SenseTime Group Inc. (0020.HK) Stock: Gains Over 3% on Generative AI Revenue Surge

TLDRs;

- SenseTime revenue surged 35% to US$330M in H1 2025, led by a 72.7% rise in generative AI sales.

- Generative AI now represents 77% of revenue, while computer vision sales declined nearly 15% amid client changes.

- Net loss narrowed by half, but gross margins fell due to higher hardware and data center expenses.

- SenseTime launched a compute mall with semiconductor partners, aligning with China’s AI Plus strategy for industry-wide adoption.

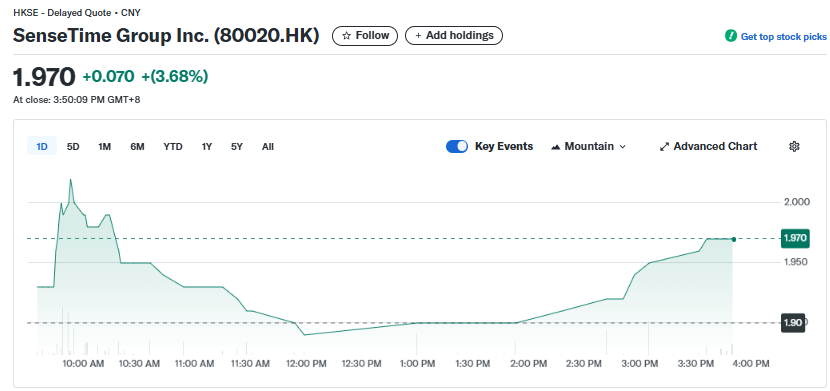

Shares of SenseTime Group Inc. (0020.HK) climbed 3.68% Thursday after the Chinese artificial intelligence (AI) company reported a sharp revenue increase in the first half of 2025, fueled by soaring demand for generative AI services.

The Hong Kong-listed firm delivered financial results that highlight its strategic pivot from traditional computer vision and surveillance technologies toward the fast-expanding generative AI sector.

SenseTime Group Inc. (80020.HK)

SenseTime Group Inc. (80020.HK)

Generative AI Powers Majority of Sales

SenseTime’s revenue surged 35.6% year-on-year to 2.4 billion yuan (US$330 million) in the six months ending June 2025. The company’s generative AI division played a central role in this performance, posting 72.7% growth to 1.8 billion yuan (US$252 million).

That unit now accounts for 77% of total sales, compared to 60.4% a year ago, a remarkable shift that underscores the company’s repositioning in the global AI market.

This surge also narrowed SenseTime’s adjusted net loss by half, to 1.2 billion yuan (US$168 million), reflecting both stronger revenues and improved cost management in certain areas. However, challenges remain, particularly in balancing profitability with continued investment in AI research and infrastructure.

Margins Face Pressure From Rising Costs

Despite higher top-line growth, SenseTime’s gross margin fell to 38.5% compared to previous years. Gross profit climbed 18.4% to 908 million yuan (US$127 million), but rising hardware and data center costs weighed on profitability.

The company’s computer vision segment generated 436 million yuan (US$61 million) in revenue, marking a 14.8% decline after changes in collaboration with a major client. This drop further signals the company’s move away from its surveillance roots and into AI-driven consumer and enterprise applications.

Research and development spending also rose 12% to 2.1 billion yuan (US$294 million), underscoring its heavy investment in AI innovation. By contrast, selling expenses fell 17.3% to 272 million yuan, as the company streamlined its marketing and client acquisition processes.

Pivot Aligns With China’s AI Strategy

SenseTime’s strategic repositioning comes at a time when China is doubling down on its “AI Plus” initiative, which aims to integrate artificial intelligence across sectors ranging from healthcare and finance to manufacturing and education.

The plan targets 70% adoption of intelligent devices and AI agents by 2027, with further growth to 90% by 2030.

SenseTime has openly aligned its operations with this national agenda, which provides both regulatory support and market opportunities. The Chinese AI market, valued at US$70 billion today, is projected to double by 2030, offering a fertile environment for SenseTime’s generative AI products and services.

New AI Infrastructure Investment

To bolster its growth, SenseTime recently launched a “compute mall” in collaboration with Chinese semiconductor partners.

The initiative allows clients to access flexible AI computing resources on demand, a move designed to reduce dependency on foreign chips and support scalable AI adoption in China.

This infrastructure push demonstrates SenseTime’s intent to strengthen its role not only as an AI applications provider but also as a foundational technology player in China’s digital economy.

The post SenseTime Group Inc. (0020.HK) Stock: Gains Over 3% on Generative AI Revenue Surge appeared first on CoinCentral.

You May Also Like

Fed rate decision September 2025

GBP/USD rallies as Fed independence threats hammer US Dollar