Hyperliquid (HYPE) Price Prediction: Wyckoff Distribution Puts Pressure on Bulls as $42 Support Faces Challenge

After climbing to new highs near $50, the HYPE Hyperliquid price quickly slid back to the $42 to $43 zone, leaving participants split between caution and optimism. Market watchers now argue that this critical support could decide whether HYPE stages a sharp rebound towards $50 or slips further into a deeper correction.

Hyperliquid Price Under Pressure

Hyperliquid just experienced one of its steepest absolute dollar declines in record time, falling from $50.91 to $43.75 within 48 hours, a $7.16 drop, as highlighted by analyst Henrik. The move reflects how quickly sentiment can flip when momentum cools off after a strong run. Technically, the breakdown from the $50 zone suggests supply has overwhelmed demand in the short term.

Hyperliquid price tumbled over 14% in just two days, testing the $42–$43 support zone after a sharp drop from $50.91. Source: Henrik via X

The $42 to $43 zone now becomes a critical level to monitor, as holding above it would prevent further downside toward the $38 support. If buyers can stabilize here, a rebound back toward $47 to $48 could come into play for HYPE Hyperliquid price.

Hyperliquid Finds Support at Key Zone

After sharp declines, Hyperliquid HYPE is now testing a critical support band between $42 and $43, an area highlighted by analyst HYPEconomist on the 4H chart. This zone is now a fresh support level for HYPE, where price is expected to react positively.

HYPE is holding steady at the $42–$43 support zone, with analysts eyeing a potential rebound toward $47–$50. Source: HYPEconomist via X

Technically, defending this level would keep the broader uptrend structure intact, giving room for a bounce towards $47 to $48 in the short term. A clean push above $48 would reopen the path to $50 resistance, while failure to hold the $42 floor risks a deeper retracement towards $38.

Wyckoff Distribution Signals Weakness for Hyperliquid

Analyst Deftsuo has raised concerns around Hyperliquid’s mid-term structure, pointing to a Wyckoff distribution schematic unfolding on the daily chart. According to his breakdown, phases A through C have already played out, with the market completing the spring phase as well now.

Hyperliquid’s daily chart is showing signs of a Wyckoff distribution, with upcoming $500M monthly token unlocks adding pressure to its price outlook. Source: Deftsuo via X

This kind of setup typically signals that supply is beginning to dominate demand, shifting momentum away from buyers. With $500M in token unlocks expected monthly for almost two years starting November, Deftsuo believes that the sheer scale of new supply could weigh heavily on price action, pushing valuations lower.

From a technical lens, the Hyperliquid Price Prediction now leans towards caution, with $42 to $43 acting as the immediate support zone to defend. A failure to hold this band could extend the decline first toward $38, and if weakness persists, deeper liquidity pockets open up at $30 and even $20 as downside targets.

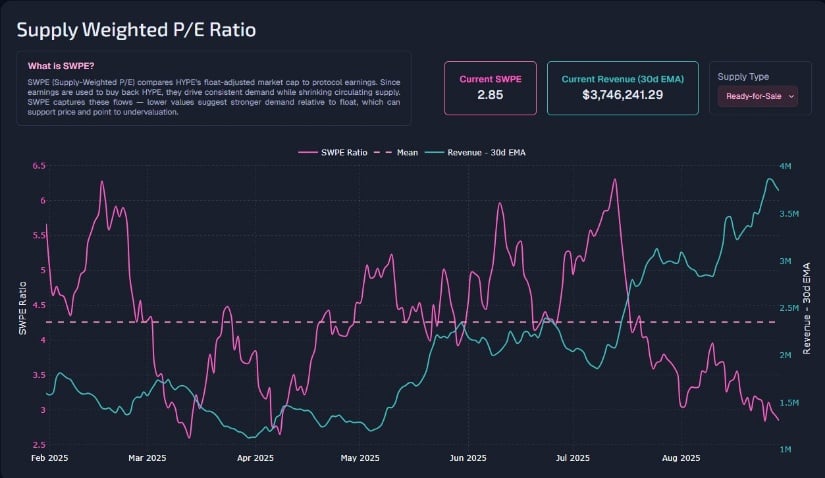

Valuation Metrics Show Undervaluation

While short-term charts have highlighted pressure on Hyperliquid, analyst NMTD8 points to valuation data that paints a different picture. The Supply-Weighted P/E (SWPE) ratio has dropped to 2.85, a level last seen in March and April when HYPE was trading at relative lows. The difference now is that revenues are significantly higher, with the 30-day EMA crossing $3.7M, showing strong protocol growth even as the ratio signals undervaluation.

Hyperliquid’s SWPE ratio has fallen to 2.85, signaling undervaluation as revenues climb above $3.7M on a 30-day EMA. Source: NMTD8 via X

This combination suggests that while price action may be shaky around the $42 to $43 band, the underlying fundamentals remain supportive. If revenues continue climbing and buybacks persist, HYPE could see its valuation multiples normalize higher.

Final Thoughts: Can Hyperliquid Bounce Back?

Hyperliquid finds itself at a crossroads where short-term technical weakness clashes with strong underlying fundamentals. The recent dip to the $42 to $43 band reflects market nerves, but at the same time, surging revenues, record volumes, and aggressive buybacks keep the long-term story compelling. If this support zone holds and buy-side pressure rebuilds, the possibility of a rebound towards $47 to $50 remains firmly in play.

At the same time, the pressure of upcoming token unlocks and distribution patterns adds risk to the outlook. For now, it’s a battle between strong fundamentals and heavy supply. If the fundamentals keep improving, Hyperliquid has a real shot at turning this setback into a comeback.

You May Also Like

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?

This U.S. politician’s suspicious stock trade just returned over 200% in weeks