AI Agent Market Map: Hype is over, technology continues

By Tiger Research

Compiled by AididiaoJP, Foresight News

summary

- While the AI agent market saw a sharp decline in popularity following the token price crash, technological development continues at a steady pace. The DeFAI sector is regaining attention with real product releases and specialized on-chain functionality.

- Specialized agents optimized for specific functions have replaced the previous general-purpose agents. Projects such as Virtuals are actively building the infrastructure to connect these agents and enable them to collaborate.

- AI agents will be integrated into crypto projects as core functionality. Infrastructure that enables smooth communication and collaboration between agents will become crucial.

The hype ends, the technology continues

The cryptocurrency industry has incorporated AI technology in various ways, with AI agents receiving the most attention. The total market capitalization of agent-related tokens reached approximately $16 billion at one point. This demonstrated strong market interest, but the interest was short-lived. Most projects failed to meet development expectations, and token prices plummeted by over 90% from their peak.

Falling prices don't necessarily signal technological regression. AI agents remain a crucial area of technology in the crypto space. Discussions about practical use cases are becoming more concrete, and teams continue to test new approaches. This report explores how AI agents are playing a role in crypto and explores potential future developments.

Reshaping the AI Agent Ecosystem After the Hype

Early AI agent projects gradually faded from the market

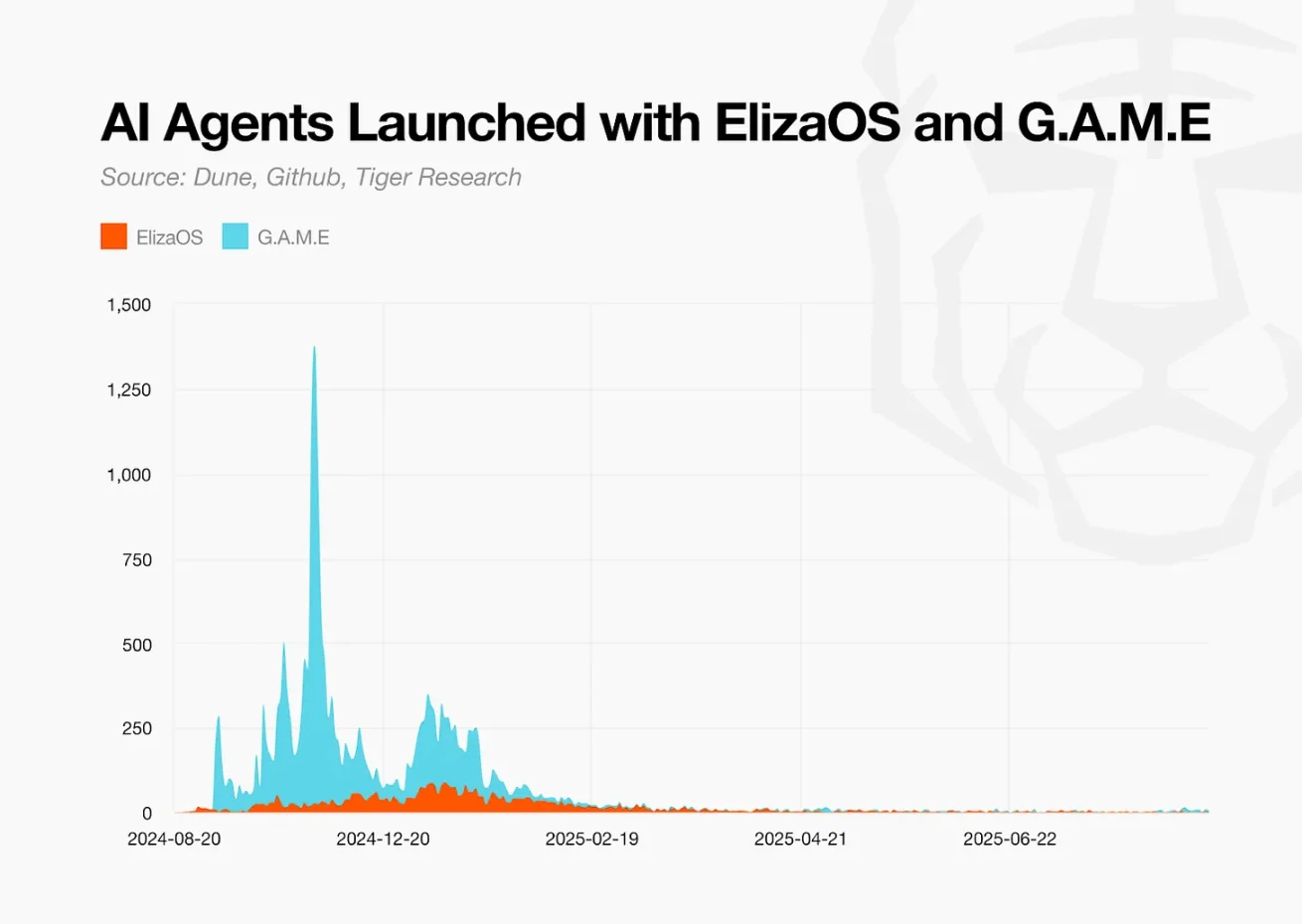

The AI agent sector in the crypto space began to gain traction in late 2024. ElizaOS by the ai16z team and the GAME development stack by the Virtuals Protocol team significantly lowered the barrier to entry for agent development. Launchpads like DAOS.fun and Virtuals Fun provided platforms for tokenizing developed agents. This streamlined process from development to release fueled a surge in market interest, leading to the rapid emergence of numerous agent projects.

Most projects have ambitious roadmaps leveraging AI technology. Investors, anticipating innovative services, have driven up token prices. In reality, these projects are merely wrappers of OpenAI or Anthropic's base models, tweaked or cue-engineered. Most are building advanced chatbots for X or Telegram rather than developing standalone services. While these projects emphasize innovative visions and technological differentiation, their actual operations are virtually indistinguishable from meme coins.

Source: aixbt

However, some projects are exceptions. Projects like aixbt and Soleng have partially implemented their roadmaps and launched actual services. They use token gating to provide exclusive access to token holders. Aixbt provides project analysis reports, while Soleng analyzes Github repositories to support investor decision-making.

Even these relatively successful projects couldn't overcome structural limitations. Unstable revenue structures reliant solely on token price increases hindered progress. Technological competitiveness lagged behind that of Web2 companies. Token prices eventually plummeted, operating funds dried up, and most projects have now suspended operations.

The DeFAI project has rekindled hope in the field

