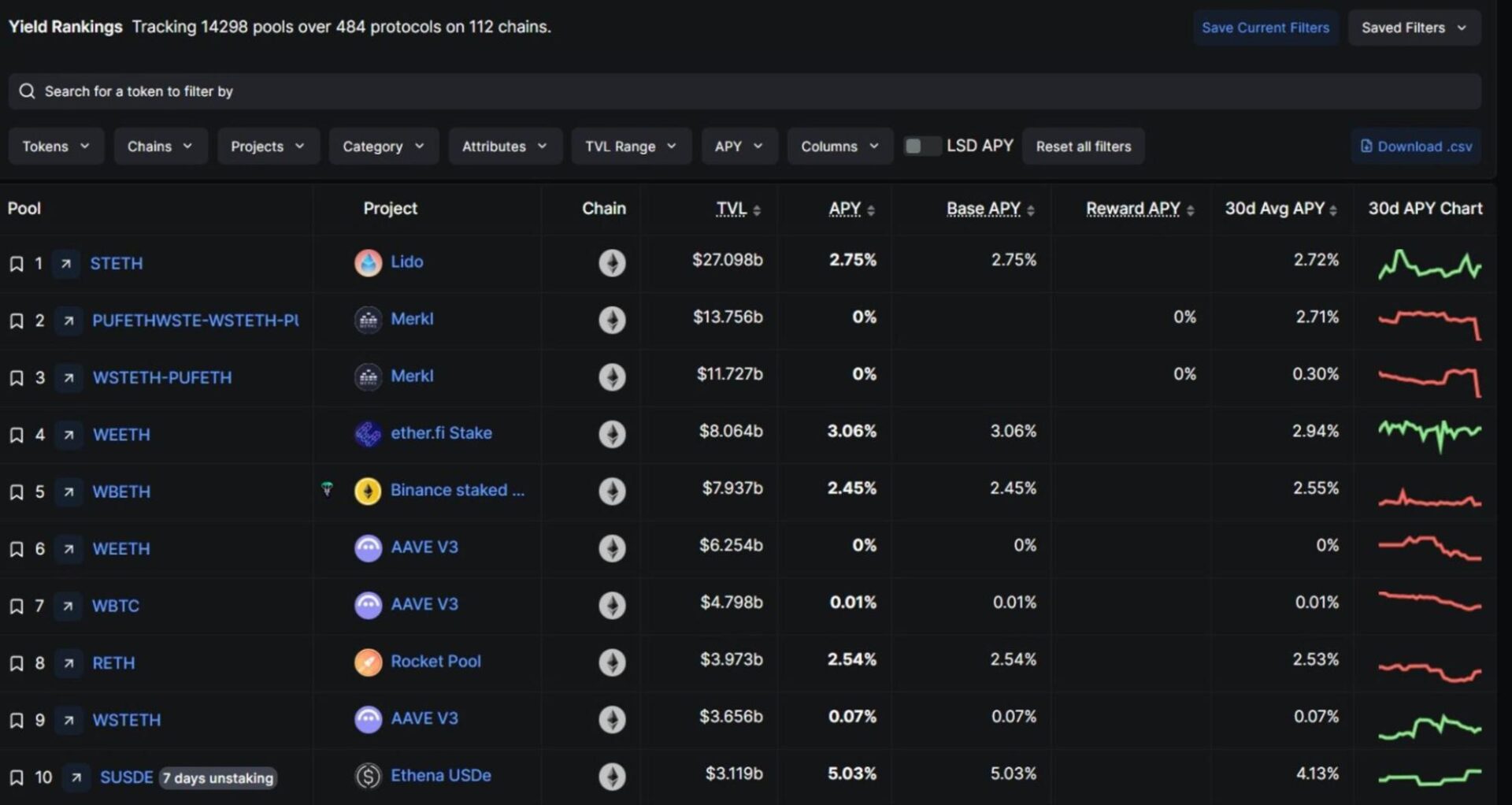

Yield Opportunities

Some investors are drawn to DeFi platforms because of the potential to earn passive income. When a protocol offers high returns through staking, lending, or liquidity farming, it motivates users to lock up their assets to earn passive income. The higher or more competitive the yield, the more likely people are to deposit funds, increasing the total value locked. However, unsustainably high yields can lead to inflated TVL that drops quickly if the rewards drop.

Market Conditions

The general crypto market is highly volatile, and these market conditions impact TVL. In a bull market, rising token prices naturally push TVL because the assets staked become more valuable in USD, even if the token amount stays the same. During bear market, falling token prices can shrink TVL even if users don’t withdraw their assets. In addition, these volatile conditions can affect how willing people are to commit funds to protocols.

