SentinelOne, Inc. (S) Stock: Climbs as AI Cybersecurity Demand Drives Growth

TLDRs:

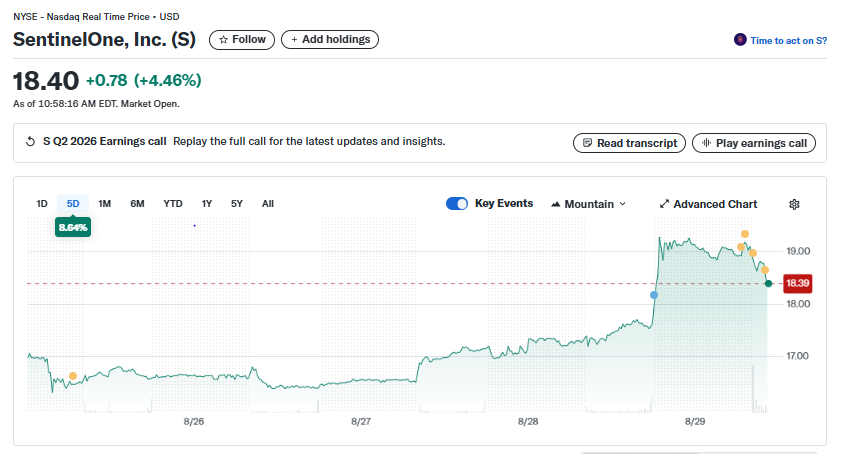

- SentinelOne shares jumped 9% after raising annual revenue forecast on strong Q2 results.

- Q2 revenue rose 22% year-on-year to $242.2 million, beating analyst expectations.

- Annualized recurring revenue hit $1 billion, a 24% increase from last year.

- Expansion into AI-driven security and cloud solutions drives strategic growth.

Shares of SentinelOne, Inc. (S) climbed roughly 9% in after-hours trading before recoiling after the cybersecurity firm reported strong second-quarter results and raised its full-year revenue forecast.

The company now expects annual revenue between $998 million and $1 billion, up slightly from its previous projection of $996 million to $1 billion.

For the third quarter, SentinelOne expects revenue of $256 million, surpassing analyst estimates of $254.4 million. The company’s adjusted earnings per share also beat forecasts, coming in at four cents, compared to the three-cent consensus.

SentinelOne, Inc. (S)

SentinelOne, Inc. (S)

Annualized Recurring Revenue Hits $1 Billion

As of July 31, 2025, SentinelOne’s annualized recurring revenue reached $1 billion, marking a 24% year-over-year increase.

This milestone highlights the firm’s success in scaling its subscription-based business model and indicates that its AI-driven cybersecurity offerings are resonating with enterprises seeking automated threat detection and real-time protection.

Revenue growth of 22% year-on-year to $242.2 million in Q2 demonstrates that SentinelOne’s performance is outpacing the broader AI cybersecurity market, projected to expand at a 21.3% compound annual growth rate through 2033.

AI Cybersecurity Market Driving Demand

Analysts note that the surge in demand for AI-enabled cybersecurity solutions is a key driver behind SentinelOne’s strong performance.

Enterprises are increasingly adopting AI tools to address rising data privacy regulations, real-time compliance needs, and complex threat landscapes.

SentinelOne’s approach, which emphasizes AI-native protection across endpoints, cloud environments, and security information and event management (SIEM) platforms, positions the company to benefit from the accelerating adoption of automated cybersecurity technologies.

Diversification Beyond Core Products

Beyond its traditional endpoint protection solutions, SentinelOne has diversified its offerings into AI SIEM and cloud security, which now account for 50% of new bookings. The introduction of the modular SentinelOne Flex licensing model has enabled high-value deals and extended contract durations.

Despite ongoing profitability challenges typical of high-growth tech firms, SentinelOne achieved positive 2% non-GAAP operating margins in Q2, a marked improvement from negative 33% GAAP operating margins.

The company’s strategy demonstrates that cybersecurity firms can achieve both revenue growth and improved unit economics by broadening their platform capabilities rather than relying solely on legacy products.

Looking Ahead

With strong quarterly results, an upgraded revenue forecast, and strategic diversification into AI-powered security solutions, SentinelOne is solidifying its position as a leader in the rapidly expanding cybersecurity sector.

As the market continues to shift toward AI-driven threat detection and cloud-based security, the company appears well-positioned to capture a growing share of enterprise cybersecurity spending.

Investors and industry watchers will be closely monitoring SentinelOne’s performance in the coming quarters, particularly as the company balances growth with profitability and expands its influence in the AI cybersecurity landscape.

The post SentinelOne, Inc. (S) Stock: Climbs as AI Cybersecurity Demand Drives Growth appeared first on CoinCentral.

You May Also Like

X to cut off InfoFi crypto projects from accessing its API

X Just Killed Kaito and InfoFi Crypto, Several Tokens Crash