AI agent technology, once facing over-hyped expectations, is now entering a correction phase. The DeFi (DeFi) sector is regaining attention by proving its real-world value. DeFi agents execute automated investment strategies 24/7. They enable users to easily access complex DeFi services through simple natural language commands. This sector was a core narrative in the early days of the AI agent space. Most projects remained in the roadmap phase, struggling to achieve actual implementation. The sector temporarily lost attention. Recent product launches are rebuilding market expectations.

Representative projects include Wayfinder and HeyAnon. Wayfinder uses specialized AI agents called "Shells" to perform on-chain tasks. Shells execute transactions directly on-chain through a built-in dedicated wallet. The system utilizes a specialized multi-agent architecture, encompassing trading agents, perpetual agents, and contract agents. Each agent type specializes in a specific role, enabling automation of various investment strategies. Users can easily execute simple cross-chain trades or advanced strategies such as basis trading and leveraged fixed-investing.

From individual agents to agent networks

Early AI agent projects promoted "general-purpose agents" that could perform all functions. This approach prioritized funding over technological completeness. Projects proposed excessive roadmaps to capture a broader market, and most exposed limitations during implementation.

The current agent ecosystem is moving in a completely different direction. Builders, recognizing the limitations of general-purpose agents, are now developing specialized agents. These agents can collaborate with one another, similar to how skilled craftsmen with diverse expertise—carpenters, electricians, plumbers, and so on—collaborate to build a house.

Virtuals Protocol's ACP represents this trend. It provides a standard framework for communication and task allocation between different agents. Theoriq and General Impression are also building infrastructure to enhance interoperability between agents. The market is reshaping itself, shifting towards maximizing the value of the entire agent ecosystem, rather than the value of individual agents.

Future scenarios for the AI agent market

Even after the early hype cooled, AI agents continued to evolve. While the speculation ended, projects continued to build new features and services using AI agents. Two developments stood out.

First, AI agents are becoming essential infrastructure. They are no longer a standalone field, but are being integrated into crypto projects as a fundamental feature. Nansen, a blockchain data platform, has developed research agents to make complex on-chain data easier to explore. DeFi projects are also adding agents to improve user access. AI agents will become the final interface connecting users to the blockchain, not an optional feature.

Second, agent commerce will grow. As AI agents become standard, interactions between agents and humans will become more frequent. Secure transaction protocols and trust mechanisms will become increasingly important. Projects like Virtuals Protocol's ACP are laying the foundation for this.

These changes will simplify the complexities of the crypto space, improve user experience, and create new economic opportunities.

You May Also Like

X to cut off InfoFi crypto projects from accessing its API

X Just Killed Kaito and InfoFi Crypto, Several Tokens Crash