Token Incentives

Many DeFi projects use token rewards to attract liquidity. For instance, they may reward users in native governance tokens or bonus tokens for providing liquidity or staking. These incentives can boost TVL rapidly by encouraging more deposits. However, if these rewards are cut back or the incentive token loses value, users often pull funds out, causing the total value locked to drop.

Security Reputation

The perceived risks and security of a protocol are essential in TVL. Projects with strong audits, transparent teams, and a good track record of avoiding hacks tend to attract more locked capital because users trust that their funds are safer. On the other hand, if a protocol suffers a security breach or has a reputation for poor security, users will likely withdraw funds quickly, leading to a sharp decline in TVL.

What are the Key Differences Between TVL and Market Cap?

The key difference between TVL and market cap is the value they measure. TVL shows users’ total dollar value of digital assets deposited into a protocol or across an entire blockchain network. It reflects how much capital is actively used for staking, lending, liquidity pools, or other on-chain activities. With TVL, you are gauging the protocol’s liquidity, usability, popularity, and how much trust and confidence users have in it.

On the other hand, market capitalization measures the total value of a cryptocurrency’s circulating supply. It’s calculated by multiplying the current price of a token by the total number of tokens in circulation. Market capitalization tells you how much the market values the entire supply of a token at current prices, making it a common metric for comparing the relative size of tokens.

What are Top 10 DeFi Protocols and Blockchains by TVL in 2025?

The top ten DeFi protocols by total value locked (TVL) in July 2025 are Aave, Lido, Etherfi, EigenLayer, SparkLend, Ethena, Sky, Pendle, Uniswap, and Morpho. Here is an overview of the top ten protocols with the number of blockchains, TVL, and 7-day TVL change.

| Rank | Protocol | Number of Blockchains | TVL | 7-day TVL Change |

| 1 | Aave | 34 | $30.001b | +15.04% |

| 2 | Lido | 10 | $27.819b | +19.78% |

| 3 | EigenLayer | 2 | $14.432b | +20.71% |

| 4 | Etherfi | 2 | $8.46b | +19.45% |

| 5 | SparkLend | 4 | $6.803b | +8.18% |

| 6 | Ethena | 5 | $6.77b | +0.24% |

| 7 | Sky | 2 | $5.628b | +2.42% |

| 8 | Pendle | 19 | $4.904b | +0.01% |

| 9 | Uniswap | 72 | $5.305b | +7.56% |

| 10 | Morpho | 25 | $3.96b | +13.44% |

Please note: Data in this table is subject to change daily since TVL is influenced by market conditions. For more up-to-date data on the top protocols by TVL, check DeFiLlama Protocol Ranking and DappRadar DeFi TVL Ranking pages.

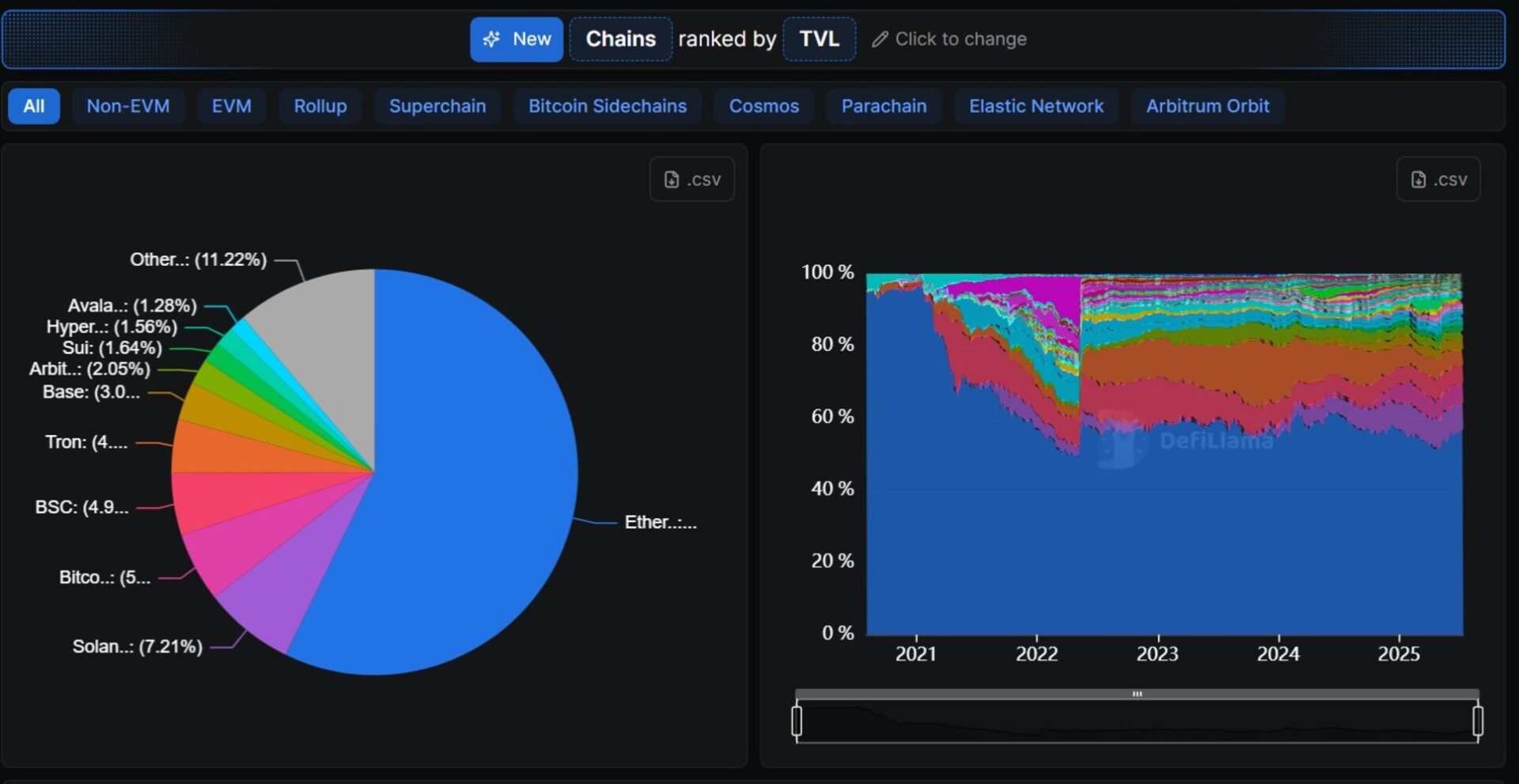

Moving on, the top ten blockchains by TVL in 2025 are Ethereum, Solana, Bitcoin, BSC, Tron, Base, Arbitrum, Sui, Hyperliquid L1, and Avalanche.

| Rank | Blockchain | Protocols | DeFi TVL | Bridged TVL |

| 1 | Ethereum | 1393 | $73.247b | $431.45b |

| 2 | Solana | 235 | $9.284b | $48.301b |

| 3 | Bitcoin | 61 | $7.083b | $0 |

| 4 | BSC | 906 | $6.367b | $16.842b |

| 5 | Tron | 35 | $5.425b | $87.596b |

| 6 | Base | 556 | $3.913b | $17.207b |

| 7 | Arbitrum | 818 | $2.628b | $14.875b |

| 8 | Sui | 71 | $2.196b | $2.913b |

| 9 | Hyperliquid L1 | 49 | $1.929b | $5.861b |

| 10 | Avalanche | 456 | $1.636b | $6.778b |

Bridged TVL captured in the table above is the total value of cryptocurrency locked in cross-chain bridges that enable the transfer of tokens between different blockchain networks. These bridges lock tokens on the source blockchain and mint equivalent wrapped tokens on the destination blockchain, allowing users to move assets seamlessly across chains while maintaining liquidity.

For instance, when you lock ETH on Ethereum via a bridge, the bridge mints or releases an equivalent amount of wrapped tokens (e.g., WETH) on the destination blockchain (e.g, Polygon). You can then use these wrapped tokens on the new blockchain for trading, staking, or yield farming activities.

If you’re curious about another way to keep your crypto liquid while still earning staking rewards, check out this guide on liquid staking to understand how it works.

That said, please note that the data in the table is subject to change daily. For more up-to-date information on the top ten blockchains by TVL, check DeFiLlama’s “Chains Ranked by TVL” page.

How to Analyze TVL in Different Protocols?

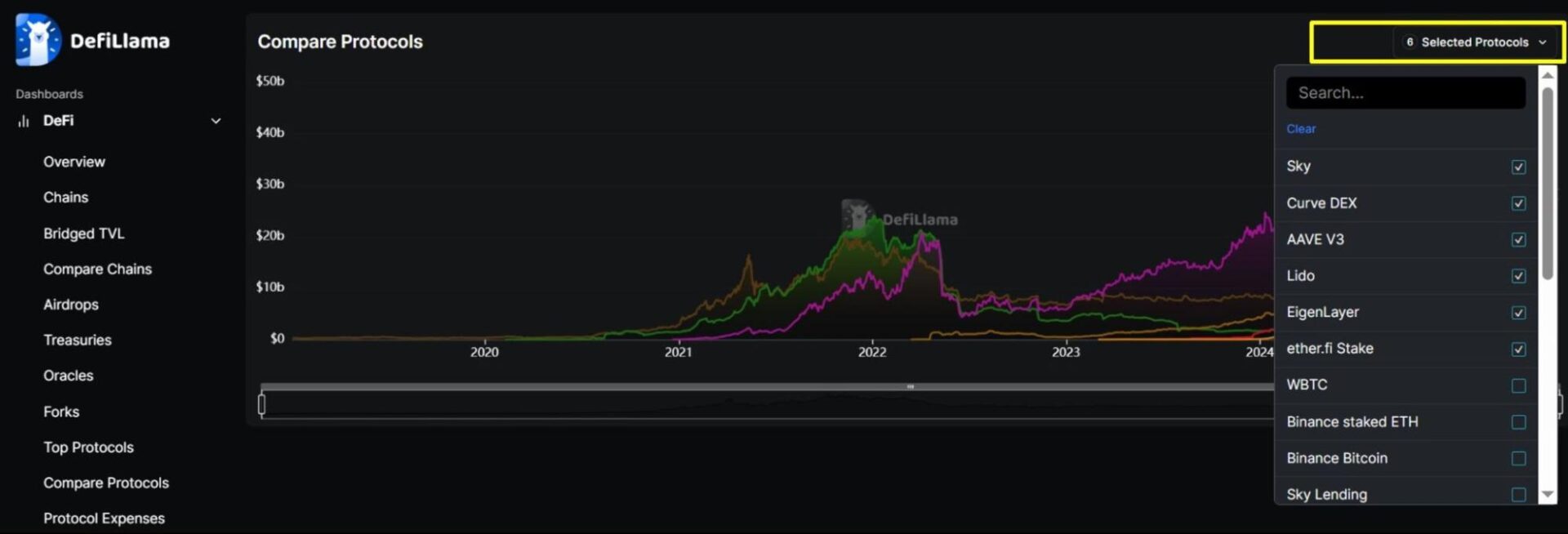

To analyze TVL in different protocols, you must compare similar platforms, watch TVL trends over time, check what tokens are locked in a protocol, determine the protocol’s category, and then cross-check with other variables to ensure accuracy.

- Compare Similar Protocols: Start by comparing platforms that are in the same category (offer the same services). For instance, DEXs need deep pools for trading, while lending protocols hold locked funds for loans. There are over 60 categories, so comparing protocols by category helps you see which projects lead their niche.

- Watch TVL Trends Over Time: A steady, organic growth usually signals rising trust and user participation, while sudden spikes can sometimes result from aggressive liquidity mining incentives. These short-term rewards boost deposits fast and attract investors only looking to earn quick returns and exit.

- Look at Liquidity Pools and Staking: TVL can come from lending, staking, or farming. Look at where the value is sitting. If the funds are being used actively, it is a good sign. If most of the assets are idle, the high total value locked might not mean much.

- Check Liquidity Concentration: It is also advisable to check how concentrated the liquidity is. If most of the TVL comes from a few big wallets or depends on unsustainable rewards, it can disappear fast. Poorly secured or shady protocols bring an even bigger risk. In the worst case, developers can orchestrate a rug pull, draining all the locked funds and leaving investors with nothing.

- Check Audits and Security: Protocols with high TVL are often attractive targets for fraudsters. Before trusting the number, check if the protocol has undergone proper security audits. If there are no audits or the project is popular for ignoring past vulnerabilities, the platform might be unsafe. If you have security concerns about a single protocol, you can track projects that have been hacked in the past on DeFiLlama to find safer alternatives.

- Cross-Check With Volume and User Count: TVL shows how much is locked, but not how active the platform is. Compare it with transaction volume and daily user count. A protocol with high TVL but low activity may not be doing much with the funds.

- Analyze TVL Ratios and Other Metrics: Relevant ratios and metrics to analyze are the market cap to TVL (MC/TVL) ratio and TVL share. For the market cap to TVL ratio, a ratio close to 1.0 suggests fair valuation, below 1.0 may indicate undervaluation, while a ratio above 1.0 may indicate overvaluation of the protocol. For the TVL share, you are checking the percentage of total DeFi TVL that the protocol controls to determine market share.

Remember that TVL can overstate the fundamental health and activity of a particular decentralized finance protocol. So, alongside these variables, do your own research and ensure you analyze other critical metrics like TVL growth rate, market conditions, user activity and confidence, tokenomics, yield rates, and other factors affecting TVL performance.

The post What Is TVL? Understanding Total Value Locked in 2025 appeared first on CryptoNinjas.

You May Also Like

A Radical Neural Network Approach to Modeling Shock Dynamics

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release